07-15-2015, 02:19 PM

07-15-2015, 02:19 PM

|

#141

|

|

Franchise Player

Join Date: Nov 2006

Location: Salmon with Arms

|

Quote:

Originally Posted by I_H8_Crawford

It wouldn't shock me if there was some political pressure on them to drop rates now - hopefully increase some consumer spending, make the economy look a bit better in time for the election...

Next rate announcement comes soon before the election, and it would probably look bad on the government if the rate were to be dropped then instead of now... people going to the polls would definitely remember an announcement that rate is dropped b/c of recession a few weeks before election, vs. doing it now, months before said election.

|

I think it's a too big, out too "macro" of a view. This rate drop is good for highly leveraged companies, bad for actual people. More consumer debt is bad. Industrial debt is good

|

|

|

07-15-2015, 02:20 PM

07-15-2015, 02:20 PM

|

#142

|

|

Franchise Player

Join Date: Oct 2001

Location: Vancouver

|

Quote:

Originally Posted by Fire

No, it's time for people to get into more debt. Duh!

|

Isn't that how a lot of people make money though? Borrow when rates are low, then pay it back when rates are high?

A lot of wealthy people get that way by putting themselves in debt at some point.

__________________

"A pessimist thinks things can't get any worse. An optimist knows they can."

|

|

|

07-15-2015, 02:21 PM

07-15-2015, 02:21 PM

|

#143

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Quote:

Originally Posted by peter12

So now the house-flipping will heat up even more in Vancouver and Toronto, and middle-class owners will take on even more debt. I don't see the BoC's line of reasoning on this cut.

|

Well the house angle is just one consideration. The other factors include things like GDP (which shows us as in a recession or teetering on the brink). The other thing this does as alluded to in one of the three threads on the topic now, is reduce the currency. By devaluing this, exporters ramp up production and it increases demand for them. This includes oil and gas. For a commodity like oil this has an additional benefit where they sell in USD and pay expenses in CAD.

So yeah, the housing angle is potentially dangerous, but the other benefits are still part of the decision.

|

|

|

|

The Following User Says Thank You to Slava For This Useful Post:

|

|

07-15-2015, 02:23 PM

07-15-2015, 02:23 PM

|

#144

|

|

Franchise Player

|

Quote:

Originally Posted by Slava

Well the house angle is just one consideration. The other factors include things like GDP (which shows us as in a recession or teetering on the brink). The other thing this does as alluded to in one of the three threads on the topic now, is reduce the currency. By devaluing this, exporters ramp up production and it increases demand for them. This includes oil and gas. For a commodity like oil this has an additional benefit where they sell in USD and pay expenses in CAD.

So yeah, the housing angle is potentially dangerous, but the other benefits are still part of the decision.

|

The housing angle is really what we should be concerned about. Impact on exports and especially commodities will be negligible given the state of the global marketplace (slumping US and Chinese economies). The real estate market will blow up in our faces.

|

|

|

07-15-2015, 02:24 PM

07-15-2015, 02:24 PM

|

#145

|

|

Franchise Player

Join Date: Apr 2004

Location: Calgary

|

Quote:

Originally Posted by FlamesAddiction

Isn't that how a lot of people make money though? Borrow when rates are low, then pay it back when rates are high?

A lot of wealthy people get that way by putting themselves in debt at some point.

|

Problem is most of the "average" Canadians don't borrow to invest, they borrow to buy that new Audi, or get granite in their house, or get that new 4K TV....

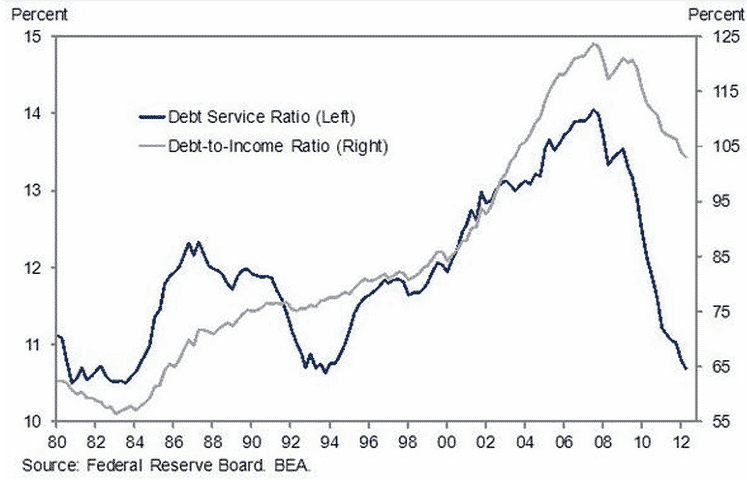

This chart is terrifying:

