09-11-2023, 03:18 PM

09-11-2023, 03:18 PM

|

#1841

|

|

Franchise Player

|

Quote:

Originally Posted by opendoor

I don't know, isn't that kind of glossing over what is probably the biggest factor? Japan has a declining population which is currently lower than it was in 1990. It's not particularly hard to have relatively affordable housing with a declining population.

|

That's true, although Tokyo has much stronger population trends than the country as a whole because it gets migration from the rest of the country.

|

|

|

09-11-2023, 03:20 PM

09-11-2023, 03:20 PM

|

#1842

|

|

Franchise Player

|

Quote:

Originally Posted by blankall

That's paywalled. But it's well known that there are two major differences in Japan:

1. They do not have a rapidly expanding population and take on very few immigrants. This is likely to, however, cause all sorts of much more disastrous economic effects, as the population continues to shrink. The population of Japan has been shrinking for about 1.5 decades and this process is expected to accelerate.

2. Japan has extremely practical zoning and building laws. The average house in Japan lasts 20-30 years, depending on the materials its constructed from. People are simply allowed to build new buildings without being dragged down with red tape. The country also zoned the entire country into 1 of 12 zones and allows any kind of building that complies with the zoning to be built within each zone, without some crazy permitting system. There are no town hall debates about building a skyrise. If the (very broad) zoning and market conditions allow it, the build is a go.

|

Yeah, the zoning is a big part of the article. It's focused toward a NY audience, so compares Tokyo suburbs to places like Long Island where commuter rail stations have single family homes surrounding them because of zoning.

(1) isn't something I think we should emulate. In fact I think there's a real risk that having housing be unaffordable will erode support for immigration, which would be really unfortunate.

|

|

|

09-11-2023, 03:58 PM

09-11-2023, 03:58 PM

|

#1843

|

|

Franchise Player

Join Date: Mar 2002

Location: Auckland, NZ

|

Sorry for the sidetrack - I went to Japan over the summer, and it was so so so nice paying comparatively lower prices for food, drink and tourist stuff. Could eat a sushi dinner fit for a king for less than $40. Drinks were always less than $7 virtually anywhere. A bowl of ramen with a 16oz beer was about $13. My hotel was a 5-star botique hotel that cost $100 a night. Water at the airport was $1, unlike the $6 it is here in Calgary. Can't comment about the price of real estate, but the notion that Japan is one of the more expensive places to travel to should really fade away already.

|

|

|

09-11-2023, 04:25 PM

09-11-2023, 04:25 PM

|

#1844

|

|

Franchise Player

|

It makes sense, as Japan isn't really a super wealthy country at this point. Their median income is right in line with places like Poland, Lithuania, and Spain. Whereas the median income in Canada is almost 50% higher than Japan's and in the US it's nearly double.

|

|

|

09-11-2023, 04:42 PM

09-11-2023, 04:42 PM

|

#1845

|

|

Franchise Player

Join Date: Oct 2001

Location: NYYC

|

Apart from the macro conditions there, it's a great time to visit Japan right now for Canadians, as the YEN/CAD exchange is really favourable to us at the moment.

|

|

|

|

The Following User Says Thank You to Table 5 For This Useful Post:

|

|

09-11-2023, 04:49 PM

09-11-2023, 04:49 PM

|

#1846

|

|

Franchise Player

Join Date: Mar 2002

Location: Auckland, NZ

|

Quote:

Originally Posted by Table 5

Apart from the macro conditions there, it's a great time to visit Japan right now for Canadians, as the YEN/CAD exchange is really favourable to us at the moment.

|

100%. When I went it was about 105 yen / $1 CDN. I've been before when you could only get about 70 yen / $1 CDN. Fantastic exchange right now for that country, combined with the prices there.

|

|

|

09-11-2023, 05:04 PM

09-11-2023, 05:04 PM

|

#1847

|

|

Such a pretty girl!

Join Date: Jan 2004

Location: Calgary

|

Too bad flight prices wipe that advantage out now.

__________________

|

|

|

09-11-2023, 05:14 PM

09-11-2023, 05:14 PM

|

#1848

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Quote:

Originally Posted by accord1999

I also think the bursting of the Japanese housing and asset bubble is a factor as it reminds people, even 30 years later, that housing isn't always a good investment and prices can go down.

