12-15-2014, 04:01 PM

12-15-2014, 04:01 PM

|

#161

|

|

Franchise Player

Join Date: Jun 2004

Location: Calgary

|

Quote:

Originally Posted by blankall

The only reason they are underwater is due to the low oil prices.... Which is exactly my point. If oil prices were at their natural levels the shale fields would be profitable.

Instead OPEC is using the same simple and dirty trick all monopolists use. Sell at artificially low prices, drive the smaller and developing competition out of business, and then jack up the price.

|

Your post confuses me, how do you exactly determine the natural price level for oil? Or is the "natural price level" what you want it to be to turn a profit for you?

Does supply and demand not dictate the price in the oil world anymore? and why should the saudis and opec cut production to prop up the natural price of oil for you?

Instead of the Saudis taking the hit and cutting production they are letting the inefficient producers take it on the chin and eventually it will result in less production and the supply and demand situation will tighten and prices will go back up yet the Saudis won't have given market share away.

There doesn't seem to me to be any cheap or dirty tricks involved here at all just good business even though it might not seem like it from your perspective.

|

|

|

|

The Following 3 Users Say Thank You to Dan02 For This Useful Post:

|

|

12-15-2014, 04:18 PM

12-15-2014, 04:18 PM

|

#162

|

|

Lifetime Suspension

|

This is the complete opposite of a monopoly. The reason we have such low oil prices is because of competition. Which is great as a consumer but terrible as an Albertan

|

|

|

|

The Following User Says Thank You to ExiledFlamesFan For This Useful Post:

|

|

12-15-2014, 04:49 PM

12-15-2014, 04:49 PM

|

#163

|

|

Ate 100 Treadmills

|

Ummmm OPEC is the definition of an oligopy. Oil markets are in no way governed by competition. A few large suppliers openly collude to control prices by artificially throttling or increasing supply.

|

|

|

12-15-2014, 05:07 PM

12-15-2014, 05:07 PM

|

#164

|

|

Lifetime Suspension

|

Quote:

Originally Posted by blankall

Ummmm OPEC is the definition of an oligopy. Oil markets are in no way governed by competition. A few large suppliers openly collude to control prices by artificially throttling or increasing supply.

|

OPEC in not an oligopy. OPEC is a cartel. There are other players in the global oil market. OPEC controls a percent of the market, not the entire market. And over the last 5-10 years this market share had dropped significantly

Last edited by ExiledFlamesFan; 12-15-2014 at 06:59 PM.

|

|

|

12-15-2014, 05:15 PM

12-15-2014, 05:15 PM

|

#165

|

|

Franchise Player

Join Date: Jun 2004

Location: Calgary

|

The Oil market is certainly not a oligopoly outside of a few countries like Venezuela.

|

|

|

12-15-2014, 06:09 PM

12-15-2014, 06:09 PM

|

#166

|

|

First Line Centre

|

Quote:

Originally Posted by Flash Walken

Opec are putting pressure on Iran and Russia, that's the reason this is happening.

|

Yes, a big part of this is Sunni-Shi issues and Saudi Arabia wanting to hurt

Iran (Shi Muslims) as much as possible.

|

|

|

12-19-2014, 11:17 PM

12-19-2014, 11:17 PM

|

#167

|

|

First Line Centre

Join Date: Aug 2009

Location: Calgary

|

Saudis today saying low oil prices are temporary. They're not making money at $55/barrel and decreasing demand by weakening the global economy. Oil production is more than just for gas.

|

|

|

12-19-2014, 11:32 PM

12-19-2014, 11:32 PM

|

#168

|

|

Franchise Player

Join Date: Oct 2013

Location: Nanaimo

|

Another reason to get of the dependency of oil.

|

|

|

12-19-2014, 11:56 PM

12-19-2014, 11:56 PM

|

#169

|

|

First Line Centre

Join Date: Aug 2009

Location: Calgary

|

Quote:

Originally Posted by combustiblefuel

Another reason to get of the dependency of oil.

|

Because we're at the mercy of opec?

|

|

|

12-20-2014, 12:30 AM

12-20-2014, 12:30 AM

|

#170

|

|

Lifetime Suspension

|

Quote:

Originally Posted by stampsx2

Saudis today saying low oil prices are temporary. They're not making money at $55/barrel and decreasing demand by weakening the global economy. Oil production is more than just for gas.

