09-13-2024, 02:38 PM

09-13-2024, 02:38 PM

|

#13901

|

|

Franchise Player

|

Quote:

Originally Posted by Firebot

|

You can hope voters grow a brain and probably lose an election, or you can give them what they want and have a chance at winning one.

The carbon tax was brought in for BC in 2008 under a centre-right government and they won a majority the next year. No one seemed to have an issue with it for 1.5 decades as it helped curb the growth in emissions in BC without impacting economic growth, all while funding tax cuts for everyone. But now one side of the political spectrum has made a point of riling people up by blaming everyone's problems on a carbon tax that adds about 0.1% to the inflation figure and governments have to scramble to adapt.

That's the problem with having to appeal to low-information swing voters who frankly don't have the faintest clue what they're talking about when it comes to policy. But that's the reality of a close election.

|

|

|

|

The Following 10 Users Say Thank You to opendoor For This Useful Post:

|

|

09-13-2024, 04:32 PM

09-13-2024, 04:32 PM

|

#13902

|

|

Franchise Player

Join Date: Mar 2006

Location: Victoria

|

Quote:

Originally Posted by Mr.Coffee

Because the incoming “gotchas” are going to be petty and annoying, can we just get this out there now for when the Conservatives take power?

Yes they’re corrupt, yes they’re tied to elites every bit as the Liberals, yes they will do political maneuvering, as they have in the past, that will be self-fulfilling just like the current government.

That’s precisely why the continual loosening of norms and expectations that Canadians hold for their government is a problem. Stretching the bounds simply allows “the other guys” to do it too. The Libs couldn’t figure out where billions were lost to? Can’t wait to see what the Cons do in that dept.

Yes, we know.

|

Nah. The gotchas will be coming out when they run the country comparably to how the UCP runs Alberta and all the mouthbreathers who yelled "hidden agenda!" and "they'll moderate once they're in power!" go into hiding like they did in the Alberta politics thread.

|

|

|

|

The Following 4 Users Say Thank You to rubecube For This Useful Post:

|

|

09-13-2024, 09:20 PM

09-13-2024, 09:20 PM

|

#13903

|

|

Franchise Player

Join Date: Sep 2015

Location: Paradise

|

Quote:

Originally Posted by opendoor

You can hope voters grow a brain and probably lose an election, or you can give them what they want and have a chance at winning one.

The carbon tax was brought in for BC in 2008 under a centre-right government and they won a majority the next year. No one seemed to have an issue with it for 1.5 decades as it helped curb the growth in emissions in BC without impacting economic growth, all while funding tax cuts for everyone. But now one side of the political spectrum has made a point of riling people up by blaming everyone's problems on a carbon tax that adds about 0.1% to the inflation figure and governments have to scramble to adapt.

That's the problem with having to appeal to low-information swing voters who frankly don't have the faintest clue what they're talking about when it comes to policy. But that's the reality of a close election.

|

Are you talking about the Bank of Canada's 0.1 to 0.15% number that only factored in Fuel and natural gas (and other fossil fuels), but didnt factor in the secondary effects such as higher cost to produce and transport food and goods that would compound it. And higher costs of some services.

Bank of Canada has been criticized, for discluding compounding effects of it. Other economists have estimated it around .2% which is 10% of the Bank of Canada's target of 2%. That's not insignificant.

