08-02-2011, 10:31 AM

08-02-2011, 10:31 AM

|

#401

|

|

Franchise Player

Join Date: Aug 2005

Location: Memento Mori

|

Quote:

Originally Posted by MarchHare

Are we talking total household income or individual salaries? A househld with two earners, one making $150k and the other making $100k (or any other combination that adds up to $250k), would not see a tax increase under Obama's proposal.

In any event, having an income of $250k or more puts one in the top 1.5% of American households ( source). If that's not considered wealthy, than what is? I contend that if you can't manage your finances properly with an income of $250k or more, then you fail home economics forever considering $250k is eight times the median American household income ($31k, source). |

Wow, me and MarchHare agree about something.

That hypothetical couple SUCKS at money management. Just as a comparison, er, I, um, make almost er, that much  and I saved $48,000 last year.

__________________

If you don't pass this sig to ten of your friends, you will become an Oilers fan.

|

|

|

08-02-2011, 10:35 AM

08-02-2011, 10:35 AM

|

#402

|

|

Franchise Player

Join Date: May 2004

Location: YSJ (1979-2002) -> YYC (2002-2022) -> YVR (2022-present)

|

Quote:

Originally Posted by Shazam

That's a horrible article.

Yeah, whatever. What a load of crap.

|

No kidding.

Quote:

|

Some of the expenses incurred by couples like the Joneses may seem lavish -- such as $5,000 on a housecleaner, a $1,200 annual tab for dry cleaning and $4,000 on kids' activities. But when both parents are working, it is impossible for them to maintain the home, care for the children and dress for their professional jobs without a big outlay.

|

How do couples with two parents who both work professional jobs but have a total household income of "only" $100k cope, then? Somehow I think those families manage to get by just fine without a $5000/year housecleaner.

|

|

|

|

The Following User Says Thank You to MarchHare For This Useful Post:

|

|

08-02-2011, 10:36 AM

08-02-2011, 10:36 AM

|

#403

|

|

Franchise Player

Join Date: Aug 2004

Location: Moscow, ID

|

The Fiscal Times is owned by Peter Peterson, a billionaire investment banker. Hmmmm...

Once they buy all the things they need and want and put a bunch of money into savings, they don't have anything left over. The horror.

__________________

As you can see, I'm completely ridiculous.

|

|

|

08-02-2011, 10:36 AM

08-02-2011, 10:36 AM

|

#404

|

|

Crash and Bang Winger

Join Date: Nov 2006

Location: South Texas

|

Quote:

Originally Posted by Shazam

That's a horrible article.

Yeah, whatever. What a load of crap.

|

Horrible because it doesn't fit in with your view of rich?

The only expense I have a problem with that was listed is the housekeeper. As for the child expenses that's pretty standard when both parents are working and a drycleaning bill for $1,200 for two professionals doesn't really seem that outlandish. Both those amounts would vary depending where you live but the fact that these costs are incurred don't exactly seem extravigent.

|

|

|

08-02-2011, 10:41 AM

08-02-2011, 10:41 AM

|

#405

|

|

Franchise Player

Join Date: Aug 2005

Location: Memento Mori

|

Quote:

Originally Posted by Rockin' Flames

Horrible because it doesn't fit in with your view of rich?

The only expense I have a problem with that was listed is the housekeeper. As for the child expenses that's pretty standard when both parents are working and a drycleaning bill for $1,200 for two professionals doesn't really seem that outlandish. Both those amounts would vary depending where you live but the fact that these costs are incurred don't exactly seem extravigent.

|

It's horrible because they loaded up on the costs. In other words, your theoretical couple can't stop putting their money into a firepit and burning it.

Why would it not fit into my view of the rich? I just told you I make almost that amount, and I actually manage to save money. Oh yeah, I have two money-sucking kids to take care of too.

When I was younger, a very rich person once told me "You become rich by not spending money." Hey, it actually works!

