09-06-2025, 05:25 PM

09-06-2025, 05:25 PM

|

#5601

|

|

#1 Goaltender

|

Quote:

Originally Posted by powderjunkie

Some interesting ideas, but I find it hard to see any of them significantly increasing revenue compared what is currently raised through taxation (direct and indirect).

Here's a fairly simple idea that would raise some cash while driving a bunch of other desirable outcomes, and reduce certain expenses: Congestion Pricing

Calgary is pretty well set up to implement this in the core, with 4 bridges crossing the river, and 6 underpasses, and 1-2 western access points (though really only one as the 5 Ave connector reversal would become unnecessary and be converted to a 'wheeling highway' and letting the current very busy MUP become walking only, but I digress)

- direct cash raised from this

- increased transit usage = increased revenue (also leading to generally improved transit service)

- it should be noted that there would be reduced parking revenue for CPA, but it's also worth noting its incredibly dumb how current policy encourages private parking lots in DT, but reducing parking demand can turn some of these private and publicly owned parking facilities into more productive assets, including housing (DT will become even more desirable to live in)

- reduced road expenditure across the board (all of the cars heading into DT use other roads to get there, so we could slow down road expansions that are already unnecessary, but I digress)

- health benefits from reduced pollution and making alternate modes more attractive

DBA would #### bricks, but I'm not sure that would be totally founded - some trips may redistribute around the city (fine from a broader civic standpoint), while alternate mode access should improve significantly. And between Map Town and A&B Sound closing, there's really no reason to go downtown for anything other than employment, anyways (do we have a text colour for half-serious?)

A major unintended consequence would be shifting a lot of vehicle traffic to the beltline, but there would be ways to mitigate that

|

Can you imagine the UCP backlash if Calgary put in congestion pricing on roads into downtown?

|

|

|

09-06-2025, 07:04 PM

09-06-2025, 07:04 PM

|

#5602

|

|

Franchise Player

Join Date: Mar 2015

Location: Pickle Jar Lake

|

Quote:

Originally Posted by woob

Can you imagine the UCP backlash if Calgary put in congestion pricing on roads into downtown?

|

They'd lose their #### so hard they'd smell like Donald Trump.

|

|

|

09-06-2025, 07:31 PM

09-06-2025, 07:31 PM

|

#5603

|

|

Franchise Player

Join Date: Aug 2009

Location: wearing raccoons for boots

|

It would probably make them ban bikes altogether

|

|

|

09-06-2025, 08:13 PM

09-06-2025, 08:13 PM

|

#5604

|

|

Loves Teh Chat!

|

Quote:

Originally Posted by CliffFletcher

Yes, Calgary already has the best dedicated bike infrastructure in North America. Itís 17km by bike from my house to my office downtown. I can do 14k of that on dedicated cycling/pedestrian pathways. Thatís pretty incredible - there are very few cities in the world this size where cyclists can get from far-flung suburbs to the edge of the urban core largely on dedicated paths.

Itís the final few km that are tricky. The roads in the inner core are necessarily congested (for a city its population, Calgary has a very dense core), and each commuter has a different destination among the hundreds of buildings in that core. Itís similar to the final km problem in shipping fulfillment.

|

We have great recreational infrastructure. Commuting and getting from A to B has work to be done if you're not going straight downtown. But you're right that there is great pathway infrastructure overall despite many missing links.

Montreal would probably debate the title for best bike infrastructure in North America too.

|

|

|

09-06-2025, 08:18 PM

09-06-2025, 08:18 PM

|

#5605

|

|

Craig McTavish' Merkin

|

Quote:

Originally Posted by woob

Can you imagine the UCP backlash if Calgary put in congestion pricing on roads into downtown?

|

I would dine on their rage with fava beans and a nice Chiani. Charge based on size too. Driving a truck to a downtown office job should ####ing cost you.

You know how many times I had to call CPA on a Silverado before he got the hint and quit illegally parking in an alley? Five.

There was a TRX that used the loading dock of a building I go to every day. He was never hauling anything. He's a lawyer. He was just too cheap to pay to park his $140,000 compensator.

Last edited by DownInFlames; 09-06-2025 at 08:22 PM.

Reason: Don't post angry

|

|

|

|

The Following User Says Thank You to DownInFlames For This Useful Post:

|

|

09-06-2025, 08:25 PM

09-06-2025, 08:25 PM

|

#5606

|

|

Franchise Player

Join Date: Mar 2007

Location: Income Tax Central

|

Quote:

Originally Posted by puffnstuff

It would probably make them ban bikes altogether

|

Or make them register and get insured! Get license plates on them and then cyclists have to wear a yellow arm-band at all times!