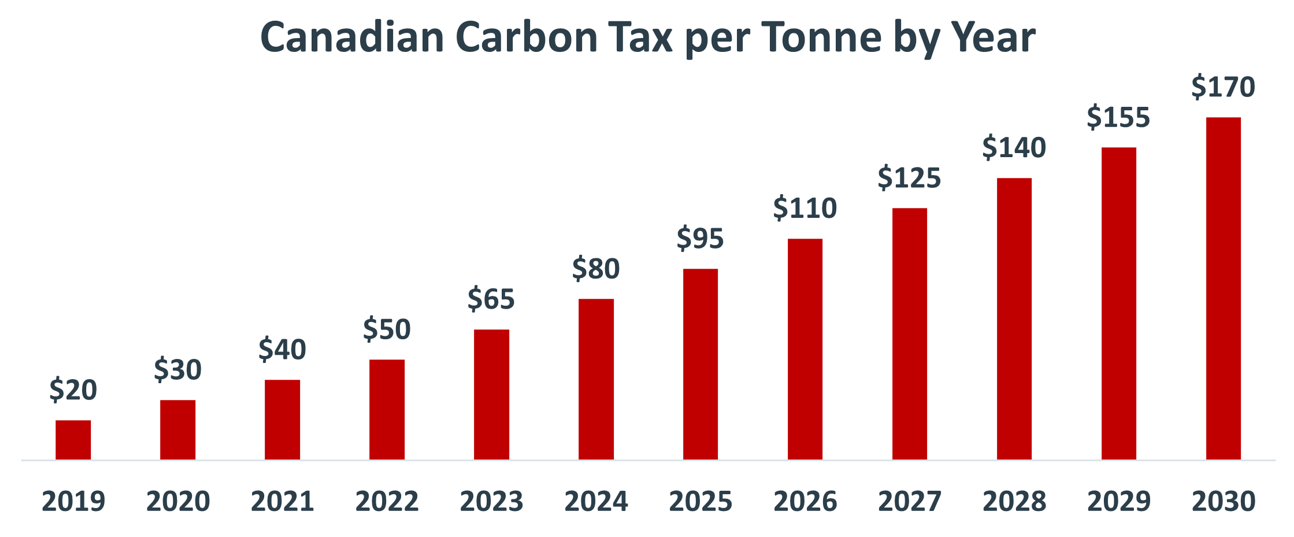

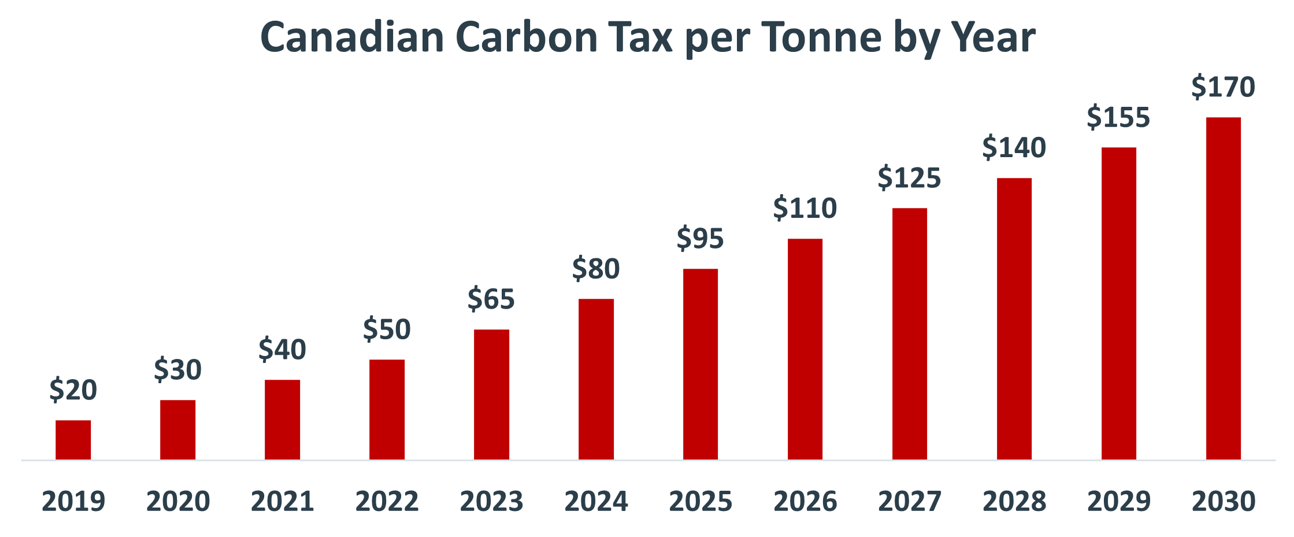

Also Carbon tax is slated to increase year over year and will be more than double what it is now by 2030. That will make it much more significant. say it goes up to about 0.4% total direct and indirect inflation by 2030. That's 20% of the target inflation.

|

|

|

09-13-2024, 09:25 PM

09-13-2024, 09:25 PM

|

#13904

|

|

damn onions

|

Quote:

Originally Posted by rubecube

Nah. The gotchas will be coming out when they run the country comparably to how the UCP runs Alberta and all the mouthbreathers who yelled "hidden agenda!" and "they'll moderate once they're in power!" go into hiding like they did in the Alberta politics thread.

|

Haha fair enough well if they do run the country like the UCPs I will 110% be there with ya. I kind of find it hard to believe they’ll be that bad but I guess you never know.

|

|

|

09-13-2024, 09:40 PM

09-13-2024, 09:40 PM

|

#13905

|

|

Franchise Player

Join Date: Aug 2008

Location: California

|

Quote:

Originally Posted by Samonadreau

Are you talking about the Bank of Canada's 0.1 to 0.15% number that only factored in Fuel and natural gas (and other fossil fuels), but didnt factor in the secondary effects such as higher cost to produce and transport food and goods that would compound it. And higher costs of some services.

Bank of Canada has been criticized, for discluding compounding effects of it. Other economists have estimated it around .2% which is 10% of the Bank of Canada's target of 2%. That's not insignificant.

Also Carbon tax is slated to increase year over year and will be more than double what it is now by 2030. That will make it much more significant. say it goes up to about 0.4% total direct and indirect inflation by 2030. That's 20% of the target inflation.

|

How does the Carbon tax cause inflation every year if the rate was unchanged? Like if it’s $40 per tonne one year and $40 per tonne the next year then there should be no inflation caused by Carbon tax.

|

|

|

09-13-2024, 09:46 PM

09-13-2024, 09:46 PM

|

#13906

|

|

Franchise Player

Join Date: Aug 2008

Location: California

|

Quote:

Originally Posted by Mr.Coffee

Haha fair enough well if they do run the country like the UCPs I will 110% be there with ya. I kind of find it hard to believe they’ll be that bad but I guess you never know.

|

If they do they will be booted in 4 years because the rest of the country knows how to flip flop and the liberals will have their #### in order.

|

|

|

09-13-2024, 09:48 PM

09-13-2024, 09:48 PM

|

#13907

|

|

Franchise Player

Join Date: Mar 2006

Location: Victoria

|

Quote:

Originally Posted by Mr.Coffee

Haha fair enough well if they do run the country like the UCPs I will 110% be there with ya. I kind of find it hard to believe they’ll be that bad but I guess you never know.

|

They're telling us who they are. Why don't you believe them?

|

|

|

09-13-2024, 09:50 PM

09-13-2024, 09:50 PM

|

#13908

|

|

Franchise Player

Join Date: Mar 2006

Location: Victoria

|

Quote:

Originally Posted by GGG

If they do they will be booted in 4 years because the rest of the country knows how to flip flop and the liberals will have their #### in order.

|

That's not necessarily true. They could launch a bunch of anti-trans and anti-science nonsense, and still hold power as long as they're able to fool enough dummies with culture war nonsense or into believing their cuts are actually helping the bottom line.

|

|

|

09-13-2024, 09:54 PM

09-13-2024, 09:54 PM

|

#13909

|

|

Franchise Player

Join Date: Aug 2008

Location: California

|

Quote:

Originally Posted by rubecube

That's not necessarily true. They could launch a bunch of anti-trans and anti-science nonsense, and still hold power as long as they're able to fool enough dummies with culture war nonsense or into believing their cuts are actually helping the bottom line.

|

If you use Trump support in Canada as a proxy for those beliefs and then consider that they barely hold power in Alberta you can rest easy on this not being the case.

There just isn’t that level of support for extreme conservatism in Canada.

|

|

|

09-13-2024, 10:21 PM

09-13-2024, 10:21 PM

|

#13910

|

|

Franchise Player

Join Date: Sep 2015

Location: Paradise

|

Quote:

Originally Posted by GGG

How does the Carbon tax cause inflation every year if the rate was unchanged? Like if it’s $40 per tonne one year and $40 per tonne the next year then there should be no inflation caused by Carbon tax.

|

It's not the same every year. It goes up every year.