__________________

If you don't pass this sig to ten of your friends, you will become an Oilers fan.

|

|

|

08-02-2011, 10:53 AM

08-02-2011, 10:53 AM

|

#406

|

|

Franchise Player

Join Date: Aug 2004

Location: Moscow, ID

|

It's clearly an article written by wealthy interests to lay out the worst case scenario for making 250K a year, to try to turn attention away from the fact that raising taxes on the well-to-do to the extremely wealthy is very necessary. The Jones's can afford the tax hike.

__________________

As you can see, I'm completely ridiculous.

|

|

|

|

The Following User Says Thank You to Weiser Wonder For This Useful Post:

|

|

08-02-2011, 10:54 AM

08-02-2011, 10:54 AM

|

#407

|

|

Crash and Bang Winger

|

I'll hand it to them. If they're spending the bulk of $250 000 a year, then at least they're contributing to a shriveling domestic economy. A millionaire could live the exact same lifestyle as this family does, and keep 75% of their money.

|

|

|

08-02-2011, 10:57 AM

08-02-2011, 10:57 AM

|

#408

|

|

Franchise Player

Join Date: May 2004

Location: YSJ (1979-2002) -> YYC (2002-2022) -> YVR (2022-present)

|

Quote:

Originally Posted by Rockin' Flames

Horrible because it doesn't fit in with your view of rich?

|

It's horrible because it's completely out of touch with reality.

For perspective, consider the case of my parents, who by anyone's definition are considered "wealthy". Until recently, my father worked as a VP at a well-known Canadian company, and my mother is retired (she worked as a PA in a law firm until about five years ago). Their total household income is significantly less than $250k per year, and they live in one of the most heavily-taxed areas of the country (New Brunswick). Housing prices are obviously lower there than in Calgary, Toronto, Vancouver, or other major metropolitan areas, but their property taxes are considerably higher than what we pay. They live in a suburban community with no public transit and no amenities within walking distance, so they have to drive everywhere. Gas prices in NB are typically higher than they are in Calgary.

Despite having a household income well below what you consider "wealthy", my parents own a 3000+ sqft waterfront home with a private beach. They each drive a Mercedez-Benz (E-Class and SL-Class). They own two Sea-doos and numerous other watercraft (canoes, kayaks, etc.). Over the last 10-15 years, they paid 50% of the university expenses for two children, one of whom completed two Bachelor's and one Master's degrees. They travel extensively and take numerous trips to explore Europe or vacation at tropical resorts annually. They've also saved appropriately for retirement and have been maxxing their RRSP contributions for years.

So you'll forgive me if I'm a bit sceptical when someone tries to tell me that having a household income of $250k per year doesn't make you wealthy. My parents have a very lavish lifestyle that is undoubtedly the envy of most Canadians, and they do it with a household income of less than that amount.

|

|

|

08-02-2011, 10:58 AM

08-02-2011, 10:58 AM

|

#409

|

|

Franchise Player

Join Date: Aug 2005

Location: Memento Mori

|

Quote:

Originally Posted by MarchHare

It's horrible because it's completely out of touch with reality.

For perspective, consider the case of my parents, who by anyone's definition are considered "wealthy". Until recently, my father worked as a VP at a well-known Canadian company, and my mother is retired (she worked as a PA in a law firm until about five years ago). Their total household income is significantly less than $250k per year, and they live in one of the most heavily-taxed areas of the country (New Brunswick). Housing prices are obviously lower there than in Calgary, Toronto, Vancouver, or other major metropolitan areas, but their property taxes are considerably higher than what we pay. They live in a suburban community with no public transit and no amenities within walking distance, so they have to drive everywhere. Gas prices in NB are typically higher than they are in Calgary.

Despite having a household income well below what you consider "wealthy", my parents own a 3000+ sqft waterfront home with a private beach. They each drive a Mercedez-Benz (E-Class and SL-Class). They own two Sea-doos and numerous other watercraft (canoes, kayaks, etc.). Over the last 10-15 years, they paid 50% of the university expenses for two children, one of whom completed two Bachelor's and one Master's degrees. They travel extensively and take numerous trips to explore Europe or vacation at tropical resorts annually. They've also saved appropriately for retirement and have been maxxing their RRSP contributions for years.