For too long now in the hot Canadian markets, it's always been prices going up and you have to buy now or you'll be priced out forever.

|

This has largely been two markets though. In Calgary, prices were stagnant for the better part of a decade (~2015-2021). For people that bought in say 2007-08 they were probably underwater for a decade or so.

And I do wonder how much of the runup (which seems to have ebbed to some extent) was Canada "catching up" with other places around the world? People want to live in Toronto and Vancouver. It's expensive to live in cities that are desirable to people around the world. I realise as a Calgaruan that seems odd (I personally wouldn't want to live in Toronto), but people from the UK say the same thing about London, and I'd live there in a heartbeat.

|

|

|

09-11-2023, 05:35 PM

09-11-2023, 05:35 PM

|

#1849

|

|

Ate 100 Treadmills

|

Quote:

Originally Posted by Slava

This has largely been two markets though. In Calgary, prices were stagnant for the better part of a decade (~2015-2021). For people that bought in say 2007-08 they were probably underwater for a decade or so.

And I do wonder how much of the runup (which seems to have ebbed to some extent) was Canada "catching up" with other places around the world? People want to live in Toronto and Vancouver. It's expensive to live in cities that are desirable to people around the world. I realise as a Calgaruan that seems odd (I personally wouldn't want to live in Toronto), but people from the UK say the same thing about London, and I'd live there in a heartbeat.

|

Calgary is different than many other places in Canada, even. They have their own real estate run ups related to oil prices. Calgary was definitely undervalued, which is a common occurrence following a major boom/bust cycle. Unlike many other cities in NA, Calgary's population continued to grow following their last big bust. At some point the effects from that increase in population overcame the boom/bust cycle, but the market never caught up, well until now.

|

|

|

09-11-2023, 05:55 PM

09-11-2023, 05:55 PM

|

#1850

|

|

Powerplay Quarterback

|

Quote:

Originally Posted by Slava

And I do wonder how much of the runup (which seems to have ebbed to some extent) was Canada "catching up" with other places around the world? People want to live in Toronto and Vancouver. It's expensive to live in cities that are desirable to people around the world. I realise as a Calgaruan that seems odd (I personally wouldn't want to live in Toronto), but people from the UK say the same thing about London, and I'd live there in a heartbeat.

|

There's catch-up and it's fair for Toronto and Vancouver to be the most expensive markets in Canada but I don't think they can be compared to (or sometimes exceeding) the likes of London or Seattle/SF which have much more wealthier people, higher average/median incomes and are more important globally.

I still think Toronto/Vancouver's markets are less supported by fundamentals and will eventually correct significantly as the cost of borrowing starts to bite. Canada getting through the 2007-2008 US housing bubble bursting relatively unscathed probably has turned out to be a negative since it reinforced the moral hazards of housing speculation.

Last edited by accord1999; 09-11-2023 at 06:02 PM.

|

|

|

|

The Following User Says Thank You to accord1999 For This Useful Post:

|

|

09-13-2023, 11:04 AM

09-13-2023, 11:04 AM

|

#1851

|

|

#1 Goaltender

|

Inflation in the US went higher than expected as a result of surging oil prices

https://finance.yahoo.com/news/infla...123228949.html

Quote:

The Consumer Price Index (CPI) rose 0.6% over last month and 3.7% over the prior year in August, an acceleration from July's 0.2% monthly increase and 3.2% annual gain in prices.

The year-over-year increase was slightly higher than economist forecasts of a 3.6% annual jump, according to data from Bloomberg.

On a "core" basis, which strips out the more volatile costs of food and gas, prices in August climbed 4.3% over last year — a slowdown from the 4.7% annual increase seen in July, according to Bloomberg data. Monthly core prices rose 0.3%, slightly higher than economist expectations of a 0.2% month-over-month gain and also higher than July's 0.2% monthly rise.

|

Another US hike by end of year is suddenly looking more likely, though next week rates are predicted to stay steady. This will put incredible pressure on the BoC to act on rates while still below the US by 50bps even as we fall in a recession.

|

|

|

09-13-2023, 11:32 AM

09-13-2023, 11:32 AM

|

#1852

|

|

Franchise Player

|

I don't know if that necessarily means a hike is more likely. Core inflation still continues to moderate, with the 3-month rolling average dropping under 3% for the first time in a long time. And interest rate hikes aren't going to have a huge impact on energy commodity prices, which is basically the only reason the reading came in high. With energy taken out, August inflation would have been about 2.2% annualized.