Last edited by Samonadreau; 09-13-2024 at 10:26 PM.

|

|

|

09-13-2024, 10:31 PM

09-13-2024, 10:31 PM

|

#13911

|

|

Franchise Player

Join Date: Aug 2008

Location: California

|

Quote:

Originally Posted by Samonadreau

It's not the same every year. It goes up every year.

|

But the rate it goes up every year is fixed. So the consequence of the Carbon tax on inflation shouldn’t go from .2% to .4%. At worst it should be a constant affect on inflation. But also since it’s $15 per tonne per year the rate of increase is slightly decreasing due to inflation.

And after 2030 it ends (or should only increase at the rate of inflation) so it’s a short term affect.

|

|

|

09-13-2024, 10:36 PM

09-13-2024, 10:36 PM

|

#13912

|

|

Franchise Player

Join Date: Aug 2009

Location: wearing raccoons for boots

|

Quote:

Originally Posted by Mr.Coffee

Haha fair enough well if they do run the country like the UCPs I will 110% be there with ya. I kind of find it hard to believe they’ll be that bad but I guess you never know.

|

They'll be even worse

|

|

|

09-13-2024, 10:40 PM

09-13-2024, 10:40 PM

|

#13913

|

|

Franchise Player

Join Date: Sep 2015

Location: Paradise

|

Quote:

Originally Posted by GGG

But the rate it goes up every year is fixed. So the consequence of the Carbon tax on inflation shouldn’t go from .2% to .4%. At worst it should be a constant affect on inflation. But also since it’s $15 per tonne per year the rate of increase is slightly decreasing due to inflation.

And after 2030 it ends (or should only increase at the rate of inflation) so it’s a short term affect.

|

You are right on the the premise of if it goes up by the same it should maintain the approx .2% inflation uptick.

But I would argue that when anything doubles like that in 5 years will compound somehow beyond maintaining current rate of inflation. There would be a burdening effect of some sort.

Either way I hate when people say it's 0.1% when total direct and indirect is about 0.2% and to say those numbers alone is misguided, because target is 2%,. So that's 10% of the target and means that 10% needs to be trimmed somewhere else.

Last edited by Samonadreau; 09-13-2024 at 10:42 PM.

|

|

|

09-13-2024, 10:48 PM

09-13-2024, 10:48 PM

|

#13914

|

|

First Line Centre

Join Date: Feb 2003

Location: Cranbrook

|

Quote:

Originally Posted by Samonadreau

Are you talking about the Bank of Canada's 0.1 to 0.15% number that only factored in Fuel and natural gas (and other fossil fuels), but didnt factor in the secondary effects such as higher cost to produce and transport food and goods that would compound it. And higher costs of some services.

Bank of Canada has been criticized, for discluding compounding effects of it. Other economists have estimated it around .2% which is 10% of the Bank of Canada's target of 2%. That's not insignificant.

Also Carbon tax is slated to increase year over year and will be more than double what it is now by 2030. That will make it much more significant. say it goes up to about 0.4% total direct and indirect inflation by 2030. That's 20% of the target inflation.

|

If that were the case, I would suggest that we would have seen a much higher inflation rate in BC in the 10 years that they had a Carbon Tax before one was instituted federally.

In fact, what we see is that CPI from a baseline in 2002, grew 14% Canada wide from 2002-2008, and 12% in BC - then from 2008 to 2019, where BC had a CT, but Canada-wide was not yet adopted, Canada's CPI increased 19% while BC's only grew 17%.

Now this is an imperfect comparison as there is a lot more to inflation in regional differences over that time, but BC could hardly be considered one of the less expensive places to live in Canada. If the Carbon Tax had a material effect on inflation, I would have expected inflation to have at least grown at a slightly higher pace than the rest of Canada compared to the previous years.. instead it was even lower.

https://www2.gov.bc.ca/assets/gov/da...l_averages.pdf

__________________

@PR_NHL

The @NHLFlames are the first team to feature four players each with 50+ points within their first 45 games of a season since the Penguins in 1995-96 (Ron Francis, Mario Lemieux, Jaromir Jagr, Tomas Sandstrom).