So you'll forgive me if I'm a bit sceptical when someone tries to tell me that having a household income of $250k per year doesn't make you wealthy. My parents have a very lavish lifestyle that is undoubtedly the envy of most Canadians, and they do it with a household income of less than that amount.

|

Have you realized that every time you give out financial advice in other threads, you contradict yourself with real life examples?

__________________

If you don't pass this sig to ten of your friends, you will become an Oilers fan.

|

|

|

08-02-2011, 11:02 AM

08-02-2011, 11:02 AM

|

#410

|

|

Franchise Player

Join Date: Jun 2008

Location: Calgary

|

Sounds upper middle class to me. A lot of rig pigs have the same life-style - just replace the "Mercedes" with a "Dodge Ram".

|

|

|

08-02-2011, 11:02 AM

08-02-2011, 11:02 AM

|

#411

|

|

Franchise Player

Join Date: May 2004

Location: YSJ (1979-2002) -> YYC (2002-2022) -> YVR (2022-present)

|

Quote:

Originally Posted by Shazam

Have you realized that every time you give out financial advice in other threads, you contradict yourself with real life examples?

|

What do you mean? What financial advice are you talking about?

|

|

|

08-02-2011, 11:04 AM

08-02-2011, 11:04 AM

|

#412

|

|

Franchise Player

Join Date: Aug 2005

Location: Memento Mori

|

Quote:

Originally Posted by MarchHare

What do you mean? What financial advice are you talking about?

|

In another thread you said to not in the suburbs, and that having a car is a massive drain on finances.

So you then provide an example in this thread of a family that clearly should've been struggling financially according to your advice, yet aren't.

I'll say it once, I'll say it again:

To be financially successful, spend less than you earn.

__________________

If you don't pass this sig to ten of your friends, you will become an Oilers fan.

|

|

|

08-02-2011, 11:06 AM

08-02-2011, 11:06 AM

|

#413

|

|

Franchise Player

Join Date: Aug 2004

Location: Moscow, ID

|

Quote:

Originally Posted by Shazam

I'll say it once, I'll say it again:

To be financially successful, spend less than you earn.

|

Fascinating insight.

__________________

As you can see, I'm completely ridiculous.

|

|

|

08-02-2011, 11:11 AM

08-02-2011, 11:11 AM

|

#414

|

|

Franchise Player

Join Date: May 2004

Location: YSJ (1979-2002) -> YYC (2002-2022) -> YVR (2022-present)

|

Quote:

Originally Posted by Shazam

In another thread you said to not in the suburbs, and that having a car is a massive drain on finances.

So you then provide an example in this thread of a family that clearly should've been struggling financially according to your advice, yet aren't.

I'll say it once, I'll say it again:

To be financially successful, spend less than you earn.

|

Not to get too off-topic, but in that other thread, I was giving advice to a young guy living in Calgary (not New Brunswick) who is still early in his career and is undoubtedly making much less than my father does. I didn't say that he would "struggle" if he bought a car and lived in the suburbs, only that he'd have much more disposable income (or the ability to save more of his money, whichever you prefer) if he lived in a walkable community near his workplace and didn't buy a car. I stand by that statement. His situation is significantly different than my parents', so I'm not contradicting anything.

|

|

|

08-02-2011, 11:17 AM

08-02-2011, 11:17 AM

|

#415

|

|

Powerplay Quarterback

Join Date: Sep 2010

Location: Calgary, AB

|

Quote:

Originally Posted by VladtheImpaler

Not to mention, there is a big difference between a salary of $250K in Manhattan and in Fargo.

|

While true, the average salary in NYC (including Manhattan, granted) is 48,xxx and in Fargo it's 32,xxx, with mean household income in Manhattan of 121,000. That still means that a 250,000 household is making twice the average household income in the most expensive city in the US.

Hardly the destitution that the tea party types are implying.

As for the family in the article, they seem to be struggling to make ends meet at 250,000 when average income is less than 20% of that - what do those people do? How can they afford everything? What an idiotic article - the couple in question are idiots. Overstretching your means for completely unnecessary things does not make you poor, it makes you stupid. Their expenses as listed in the article are 900/month -- on a 20,000 per month salary. Even at a tax rate of 50% (which is nowhere near the marginal tax rate in the US for a 250,000 salary) that's still 9,000 per month left over for mortgages, living expenses, college savings, retirement savings. If they are struggling on 9,000 per month, clearly these people are idiots.