EDIT:

For comparison, check out what the USA looked like pre and post-GFC:

Last edited by I_H8_Crawford; 07-15-2015 at 02:42 PM.

|

|

|

|

The Following User Says Thank You to I_H8_Crawford For This Useful Post:

|

|

07-15-2015, 02:26 PM

07-15-2015, 02:26 PM

|

#146

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Quote:

Originally Posted by peter12

The housing angle is really what we should be concerned about. Impact on exports and especially commodities will be negligible given the state of the global marketplace (slumping US and Chinese economies). The real estate market will blow up in our faces.

|

Are you referring to the slumping US economy that is a hair above full employment, at all time highs on the stock market and looking at raising their interest rates this year?

|

|

|

|

The Following 5 Users Say Thank You to Slava For This Useful Post:

|

|

07-15-2015, 02:28 PM

07-15-2015, 02:28 PM

|

#147

|

|

Franchise Player

|

Quote:

Originally Posted by Slava

Are you referring to the slumping US economy that is a hair above full employment, at all time highs on the stock market and looking at raising their interest rates this year?

|

Where have you seen numbers regarding full employment? Everything I have read, and heard is that the employment numbers are artificially inflated given how many people have stopped looking for work. Some analysts have caused it a jobless recovery.

|

|

|

07-15-2015, 02:51 PM

07-15-2015, 02:51 PM

|

#148

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Quote:

Originally Posted by peter12

Where have you seen numbers regarding full employment? Everything I have read, and heard is that the employment numbers are artificially inflated given how many people have stopped looking for work. Some analysts have caused it a jobless recovery.

|

Well unemployment is at say 5.5% or something like that? Full employment is pretty much anything at 5% or less, so that's where I come up with that.

The arguments about labour force participation strike me as more political than anything else. The opposition always claims that the numbers are inflated and the government always has to explain why its a lagging indicator and everything like that. The point is that unemployment is a reasonable idea of how many people are working. Its not perfect, but not entirely useless.

|

|

|

07-15-2015, 03:08 PM

07-15-2015, 03:08 PM

|

#149

|

|

Franchise Player

|

So basically TD wanted to get out ahead of not cutting this time, but by cutting 10 bps this time it makes prime a "round" quarter point number again. Assuming all banks follow suit, it looks like they've just expanded their margins by 0.25% on a permanent basis in the last 6 months, by passing on only 0.25% of a 0.5% rate cut.

|

|

|

07-15-2015, 03:26 PM

07-15-2015, 03:26 PM

|

#150

|

|

Lifetime Suspension

Join Date: Sep 2005

Location: The Void between Darkness and Light

|

Quote:

Originally Posted by peter12

The housing angle is really what we should be concerned about. Impact on exports and especially commodities will be negligible given the state of the global marketplace (slumping US and Chinese economies). The real estate market will blow up in our faces.

|

What 'Invisible' Money adds to Vancouver Home Prices

|

|

|

07-15-2015, 03:28 PM

07-15-2015, 03:28 PM

|

#151

|

|

First Line Centre

Join Date: Oct 2001

Location: The centre of everything

|

Quote:

Originally Posted by bizaro86

So basically TD wanted to get out ahead of not cutting this time, but by cutting 10 bps this time it makes prime a "round" quarter point number again. Assuming all banks follow suit, it looks like they've just expanded their margins by 0.25% on a permanent basis in the last 6 months, by passing on only 0.25% of a 0.5% rate cut.

|

Win-win for me  Mortgage gets cheaper and TD stock should fare a bit better...

|

|

|

|

The Following User Says Thank You to FLAMESRULE For This Useful Post:

|

|

07-15-2015, 03:47 PM

07-15-2015, 03:47 PM

|

#152

|

|

Could Care Less

|

Quote:

Originally Posted by Street Pharmacist

I think it's a too big, out too "macro" of a view. This rate drop is good for highly leveraged companies, bad for actual people. More consumer debt is bad. Industrial debt is good

|

I don't think that you can just make this claim. While rates dropping is good for highly leveraged companies, they can get into just as much trouble with managing their balance sheets as highly leveraged consumers do, if and when the business cycle changes.

I think you could say that smart, manageable debt has the potential to be good for both consumer and business, but generally speaking too much debt for either is bad.

|

|

|

07-15-2015, 03:58 PM

07-15-2015, 03:58 PM

|

#153

|

|

Franchise Player

Join Date: Nov 2006

Location: Salmon with Arms

|

Quote:

Originally Posted by heep223

I don't think that you can just make this claim. While rates dropping is good for highly leveraged companies, they can get into just as much trouble with managing their balance sheets as highly leveraged consumers do, if and when the business cycle changes.

