02-02-2012, 11:38 AM

02-02-2012, 11:38 AM

|

#2041

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Quote:

Originally Posted by Red

Yes. Not sure about the rules of this site so I am not going to link, but from what I saw some people have 10%+ LOCs.

|

Unsecured though? No way that is for a HELOC?

|

|

|

02-02-2012, 11:43 AM

02-02-2012, 11:43 AM

|

#2042

|

|

Lifetime Suspension

|

Quote:

Originally Posted by Slava

Unsecured though? No way that is for a HELOC?

|

Possibly, I don't follow all these product lines so I am not too sure.

Either way, lots of upset consumers just found out that their big screen TV will cost even more now...

|

|

|

02-02-2012, 11:45 AM

02-02-2012, 11:45 AM

|

#2043

|

|

Scoring Winger

|

Quote:

Originally Posted by Slava

Unsecured though? No way that is for a HELOC?

|

Yes it is for unsecured LOC, and most people are now in the 7-8% range.

|

|

|

|

The Following User Says Thank You to Suave For This Useful Post:

|

|

02-02-2012, 12:05 PM

02-02-2012, 12:05 PM

|

#2044

|

|

Powerplay Quarterback

|

Quote:

Originally Posted by hulkrogan

That doesn't line up with anything I've looked up on the subject, ever. If accurate, awesome. I don't think a housing crash can make anyone all that happy, even if they predict it and don't own any real estate.

|

Makes sense, look at the graph, even if house prices in Calgary are now at the same level they were in 07/08 interest rates are close to half.

Quite a bit more affordable given the interest rate environment. Doesn't take into account the long term picture but who knows what that involves.

|

|

|

02-02-2012, 12:08 PM

02-02-2012, 12:08 PM

|

#2045

|

|

Powerplay Quarterback

|

Quote:

Originally Posted by Slava

Unsecured though? No way that is for a HELOC?

|

Yes, unsecured. HELOC's are priced into a commitment letter at x above prime and x can't be changed (at least on the last TD commitment I read).

LOL @ big screen TV's.

|

|

|

02-02-2012, 12:25 PM

02-02-2012, 12:25 PM

|

#2046

|

|

Lifetime Suspension

|

Anyone know the formula they use for this affordability report?

|

|

|

02-02-2012, 12:27 PM

02-02-2012, 12:27 PM

|

#2047

|

|

Lifetime Suspension

Join Date: Dec 2011

Exp:

|

Quote:

Originally Posted by Red

Anyone know the formula they use for this affordability report?

|

Uhh, based on the axis's:

Mortgage payment / Avg household salary per month.

|

|

|

02-02-2012, 12:33 PM

02-02-2012, 12:33 PM

|

#2048

|

|

Lifetime Suspension

|

Quote:

Originally Posted by Brotato

Uhh, based on the axis's:

Mortgage payment / Avg household salary per month.

|

Found it on that link above.

Assumptions:

25% downpayment

1200 sqft bungalow is standard in 2012 and was standard 20 years ago.

No family debt levels comparison. Assuming no consumer debt etc.

Pre tax money. GST among other taxes that we pay now or more are not factored in.

Sounds legit and reasonable.

|

|

|

02-02-2012, 12:39 PM

02-02-2012, 12:39 PM

|

#2049

|

|

Scoring Winger

|

Quote:

Originally Posted by Red

Anyone know the formula they use for this affordability report?

|

Page seven of the report goes into detail of the formula. Basically it takes the cost of your mortgage (principle plus interest), utilities and property tax divided by your income.

|

|

|

02-02-2012, 12:46 PM

02-02-2012, 12:46 PM

|

#2050

|

|

Franchise Player

|

Interesting timing - I thought that the practice had been ongoing for quite a while and that they were fixing it. Not that they were loosening it now and getting trouble for it. Which ever:

http://business.financialpost.com/20...age-practices/

Finance Minister Jim Flaherty said he’s concerned about the loosening of standards by some Canadian financial institutions on mortgages that don’t require borrowers to verify income, and that steps are being taken to “correct” the practice.

Flaherty said Canada’s banking regulator looked at the practice, and he learned “what their assessment showed with respect to a few financial institutions, which is a matter of concern, and that is being corrected,” speaking in a conference call with reporters today from Tel Aviv.

|

|

|

02-02-2012, 01:20 PM

02-02-2012, 01:20 PM

|

#2051

|

|

First Line Centre

|

|

|

|

02-02-2012, 02:22 PM

02-02-2012, 02:22 PM

|

#2052

|

|

The new goggles also do nothing.

Join Date: Oct 2001

Location: Calgary

|

The banks are certainly not loosening anything in my recent experience, they're asking for more than they ever have.

__________________

Uncertainty is an uncomfortable position.