__________________

The Beatings Shall Continue Until Morale Improves!

This Post Has Been Distilled for the Eradication of Seemingly Incurable Sadness.

The World Ends when you're dead. Until then, you've got more punishment in store. - Flames Fans

If you thought this season would have a happy ending, you haven't been paying attention.

|

|

|

09-06-2025, 09:25 PM

09-06-2025, 09:25 PM

|

#5607

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Quote:

Originally Posted by Fuzz

I'd have to think given immigration and inequality it wouldn't logically be electoral suicide. But it might be hard to sell in the same way people end up supporting tax cuts for the insanely wealthy, worried one day it might affect them, as they stare at the mould spot in their double wide.

|

You think that millennials who are going to inherit that money will vote in favour of it getting taxed before they get it? I have a hard time believing that.

|

|

|

|

The Following User Says Thank You to Slava For This Useful Post:

|

|

09-06-2025, 09:28 PM

09-06-2025, 09:28 PM

|

#5608

|

|

Self Imposed Retirement

|

Things like congestion pricing, taxing home sales, and estate taxes are good policy but incredibly bad politics. The electorate gets in its own way pretty much all the time. If City of Calgary put congestion pricing into place, they would deal with their own furious voters before the province. I mean, I guess if you just taxed Airdrie?

|

|

|

09-06-2025, 09:29 PM

09-06-2025, 09:29 PM

|

#5609

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Quote:

Originally Posted by peter12

Things like congestion pricing, taxing home sales, and estate taxes are good policy but incredibly bad politics. The electorate gets in its own way pretty much all the time. If City of Calgary put congestion pricing into place, they would deal with their own furious voters before the province. I mean, I guess if you just taxed Airdrie?

|

Congestion pricing in Calgary would just hollow out the downtown core further.

|

|

|

09-06-2025, 09:30 PM

09-06-2025, 09:30 PM

|

#5610

|

|

Franchise Player

Join Date: Mar 2007

Location: Income Tax Central

|

Quote:

Originally Posted by peter12

Things like congestion pricing, taxing home sales, and estate taxes are good policy but incredibly bad politics. The electorate gets in its own way pretty much all the time. If City of Calgary put congestion pricing into place, they would deal with their own furious voters before the province. I mean, I guess if you just taxed Airdrie?

|

Airdrie, Okotoks, Cochrane, Strathmore, High River, anyone who has recently 'dined' at a Boston Pizza or Mr. Mikes, etc.

__________________

The Beatings Shall Continue Until Morale Improves!

This Post Has Been Distilled for the Eradication of Seemingly Incurable Sadness.

The World Ends when you're dead. Until then, you've got more punishment in store. - Flames Fans

If you thought this season would have a happy ending, you haven't been paying attention.

|

|

|

|

The Following User Says Thank You to Locke For This Useful Post:

|

|

09-06-2025, 09:33 PM

09-06-2025, 09:33 PM

|

#5611

|

|

Self Imposed Retirement

|

Quote:

Originally Posted by Locke

Airdrie, Okotoks, Cochrane, Strathmore, High River, anyone who has recently 'dined' at a Boston Pizza or Mr. Mikes, etc.

|

How practical is that though? Serious question. Also, are there Mr. Mikes in AB!?

|

|

|

09-06-2025, 09:38 PM

09-06-2025, 09:38 PM

|

#5612

|

|

Franchise Player

Join Date: Mar 2007

Location: Income Tax Central

|

Quote:

Originally Posted by peter12

How practical is that though? Serious question. Also, are there Mr. Mikes in AB!?

|

Its 'Haute Airdronian Cuisine' when the Boston Pizza is full.

How practical? Thats tougher to answer, but the division of funding is broken when parasites live elsewhere, earn their money in Calgary and then take it back to where they came from without contributing to the infrastructure and costs that produces their bounty.

__________________

The Beatings Shall Continue Until Morale Improves!

This Post Has Been Distilled for the Eradication of Seemingly Incurable Sadness.

The World Ends when you're dead. Until then, you've got more punishment in store. - Flames Fans

If you thought this season would have a happy ending, you haven't been paying attention.

|

|

|

|

The Following User Says Thank You to Locke For This Useful Post:

|

|

09-06-2025, 09:40 PM

09-06-2025, 09:40 PM

|

#5613

|

|

Self Imposed Retirement

|

Quote:

Originally Posted by Locke

Its 'Haute Airdronian Cuisine' when the Boston Pizza is full.