I think you could say that smart, manageable debt has the potential to be good for both consumer and business, but generally speaking too much debt for either is bad.

|

Generally, incremental consumer debt is used by most consumers who aren't dedicated up ROI. Commercial interests are almost solely focused on investing and getting returns that a more expensive house, new car or new TV just aren't.

|

|

|

07-15-2015, 04:03 PM

07-15-2015, 04:03 PM

|

#154

|

|

Could Care Less

|

Quote:

Originally Posted by Street Pharmacist

Generally, incremental consumer debt is used by most consumers who aren't dedicated up ROI. Commercial interests are almost solely focused on investing and getting returns that a more expensive house, new car or new TV just aren't.

|

My point is that companies who are over-leveraged can get into a lot of trouble as well. We see it over and over in the energy business. So you can't really just say that "corporate debt is good". But I hear you.

|

|

|

07-15-2015, 04:09 PM

07-15-2015, 04:09 PM

|

#155

|

|

First Line Centre

Join Date: Feb 2010

Location: Mckenzie Towne

|

Quote:

Originally Posted by bizaro86

So basically TD wanted to get out ahead of not cutting this time, but by cutting 10 bps this time it makes prime a "round" quarter point number again. Assuming all banks follow suit, it looks like they've just expanded their margins by 0.25% on a permanent basis in the last 6 months, by passing on only 0.25% of a 0.5% rate cut.

|

FWIW, banks made their decision to cut by 0.10% some time ago in anticipation of this rate cut. TD was just the first to announce it. Other banks/lenders will follow suit very quickly.

|

|

|

07-15-2015, 04:19 PM

07-15-2015, 04:19 PM

|

#156

|

|

First Line Centre

Join Date: Jun 2011

Location: Edmonton

|

Quote:

Originally Posted by bizaro86

So basically TD wanted to get out ahead of not cutting this time, but by cutting 10 bps this time it makes prime a "round" quarter point number again. Assuming all banks follow suit, it looks like they've just expanded their margins by 0.25% on a permanent basis in the last 6 months, by passing on only 0.25% of a 0.5% rate cut.

|

Does anyone else benefit from prime going up? I have a stock that pays dividends based on a multiple of prime (linked to TD I think) so when prime goes up so does the dividend.

|

|

|

07-15-2015, 04:33 PM

07-15-2015, 04:33 PM

|

#157

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Quote:

Originally Posted by GP_Matt

Does anyone else benefit from prime going up? I have a stock that pays dividends based on a multiple of prime (linked to TD I think) so when prime goes up so does the dividend.

|

Are you sure it's a stock you hold or some other kind of investment? Most dividend policies for companies are based on very different ways of determining them and I can't think of anyone who sets dividend policy based on a multiple of prime.

|

|

|

07-15-2015, 04:53 PM

07-15-2015, 04:53 PM

|

#158

|

|

First Line Centre

Join Date: Jun 2011

Location: Edmonton

|

Quote:

Originally Posted by Slava

Are you sure it's a stock you hold or some other kind of investment? Most dividend policies for companies are based on very different ways of determining them and I can't think of anyone who sets dividend policy based on a multiple of prime.

|

It is preferred stock in a private company.

|

|

|

|

The Following User Says Thank You to GP_Matt For This Useful Post:

|

|

07-15-2015, 06:39 PM

07-15-2015, 06:39 PM

|

#159

|

|

First Line Centre

Join Date: Aug 2009

Location: Calgary

|

Quote:

Originally Posted by bizaro86

So basically TD wanted to get out ahead of not cutting this time, but by cutting 10 bps this time it makes prime a "round" quarter point number again. Assuming all banks follow suit, it looks like they've just expanded their margins by 0.25% on a permanent basis in the last 6 months, by passing on only 0.25% of a 0.5% rate cut.

|

If i was with td why wouldn't i switch? Sounds like their customers are getting the short end of the stick. For me this would be a reason to get in touch with a mortgage broker. Mortgage made easy.

|

|

|

|

The Following User Says Thank You to stampsx2 For This Useful Post:

|

|

07-16-2015, 11:03 AM

07-16-2015, 11:03 AM

|

#160

|

|

Scoring Winger

Join Date: Sep 2014

Location: Calgary, AB

|

Quote:

Originally Posted by stampsx2

If i was with td why wouldn't i switch? Sounds like their customers are getting the short end of the stick. For me this would be a reason to get in touch with a mortgage broker. Mortgage made easy.

|

TD has followed suit with all the other lenders with matching the 0.15% drop... Prime is now 2.70%.

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 10:28 AM.

|

|