|

|

|

09-13-2023, 11:38 AM

09-13-2023, 11:38 AM

|

#1854

|

|

Franchise Player

|

Quote:

Originally Posted by Bill Bumface

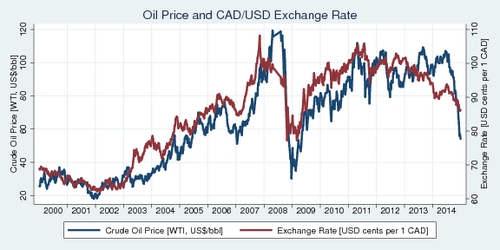

And isn't the big concern with Canada not raising rates to match the US rates that devaluation of CAD vs. USD will occur? Rising oil prices should negate that concern somewhat, given the tendency of CAD/USD to follow oil prices:

|

Pretty much. Lower rates hurt the currency, and if the currency is lower that's inflationary, because it pushes up the price of imported goods, and goods where the underlying commodity is priced in USD (most commodities).

|

|

|

09-13-2023, 12:12 PM

09-13-2023, 12:12 PM

|

#1855

|

|

First Line Centre

Join Date: Feb 2010

Location: Mckenzie Towne

|

Quote:

Originally Posted by Firebot

Inflation in the US went higher than expected as a result of surging oil prices

https://finance.yahoo.com/news/infla...123228949.html

Another US hike by end of year is suddenly looking more likely, though next week rates are predicted to stay steady. This will put incredible pressure on the BoC to act on rates while still below the US by 50bps even as we fall in a recession. |

JP Morgan just stated they don't expect the Feds to raise rates again in this cycle: https://ca.finance.yahoo.com/news/j-...160855346.html

Apparently Liberals are announcing some "unprecedented" measure to address housing affordability here in Canada this afternoon too. Looks like it'll assist home builders from what I've read, allowing them to build more to assist with lack of inventory.

|

|

|

09-13-2023, 12:19 PM

09-13-2023, 12:19 PM

|

#1856

|

|

Franchise Player

|

Quote:

Originally Posted by MillerTime GFG

Apparently Liberals are announcing some "unprecedented" measure to address housing affordability here in Canada this afternoon too. Looks like it'll assist home builders from what I've read, allowing them to build more to assist with lack of inventory.

|

Otherwise known as subsidizing the builders cost with the hope that the savings will trickle down to the home buyers via lower purchase prices?

|

|

|

|

The Following 6 Users Say Thank You to calgarygeologist For This Useful Post:

|

|

09-13-2023, 12:19 PM

09-13-2023, 12:19 PM

|

#1857

|

|

Ate 100 Treadmills

|

Quote:

Originally Posted by MillerTime GFG

JP Morgan just stated they don't expect the Feds to raise rates again in this cycle: https://ca.finance.yahoo.com/news/j-...160855346.html

Apparently Liberals are announcing some "unprecedented" measure to address housing affordability here in Canada this afternoon too. Looks like it'll assist home builders from what I've read, allowing them to build more to assist with lack of inventory. |

Canada desperately needs something dramatic. So far all the measure to increase affordability have been totally toothless. Easily circumvented bans on foreign investment. It's good to see that after about a decade of it being painfully obvious that Canada needs more development and density someone in government is finally acknowledging that.

|

|

|

09-13-2023, 12:26 PM

09-13-2023, 12:26 PM

|

#1858

|

|

First Line Centre

Join Date: Feb 2010

Location: Mckenzie Towne

|

Quote:

Originally Posted by calgarygeologist

Otherwise known as subsidizing the builders cost with the hope that the savings will trickle down to the home buyers via lower purchase prices?

|

Who knows. Apparently something to do with permits as well.

Not holding my breath.

Bond yields have dropped quite a bit since the JP Morgan announcement.

|

|

|

09-13-2023, 12:29 PM

09-13-2023, 12:29 PM

|

#1859

|

|

Ate 100 Treadmills

|

Quote:

Originally Posted by calgarygeologist

Otherwise known as subsidizing the builders cost with the hope that the savings will trickle down to the home buyers via lower purchase prices?

|

Not sure how someone could look at the absurd system of zoning, fees, permitting, taxes and building restrictions that Canada has and conclude that easing those amounts to subsidizing.

|

|

|

09-13-2023, 12:49 PM

09-13-2023, 12:49 PM

|

#1860

|

|

Franchise Player

|

I thought the issue with builders was above all, with a lack of labour.

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 07:15 AM.

|

|