|

LOL, complete BS. The Saudis could stick a straw in the sand and have a $10.00 hooker suck oil from it and make money.

|

|

|

|

The Following 5 Users Say Thank You to T@T For This Useful Post:

|

|

12-20-2014, 08:54 AM

12-20-2014, 08:54 AM

|

#172

|

|

First Line Centre

Join Date: Aug 2009

Location: Calgary

|

Quote:

Originally Posted by T@T

LOL, complete BS. The Saudis could stick a straw in the sand and have a $10.00 hooker suck oil from it and make money.

|

If there's a post that's complete bs it would be yours. A straw? Really? They could put a straw in the ground? Where's your source?

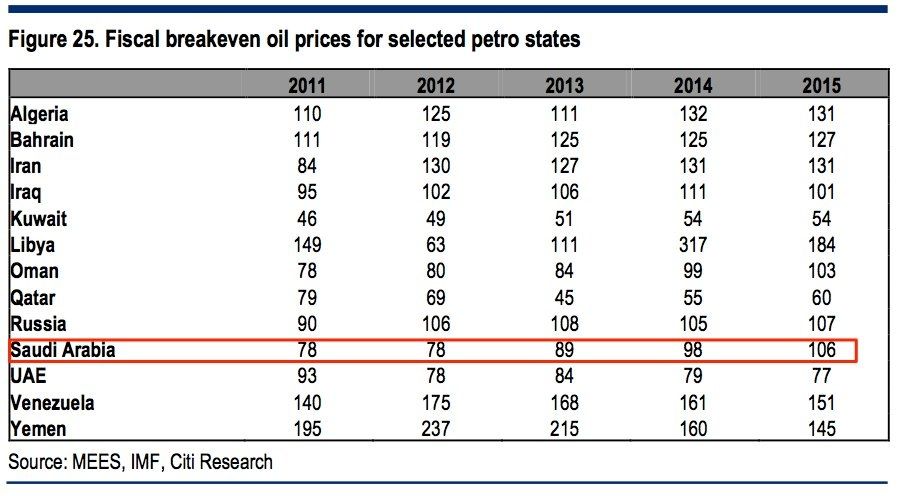

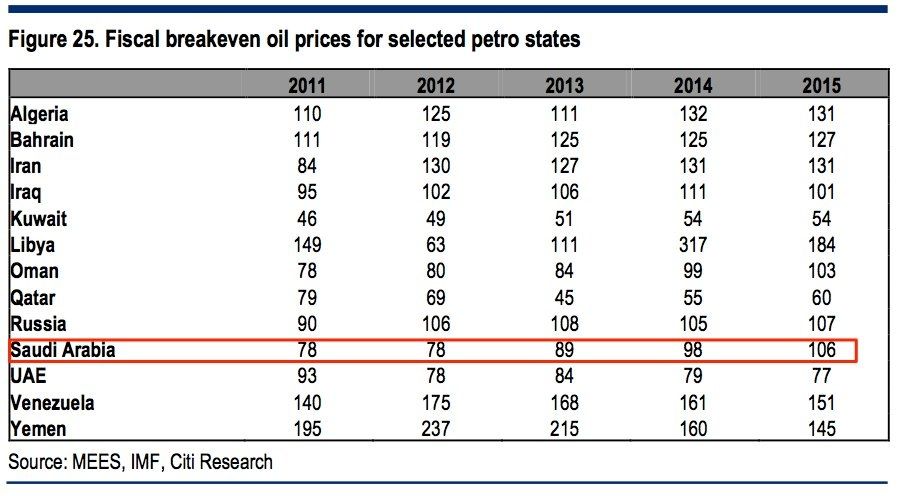

Production costs by region:

|

|

|

12-20-2014, 09:23 AM

12-20-2014, 09:23 AM

|

#173

|

|

Powerplay Quarterback

|

Quote:

Originally Posted by stampsx2

If there's a post that's complete bs it would be yours. A straw? Really? They could put a straw in the ground? Where's your source?