But certainty is an absurd one.

|

|

|

02-03-2012, 02:31 PM

02-03-2012, 02:31 PM

|

#2053

|

|

First Line Centre

|

Quote:

Originally Posted by photon

The banks are certainly not loosening anything in my recent experience, they're asking for more than they ever have.

|

On Tuesday Bloomberg released documents obtained through freedom of information requests that showed the Office of the Superintendent of Financial Institutions has some fears that loosening mortgage standards poses an "emerging risk" to Canada's economy.

In the 152 pages of documents, internal communications reveal that OSFI - the regulator in charge of all federally monitored financial instutuions in Canada - worries banks are becomming "increasingly liberal" by handing out loans without requiring borrowers to prove they have sufficient incomes to pay them back. Such loans have similarities to non-prime loans in the U.S. retail lending market," the OSFI documents reveal.

Speaking to reporters in Tel Aviv, on Thursday Jim Flaherty echoed the OSFI's concerns. OSFI's concerns stem from a fear that Canadians might be getting mortgages that they won't be able to afford, when rates go up from their current lows. That in turn would hurt the greater economy and Ottawas coffers as the taxpayers are ultimately responsible for funding any CMHC payouts for mortgages that default.

I guess it is not an immediate issue though as the Canadian employment report today was weaker than expected with a paltry 2,300 gain last month, while the unemployment rate ticked higher to 7.6%, leaving the Bank of Canada in no position to raise rates any time soon.

|

|

|

02-03-2012, 03:43 PM

02-03-2012, 03:43 PM

|

#2054

|

|

The new goggles also do nothing.

Join Date: Oct 2001

Location: Calgary

|

So which banks are these, there's a couple of properties I've been trying to do some different financing on for like 6 months.

__________________

Uncertainty is an uncomfortable position.

But certainty is an absurd one.

|

|

|

02-03-2012, 11:19 PM

02-03-2012, 11:19 PM

|

#2055

|

|

Franchise Player

|

Quote:

Originally Posted by Red

Read on redflagdeals that TD LOC interest rates are going up. Some in the tune of 4% in addition to the 6% they were already paying.

Not cheap debt anymore.

|

I got something in the mail today from TD saying my unsecured LOC is going up to 8.35. Not cheap anymore at all.

|

|

|

02-04-2012, 12:19 AM

02-04-2012, 12:19 AM

|

#2056

|

|

Powerplay Quarterback

Join Date: Mar 2006

Location: Victoria

|

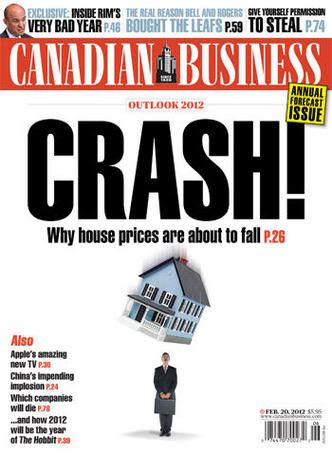

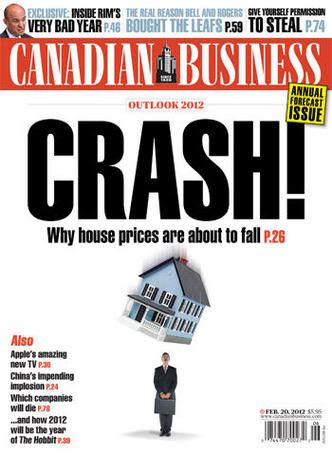

interesting cover...

|

|

|

02-04-2012, 08:51 AM

02-04-2012, 08:51 AM

|

#2057

|

|

#1 Goaltender

Join Date: Oct 2009

Location: North of the River, South of the Bluff

|

Quote:

Originally Posted by hmmhmmcamo

interesting cover...

|

While I think a correction is due, I think Calgary's market needs to be separated from the rest of Canada. Comparing the maket in Ontario, where the economy relies on much different drivers, to Calgary is difficult. So I agree some markets will get corrected, just some more than others.

Although I have been waiting for the bubble to burst in Calgary, it really hasn't yet. I am starting to come around to the model that traditionally shows Calgary with brief spikes, followed by years of flat growth in prices. I think we are seeing that now, with a strong local economy but flat price and sales growth. Probably won't change for a long while, unless Natural Gas picks up again.

Anyways, I think many markets in Canada are set for major corrections, but Calgary will be ok. Just don't expect everyone to get rich off real estate here like in 2004. You will have to actually do your homework to find those great deals for short term profit.

Anyways, I don't have the background or stats to back up my opinion, total observation on my part. However, I really do enjoy coming here and reading what more experienced people have to say on this, it's been really informative, thanks.

|

|

|

02-04-2012, 11:35 AM

02-04-2012, 11:35 AM

|

#2058

|

|

Lifetime Suspension

|

Quote:

Originally Posted by OldDutch

While I think a correction is due, I think Calgary's market needs to be separated from the rest of Canada. Comparing the maket in Ontario, where the economy relies on much different drivers, to Calgary is difficult. So I agree some markets will get corrected, just some more than others.