Last edited by billybob123; 08-02-2011 at 11:25 AM.

|

|

|

08-02-2011, 11:33 AM

08-02-2011, 11:33 AM

|

#416

|

|

First Line Centre

Join Date: Mar 2007

Location: Calgary

|

The family in that article are clearly living in a house they can't afford and driving vehicles they don't have money for, not to mention eating out more than they should be (maybe they should make a lunch at home instead of eating out every single day). Not to mention paying down the student loans before buying the big house and fancy cars, and maybe taking transit instead of driving to work.

It would be hard to feel much sympathy for someone who was going into debt because they managed their finances so badly they couldn't get by on a family income of 250k. It seems to be a case of a hypothetical family who want everything now rather than working for it and gradually building up to the ideal lifestyle.

|

|

|

|

The Following 2 Users Say Thank You to Ashartus For This Useful Post:

|

|

08-02-2011, 11:45 AM

08-02-2011, 11:45 AM

|

#417

|

|

Crash and Bang Winger

Join Date: Nov 2006

Location: South Texas

|

Quote:

Originally Posted by MarchHare

It's horrible because it's completely out of touch with reality.

For perspective, consider the case of my parents, who by anyone's definition are considered "wealthy". Until recently, my father worked as a VP at a well-known Canadian company, and my mother is retired (she worked as a PA in a law firm until about five years ago). Their total household income is significantly less than $250k per year, and they live in one of the most heavily-taxed areas of the country (New Brunswick). Housing prices are obviously lower there than in Calgary, Toronto, Vancouver, or other major metropolitan areas, but their property taxes are considerably higher than what we pay. They live in a suburban community with no public transit and no amenities within walking distance, so they have to drive everywhere. Gas prices in NB are typically higher than they are in Calgary.

Despite having a household income well below what you consider "wealthy", my parents own a 3000+ sqft waterfront home with a private beach. They each drive a Mercedez-Benz (E-Class and SL-Class). They own two Sea-doos and numerous other watercraft (canoes, kayaks, etc.). Over the last 10-15 years, they paid 50% of the university expenses for two children, one of whom completed two Bachelor's and one Master's degrees. They travel extensively and take numerous trips to explore Europe or vacation at tropical resorts annually. They've also saved appropriately for retirement and have been maxxing their RRSP contributions for years.

So you'll forgive me if I'm a bit sceptical when someone tries to tell me that having a household income of $250k per year doesn't make you wealthy. My parents have a very lavish lifestyle that is undoubtedly the envy of most Canadians, and they do it with a household income of less than that amount.

|

Just to mention a couple of items. Costs in the US are different than in Canada for a couple of sigificiant items.

1. Real Estate taxes - I've experienced about double the amount from Canada

2. My understanding is that post secondary education costs are much higher in the US. This still may vary depending upon the university but I believe overall the costs are higher. I haven't investigated much but I would like to see my son become a professional and asked someone about what kind of cost I would be looking at and the cost is about double the amount in Canada.

3. Health Care - For my family the monthly cost for health care coverage alone is about $900 through my employer. That is after my employer has helped pay for part of the health care by contributing $400 per month.

So it really doesn't seem fair to compare what a family would pay in Canada vs the US.

Factoring in what I said above. If you are a two professional household, chances are you've accumulated a significant amount of school debt. You want to save for retirement and don't forget let's try to help the kids out with their post secondary education so they are in a better position when they are done school than you currently are. Then you have the government show up and ask to increase your taxes by who knows what % because you are "supposidly" rich. It just doesn't make sense to go after the $250,000 thresehold and at the very minimum that should be raised.

|

|

|

08-02-2011, 11:56 AM

08-02-2011, 11:56 AM

|

#418

|

|

Franchise Player

Join Date: May 2004

Location: YSJ (1979-2002) -> YYC (2002-2022) -> YVR (2022-present)

|

Quote:

|

It just doesn't make sense to go after the $250,000 thresehold and at the very minimum that should be raised.

|

Once again, having a household income of $250k puts one in the top 1.5% of American families. If being richer than 98.5% of Americans doesn't classify you as being part of the wealthy elite, then what does? What number do you think makes one "wealthy"?