Production costs by region:

|

What do they mean by oil prices? Are you sure it's cost because 108 for light crude makes no sense. I read that title more as average sale price. Everything I've heard there production cost is around $20

|

|

|

12-20-2014, 09:31 AM

12-20-2014, 09:31 AM

|

#174

|

|

Powerplay Quarterback

|

Quote:

Originally Posted by stampsx2

Saudis today saying low oil prices are temporary. They're not making money at $55/barrel and decreasing demand by weakening the global economy. Oil production is more than just for gas.

|

I'm sorry - this post is a bit confusing. "They're (the Saudis) not making money at $55/barrel and decreasing demand by weakening the global economy,"

The Saudi's are weakening the global economy? Low oil prices are weakening the global economy? Or did you mean "They are not making money at $55 and the decreasing demand (of oil) caused by a weakening global economy"?

Last edited by ranchlandsselling; 12-20-2014 at 06:34 PM.

|

|

|

12-20-2014, 09:31 AM

12-20-2014, 09:31 AM

|

#175

|

|

First Line Centre

Join Date: Jun 2011

Location: Edmonton

|

That chart is the cost to balance the budget, not the cost to extract oil. They aren't going to shut in wells because they are running a budget deficit.

|

|

|

|

The Following 8 Users Say Thank You to GP_Matt For This Useful Post:

|

|

12-20-2014, 07:29 PM

12-20-2014, 07:29 PM

|

#176

|

|

Lifetime Suspension

|

Quote:

Originally Posted by GP_Matt

That chart is the cost to balance the budget, not the cost to extract oil. They aren't going to shut in wells because they are running a budget deficit.

|

Saudi Arabia has 745 billion in reserve assets. The Saudis can outlast any country or major oil corporation.

http://mobile.bloomberg.com/news/201...iscipline.html

While Russia is collapsing as we speak the Saudis are sitting pretty.

|

|

|

12-21-2014, 12:26 PM

12-21-2014, 12:26 PM

|

#177

|

|

Lifetime Suspension

|

Quote:

Originally Posted by stampsx2

If there's a post that's complete bs it would be yours. A straw? Really? They could put a straw in the ground? Where's your source?

|

I didn't think you would take the hooker with the straw literally

But fact remains middle east oil is cheap very very cheap compared to ours.

|

|

|

|

The Following 4 Users Say Thank You to T@T For This Useful Post:

|

|

12-21-2014, 11:26 PM

12-21-2014, 11:26 PM

|

#178

|

|

Franchise Player

|

The Saudis are playing a dangerous game here. If they keep the price low they could send some of the their OPEC partners such as Nigeria and Venezuela into chaos. Worse, if they do the same to Russia, Russia has the power to strike back.

Suppose Putin orders up a couple of subs to take out Saudi shipping terminals like Ras Tanura, crippling their ability to ship. World markets are thrown into chaos. Of course NATO retaliates, but wait, China can't allow both of it's main energy sources to go down..... Far fetched for sure, but when economies reach the tipping point anything can happen.

|

|

|

12-21-2014, 11:33 PM

12-21-2014, 11:33 PM

|

#179

|

|

Franchise Player

Join Date: Oct 2009

Location: Calgary

|

Quote:

Originally Posted by edslunch

The Saudis are playing a dangerous game here. If they keep the price low they could send some of the their OPEC partners such as Nigeria and Venezuela into chaos. Worse, if they do the same to Russia, Russia has the power to strike back.

Suppose Putin orders up a couple of subs to take out Saudi shipping terminals like Ras Tanura, crippling their ability to ship. World markets are thrown into chaos. Of course NATO retaliates, but wait, China can't allow both of it's main energy sources to go down..... Far fetched for sure, but when economies reach the tipping point anything can happen.

|

And I thought exhaledflamesfan was a rainy cloud, now WW3 is coming. Dammit.

__________________

All hockey players are bilingual. They know English and profanity - Gordie Howe

|

|

|

|

The Following 3 Users Say Thank You to TurdFerguson For This Useful Post:

|

|

12-21-2014, 11:38 PM

12-21-2014, 11:38 PM

|

#180

|

|

Franchise Player

|

Quote:

Originally Posted by TurdFerguson

And I thought exhaledflamesfan was a rainy cloud, now WW3 is coming. Dammit.

|

Just doing my part to spread Christmas cheer.  Chances of that scenario happening are next to nil

|

|

|

|

The Following User Says Thank You to edslunch For This Useful Post:

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 02:13 PM.

|

|