How practical? Thats tougher to answer, but the division of funding is broken when parasites live elsewhere, earn their money in Calgary and then take it back to where they came from without contributing to the infrastructure and costs that produces their bounty.

|

Don't get me wrong, I am a fan of tolling roads and bridges. I just think there are so many egress points to Calgary, you would have to employ a pretty significant infrastructure to effectively toll people.

It's also insanely controversial. For all the "UCP would kill it" folks, keep in mind, that the BC NDP killed tolling on Port Man and Golden Ears bridge in 2017.

|

|

|

09-06-2025, 09:43 PM

09-06-2025, 09:43 PM

|

#5614

|

|

Franchise Player

Join Date: Mar 2007

Location: Income Tax Central

|

Quote:

Originally Posted by peter12

Don't get me wrong, I am a fan of tolling roads and bridges. I just think there are so many egress points to Calgary, you would have to employ a pretty significant infrastructure to effectively toll people.

It's also insanely controversial. For all the "UCP would kill it" folks, keep in mind, that the BC NDP killed tolling on Port Man and Golden Ears bridge in 2017.

|

Oh it would be a logistical and political nightmare. You're literally talking about taking the cake away from people who deliberately moved so they could have it and eat it too.

This is 'torches and pitchforks' territory. How to make it work? I'd say, and I'm making this up, that Calgary should garnishee a percentage of these places' property tax remittances.

You pay your Airdrie or Okotoks Property Taxes? Calgary takes 15%. Just the tip.

__________________

The Beatings Shall Continue Until Morale Improves!

This Post Has Been Distilled for the Eradication of Seemingly Incurable Sadness.

The World Ends when you're dead. Until then, you've got more punishment in store. - Flames Fans

If you thought this season would have a happy ending, you haven't been paying attention.

|

|

|

09-07-2025, 09:36 AM

09-07-2025, 09:36 AM

|

#5615

|

|

Franchise Player

Join Date: Mar 2015

Location: Pickle Jar Lake

|

Quote:

Originally Posted by Slava

You think that millennials who are going to inherit that money will vote in favour of it getting taxed before they get it? I have a hard time believing that.

|

No, not at all. I think the proportion of millennial and gen Xers getting big paydays is going to be a lot smaller than the rest of the voting population. Not all boomers are loaded, and with immigration over the years, while the dollar value being passed down is huge, I don't think it's anywhere near a majority of people who will be recipients.

|

|

|

09-07-2025, 11:55 AM

09-07-2025, 11:55 AM

|

#5616

|

|

Franchise Player

|

Quote:

Originally Posted by Fuzz

No, not at all. I think the proportion of millennial and gen Xers getting big paydays is going to be a lot smaller than the rest of the voting population. Not all boomers are loaded, and with immigration over the years, while the dollar value being passed down is huge, I don't think it's anywhere near a majority of people who will be recipients.

|

Those inheritances will mostly be from liquidated houses. The average home value in Ontario is $800k. In B.C, it’s almost a million. Lots and lots of millennials are doing to inherit half of a $700k to $1 million house. Taxes will be have to paid when the home values are liquidated, but paydays of $300k per survivor will be common. Millennial voters aren’t going to graciously accept that being cut down to $200k out of a sense of public duty. Not when many are already earmarking those expected windfalls to fund their own retirements, or help their kids get on the housing ladder.

And if you’re going to set the inheritance tax threshold higher - at say three million in assets - it’s not going to collect as much as you’d hope. It will be drawn from far fewer households, and people with assets will find ways to pass on the money while they’re living, like buying cars, homes, etc. outright for their kids and grandkids.

Inheritance taxes sound attractive in theory, but they’re typically ineffective in practice. There’s a reason governments everywhere rely mainly on income and sales taxes - they’re easy to collect, hard to avoid, and they’re drawn from a very large proportion of citizens.

__________________

Quote:

Originally Posted by fotze

If this day gets you riled up, you obviously aren't numb to the disappointment yet to be a real fan.

|

Last edited by CliffFletcher; 09-07-2025 at 12:00 PM.

|

|

|

|

The Following User Says Thank You to CliffFletcher For This Useful Post:

|

|

09-07-2025, 12:00 PM

09-07-2025, 12:00 PM

|

#5617

|

|

Franchise Player

Join Date: Mar 2007

Location: Income Tax Central

|

I have a saying around my office: "Inheritances make people crazy."

__________________

The Beatings Shall Continue Until Morale Improves!

This Post Has Been Distilled for the Eradication of Seemingly Incurable Sadness.