Fuzz - "He didn't speak to the media before the election, either."

|

|

|

09-13-2024, 11:02 PM

09-13-2024, 11:02 PM

|

#13915

|

|

Franchise Player

Join Date: Sep 2015

Location: Paradise

|

Quote:

Originally Posted by belsarius

If that were the case, I would suggest that we would have seen a much higher inflation rate in BC in the 10 years that they had a Carbon Tax before one was instituted federally.

In fact, what we see is that CPI from a baseline in 2002, grew 14% Canada wide from 2002-2008, and 12% in BC - then from 2008 to 2019, where BC had a CT, but Canada-wide was not yet adopted, Canada's CPI increased 19% while BC's only grew 17%.

Now this is an imperfect comparison as there is a lot more to inflation in regional differences over that time, but BC could hardly be considered one of the less expensive places to live in Canada. If the Carbon Tax had a material effect on inflation, I would have expected inflation to have at least grown at a slightly higher pace than the rest of Canada compared to the previous years.. instead it was even lower.

https://www2.gov.bc.ca/assets/gov/da...l_averages.pdf |

The data there backs your point, but BC carbon tax was only at a max of $30/ton over that span and didn't increase from 2012 to 2019. I would argue that's way less burdening and puts far less pressure on inflation. For example 2030 will see us at $170/ton.

I'm all for Climate responsibility. I'm also not downplaying a Tax on something that Canadians are required to rely on possibly more then anywhere else in the world. Acknowledge that something needs to be done, but also acknowledge that's doesn't just equate to a rounding error. ai know there's rebates but people are still farther behind.

|

|

|

|

The Following User Says Thank You to Samonadreau For This Useful Post:

|

|

09-13-2024, 11:18 PM

09-13-2024, 11:18 PM

|

#13916

|

|

First Line Centre

Join Date: Feb 2003

Location: Cranbrook

|

Quote:

Originally Posted by Samonadreau

The data there backs your point, but BC carbon tax was only at a max of $30/ton over that span and didn't increase from 2012 to 2019. I would argue that's way less burdening and puts far less pressure on inflation. For example 2030 will see us at $170/ton.

I'm all for Climate responsibility. I'm also not downplaying a Tax on something that Canadians are required to rely on possibly more then anywhere else in the world. Acknowledge that something needs to be done, but also acknowledge that's doesn't just equate to a rounding error. ai know there's rebates but people are still farther behind.

|

Fair point on the fact that it really didn't change over that time, as as pointed out that would negate any inflationary pressures (late to that part of the discussion). And I won't argue it's going to get worse either, honestly I think you make good points... but, that is exactly the point of it. The whole notion of a carbon tax is that it is supposed to be so punitive that is forces the market to shift. I think what we are seeing is that instead of forcing industries and consumers to change their habits, it is just pushing costs up as the changes are not materializing.

The problem I have with the carbon tax is that it is trying to do all of the heavy lifting, which is impossible. It is as bad as when people say that we should be all in on Carbon Capture... this isn't a one solution fight.

And it should be included on imports. Great, we increased Chinese steel tariffs by 25%, but those things come from from a whole lot of coal (and i don't mean the metallurgical coal actually in the steel) and should have that tax on them as well. And penalizing EVs? Like I get that they are government subsidized in China and would be an unfair market for domestic car makers.. well why don't we subsidize our own makers more and push those EV prices down harder instead of keeping them higher.

The carbon tax only works in there is choice.. and while there is some movement to give people choices that reduce their footprints (15 min cities) things are moving way slower than they need to be for it to effectively work. So as much as I support the fact that the Carbon Tax is better than nothing, there is a very valid point that its continued growth, without giving people choices to make that lessens their reliance on fossil fuels, is just an exercise in futility.

People want to axe the tax.. fine, give me a credible replacement plan forward that focuses on reduction of fossil fuel usage and I'll listen, but right now it seems like we are in a sinking boat. One party is using a small bucket to bail water and is only making us tired. One party says forget the bucket and just enjoy the ride, and the last one is saying the bucket sucks and we need to do better, but don't ask me how.

__________________

@PR_NHL

The @NHLFlames are the first team to feature four players each with 50+ points within their first 45 games of a season since the Penguins in 1995-96 (Ron Francis, Mario Lemieux, Jaromir Jagr, Tomas Sandstrom).