Although I have been waiting for the bubble to burst in Calgary, it really hasn't yet. I am starting to come around to the model that traditionally shows Calgary with brief spikes, followed by years of flat growth in prices. I think we are seeing that now, with a strong local economy but flat price and sales growth. Probably won't change for a long while, unless Natural Gas picks up again.

Anyways, I think many markets in Canada are set for major corrections, but Calgary will be ok. Just don't expect everyone to get rich off real estate here like in 2004. You will have to actually do your homework to find those great deals for short term profit.

Anyways, I don't have the background or stats to back up my opinion, total observation on my part. However, I really do enjoy coming here and reading what more experienced people have to say on this, it's been really informative, thanks.

|

Calgary has already corrected 15% or more since the peak. The low interest rates that the government put in place as an emergency measure have kept the market from tanking more. But will it continue?

The latest 2.99% locked mortgages did not fuel many sales.

Are banks/government running out of rabbits in their hats?

People in Ontario say "it's different here". Vancouverites too. If it blows, Calgary won't be spared. Neither will all other major cities.

|

|

|

|

The Following User Says Thank You to Red For This Useful Post:

|

|

02-04-2012, 07:26 PM

02-04-2012, 07:26 PM

|

#2059

|

|

Self Imposed Exile

Join Date: Jul 2008

Location: Calgary

|

Quote:

Originally Posted by Red

People in Ontario say "it's different here". Vancouverites too. If it blows, Calgary won't be spared. Neither will all other major cities.

|

Agreed, Calgary doesn't live in a bubble (bad use of that term considering the thread), we are affected by the rest of Canada, impacts can be soften, but not ignored.

The other factor is the states, despite how well Canada has done, if they go off a cliff, were gone to (hopefully to a lesser extent)

|

|

|

02-05-2012, 11:21 AM

02-05-2012, 11:21 AM

|

#2060

|

|

Powerplay Quarterback

|

I don't see much of a correction happening in Calgary. Sure prices could soften a little, but a few percentage points down here and there and a few flat few years in between those small down year, plus continued job growth and population growth 5-10 years goes by and everything is hunky dory.

What the major correction people tend to ignore is for there to be a major correction people need to walk from their houses. I don’t see that happening. People might be underwater slightly but they’ve only got two options:

1. Ride it out because they have no choice

2. Sell at a loss but buy something else because you have to live somewhere, which supports prices

In the States I'm pretty sure there was a major overbuild of houses. The national vacancy rate in March 2011 was 11.4%. In Calgary where are you going to go if you walk or sell your house? Apartment vacancy was 1.9% in the fall of 2011 and condo vacancy was 5.7%.

“In the US Maine had the highest proportion of empty housing stock, at 22.8%. Other states with gluts of empty houses included Vermont (20.5%), Florida (17.5%), Arizona (16.3%) and Alaska (15.9%)”

In the US the apartment vacancy just hit its lowest level in 11 years at 5.2%

What was it before all these foreclosure people moved into the rental pool. Comparatively there are not too many options for a city like Calgary.

“The President of Rentfaster.ca, Darren Paddock, says one and two bedroom suites -- under a $1000 a month and in decent areas of Calgary -- move to pretty quickly, but adds any type of apartments in the more coveted areas of the city aren't on the market long.

There are more dire predictions from the Chief Economist with the Calgary Chamber of Commerce. Ben Brunnen predicts if the tightening trend continues, 2013 could be prove to be a real tight rental market in the city with rents going up.”

So baring a major collapse in oil prices and a spike in interest rates above 6% and much higher unemployment I can't see too much damage happening.

I'd be curious to see a poll on what people would do if housing prices dropped 15%. Me? I'd upgrade to a bigger house and either rent out the current one or eat the loss and just consider it a break even on moving into something bigger.

A few million sq. ft. of office space is about to start getting built again in the downtown core. On top of that there are quite a few condo towers being built. That'll create a lot of jobs on the construction side and that’s a decent amount of office space for companies to grow into. They're going to need employees to use up that space. We saw how quickly the office market went from "20% vacancy issue" and "empty office towers" in 2008/09 to “let's build some more”. Office lease rates in the downtown area have been going up about $0.50 a sq. ft. per month in the last few months. Leading up to the boom in 06-08 it was $1.00 a sq. ft. a month. There’s growth to come in Calgary as far as anyone can tell and while you may not get rich buying houses for the foreseeable future I certainly can’t imagine a scenario where prices drop a ton.

Tried to find a “House vacancy rate” for Calgary. Didn’t have much luck though. Also CREB isn’t showing their monthly data so I can’t see what the inventory is.

Last edited by ranchlandsselling; 02-05-2012 at 07:18 PM.

|

|

|

|

The Following User Says Thank You to ranchlandsselling For This Useful Post:

|

|

| Thread Tools |

Search this Thread |

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 11:59 PM.

|

|