The World Ends when you're dead. Until then, you've got more punishment in store. - Flames Fans

If you thought this season would have a happy ending, you haven't been paying attention.

|

|

|

|

The Following 2 Users Say Thank You to Locke For This Useful Post:

|

|

09-07-2025, 12:07 PM

09-07-2025, 12:07 PM

|

#5618

|

|

Franchise Player

Join Date: Mar 2015

Location: Pickle Jar Lake

|

Is that why every other G7 country does it except Canada? Because it's ineffective? That sounds more like a Frasier Institute talking point than reality.

https://theconversation.com/should-c...nce-tax-102324

https://theconversation.com/should-c...nce-tax-102324

You should also re-read my posts, because you are attacking a point I'm not making. I've already said I don't expect all millennials to support it, I'm saying the demographics and actual number of recipients are a subset of millennials, and they don't represent a majority. I can't find any numbers to support or discredit this, so perhaps I'm wrong on that. But I'm not saying those set to receive large inheritance would vote against their own interests.

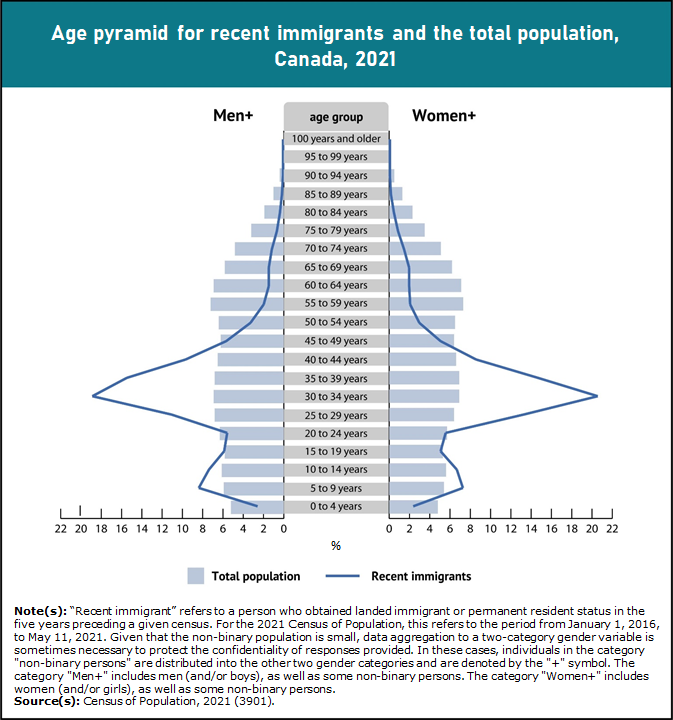

I did find this, which shows a large proportion of recent immigrants(unlikely to have large inheritances from Boomers) to make up younger populations. The real thing to figure out is the distribution of the discussed $1-2 Trillion and how many recipients above, say, a million or whatever dollars would exist.

https://www150.statcan.gc.ca/n1/dail...g-a002-eng.htm

https://www150.statcan.gc.ca/n1/dail...g-a002-eng.htm

Making a minimum untaxed amount at the right level, and having progressive would reduce the number of people it affects, and theoretically drive more support. But then, we know people vote very illogically in tax policy, and in this case may believe even if their inheritance is small, they don't want to risk that chance their parents win the lottery before they die. They may also not want their own inheritance taxed, in some distant future where they manage to succeed while paying high taxes to make up for the Boomers...still illogical in my mind.

|

|

|

09-07-2025, 12:39 PM

09-07-2025, 12:39 PM

|

#5619

|

|

Franchise Player

Join Date: Aug 2008

Location: California

|

I believe but not 100% sure that in places like France there is a gross up at death. So while in Canada the estate pays Capital gains on assets from the purchase price to the value at inheritance.

In many other jurisdictions no capital gains taxes are paid by the dead and just the inheritance taxes are paid.

Depends on country by country.

|

|

|

09-07-2025, 12:58 PM

09-07-2025, 12:58 PM

|

#5620

|

|

Franchise Player

|

Quote:

Originally Posted by GGG

I believe but not 100% sure that in places like France there is a gross up at death. So while in Canada the estate pays Capital gains on assets from the purchase price to the value at inheritance.

In many other jurisdictions no capital gains taxes are paid by the dead and just the inheritance taxes are paid.

Depends on country by country.

|

The US has inheritance taxes but also a gross up of adjusted cost basis at death. Our system is likely fairer and also more difficult to game, as the deemed disposition at death is hard to avoid.

If you wanted to raise money from a wealthy type tax you should drop the capital gains exemption on a primary residence (or maybe limit it to $1MM in lifetime gains or something like that)

|

|

|

|

The Following User Says Thank You to bizaro86 For This Useful Post:

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 05:25 AM.

|

|