Fuzz - "He didn't speak to the media before the election, either."

|

|

|

|

The Following User Says Thank You to belsarius For This Useful Post:

|

|

09-13-2024, 11:33 PM

09-13-2024, 11:33 PM

|

#13917

|

|

Franchise Player

Join Date: Aug 2008

Location: California

|

Quote:

Originally Posted by Samonadreau

You are right on the the premise of if it goes up by the same it should maintain the approx .2% inflation uptick.

But I would argue that when anything doubles like that in 5 years will compound somehow beyond maintaining current rate of inflation. There would be a burdening effect of some sort.

Either way I hate when people say it's 0.1% when total direct and indirect is about 0.2% and to say those numbers alone is misguided, because target is 2%,. So that's 10% of the target and means that 10% needs to be trimmed somewhere else.

|

Why do you argue it would compound somehow? If anything by removing money from people’s pockets it would reduce price pressure on other things or if fully rebated have no affect on purchasing power despite the inflationary increase.

I don’t see an opportunity for compounding here.

|

|

|

09-13-2024, 11:36 PM

09-13-2024, 11:36 PM

|

#13918

|

|

Franchise Player

Join Date: Sep 2015

Location: Paradise

|

I think Canadians are just frustrated over Inflation and Wage increases not matching the increased costs of living. The carbon tax is a tipping point so to speak just for frustration of the average Canadian.

I know my wages have increased about 8% in the last 5 years. Or an average of about1.6%. Would like to see the average inflation over that time. And I'm better off then a lot of others I know.

Last edited by Samonadreau; 09-13-2024 at 11:43 PM.

|

|

|

09-13-2024, 11:40 PM

09-13-2024, 11:40 PM

|

#13919

|

|

Franchise Player

Join Date: Sep 2015

Location: Paradise

|

Quote:

Originally Posted by GGG

Why do you argue it would compound somehow? If anything by removing money from people’s pockets it would reduce price pressure on other things or if fully rebated have no affect on purchasing power despite the inflationary increase.

I don’t see an opportunity for compounding here.

|

Because you can only take so much out of people's pockets and there gets to be a points where burden kicks in and they don't stop buying as much of it, or cheaper options.

If groceries go up 15%, you can try to cut 10% of your costs in purchases. Now if they up another 15% you maybe can't cut another 10% of your costs in purchases.

How much of it I have no idea, but somehow that would factor in.

Last edited by Samonadreau; 09-13-2024 at 11:46 PM.

|

|

|

09-13-2024, 11:45 PM

09-13-2024, 11:45 PM

|

#13920

|

|

Franchise Player

|

Quote:

Originally Posted by Samonadreau

Are you talking about the Bank of Canada's 0.1 to 0.15% number that only factored in Fuel and natural gas (and other fossil fuels), but didnt factor in the secondary effects such as higher cost to produce and transport food and goods that would compound it. And higher costs of some services.

Bank of Canada has been criticized, for discluding compounding effects of it. Other economists have estimated it around .2% which is 10% of the Bank of Canada's target of 2%. That's not insignificant.

|

Why would it compound? Imagine a product passes through 3 businesses and the carbon tax led to a 0.1% increase in input costs for each:

No carbon tax:

Business 1 produces good and sells it for $1,000

Business 2 buys good for $1,000 and distributes it for $500

Business 3 buys good for $1,500 and sells it retail for $2,000

With carbon tax:

Business 1 produces good and sells it for $1,001

Business 2 buys good for $1,001 and packages/transports it for $500.50

Business 3 buys good for $1,501.50 and sells it at retail for $2,002

So even with each business adding 0.1% to their final price, the end result is still a 0.1% price increase.

If the compounding you were talking about happened in reality, then small changes in commodity prices would blow up into large inflationary and deflationary price swings in the final price of a product.

Quote:

|

Also Carbon tax is slated to increase year over year and will be more than double what it is now by 2030. That will make it much more significant. say it goes up to about 0.4% total direct and indirect inflation by 2030. That's 20% of the target inflation.

|

As GGG pointed out, the effect would lessen over time because the relative increases get smaller. 40% -> 50% is a 25% increase whereas $155 -> $170 is only a 9.7% increase.

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 10:08 PM.

|

|