Healthcare and post-secondary education costs are indeed lower in Canada, but that's because they're both heavily subsidized by the government which is one of the reasons we collectively pay higher taxes than you do. I'm not sure if anyone has ever done a study to show which nation's citizens come out ahead in the end: Canadians who pay higher taxes but have lower out-of-pocket healthcare and education expenses or Americans who have a lower tax burden but must pay higher tuition fees and purchase private health insurance.

Moreover, wouldn't a family making a combined income of "only" $125k (which is itself four times the national median) have those same healthcare and education expenses too? How do they cope if a household with double that income "struggles" by your reckoning?

|

|

|

08-02-2011, 12:16 PM

08-02-2011, 12:16 PM

|

#419

|

|

Franchise Player

Join Date: Nov 2006

Location: Supporting Urban Sprawl

|

Quote:

Originally Posted by MarchHare

Once again, having a household income of $250k puts one in the top 1.5% of American families. If being richer than 98.5% of Americans doesn't classify you as being part of the wealthy elite, then what does? What number do you think makes one "wealthy"?

?

|

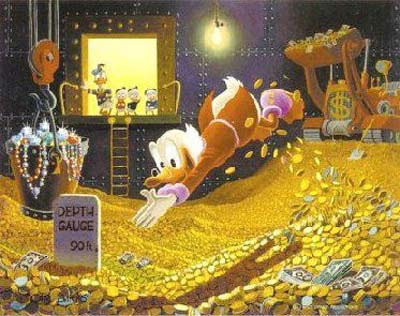

This:

__________________

"Wake up, Luigi! The only time plumbers sleep on the job is when we're working by the hour."

|

|

|

08-02-2011, 12:21 PM

08-02-2011, 12:21 PM

|

#420

|

|

Crash and Bang Winger

Join Date: Nov 2006

Location: South Texas

|

Quote:

Originally Posted by MarchHare

Once again, having a household income of $250k puts one in the top 1.5% of American families. If being richer than 98.5% of Americans doesn't classify you as being part of the wealthy elite, then what does? What number do you think makes one "wealthy"?

Healthcare and post-secondary education costs are indeed lower in Canada, but that's because they're both heavily subsidized by the government which is one of the reasons we collectively pay higher taxes than you do. I'm not sure if anyone has ever done a study to show which nation's citizens come out ahead in the end: Canadians who pay higher taxes but have lower out-of-pocket healthcare and education expenses or Americans who have a lower tax burden but must pay higher tuition fees and purchase private health insurance.

Moreover, wouldn't a family making a combined income of "only" $125k (which is itself four times the national median) have those same healthcare and education expenses too? How do they cope if a household with double that income "struggles" by your reckoning?

|

Well considering that the $250,000 bracket was brought in under Clinton at a very miniumum try rasing it with inflation over the past 10 - 15 years.

Your national median concept is leaving out some key information firstly. The national median has put every single person in the same basket and doesn't differentiate between a single guy/gal vs a 4 person household. As for the health care costs they will very depending upon the state and how many people the health care coverage would have been for. In my case if I were single and just needed health coverage for myself it would have been $80 per month because my employer still would have contributed the $400 per month towards it.

I never said that the $250k household is struggling but rather I wouldn't consider them rich.

Another factor that throws a loop in this is the way that small businesses work in the US. A signficant portion of small businesses in the US are not regular corporations but are corporations where all income from the business is tax on a person individually. If you are going to go after individuals making $250k + you will indirectly be going after these corporations.

I'm not keen on any tax increase but if they are going to raise taxes than raise is on everyone by the same percentage.

As I said before and have others I would like to see a flat tax on everyone with no loopholes.

Really there are other issues with spending that need to be fixed. I know I've mentioned it before but its a big problem and that's the entitlement programs. When you have illegal immigrents not paying taxes and receiving benefits like medicade for their children there is a problem with the entire system.

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 11:00 PM.

|

|