07-16-2023, 11:31 AM

07-16-2023, 11:31 AM

|

#1701

|

|

Ate 100 Treadmills

|

Quote:

Originally Posted by CliffFletcher

They do mandate builders include trees. But when you replace a home that takes up 50 per cent of a property with a building that takes up 80+ per cent, you have much less space for trees. And trees take 30 years to grow to maturity. So higher-density redevelopment of properties with detached homes will often mean tearing out three mature trees and replacing them with one sapling.

That has a cost that goes beyond aesthetics.

|

And what do you think the environmental cost of urban sprawl is? Everyone with a yard. Extra commutes by car.

Higher density is far less environmentally damaging and it's not even a close comparison.

|

|

|

07-16-2023, 11:36 AM

07-16-2023, 11:36 AM

|

#1702

|

|

Ate 100 Treadmills

|

Quote:

Originally Posted by Aarongavey

Inflation numbers come out this week. I expect that inflation outside of mortgage costs will be at 2% or lower so the only driver of inflation above target will be the Bank of Canada’s interest rates.

|

Rent is way up in the major cities too. Raising interest rates will not help that.

|

|

|

07-16-2023, 12:11 PM

07-16-2023, 12:11 PM

|

#1703

|

|

Franchise Player

|

Quote:

Originally Posted by Aarongavey

Inflation numbers come out this week. I expect that inflation outside of mortgage costs will be at 2% or lower so the only driver of inflation above target will be the Bank of Canada’s interest rates.

|

Grocery stores: hold my beer

|

|

|

|

The Following 4 Users Say Thank You to iggy_oi For This Useful Post:

|

|

07-16-2023, 02:58 PM

07-16-2023, 02:58 PM

|

#1704

|

|

Franchise Player

Join Date: Jun 2004

Location: SW Ontario

|

Quote:

Originally Posted by Aarongavey

Inflation numbers come out this week. I expect that inflation outside of mortgage costs will be at 2% or lower so the only driver of inflation above target will be the Bank of Canada’s interest rates.

|

Look at what happened during the inflation during the 70s and 80s. They would hold/drop interest rates and then inflation would go ramping back up and they would have to start raising rates again.

I'm not even sure if interest rates are doing a ton at this point, but obviously the banks think they are - so you don't just hit the target and start dropping rates and bring inflation back up. You want to get to a stable position.

|

|

|

07-16-2023, 03:23 PM

07-16-2023, 03:23 PM

|

#1705

|

|

Lifetime Suspension

Join Date: Jul 2012

Location: North America

|

|

|

|

07-16-2023, 03:26 PM

07-16-2023, 03:26 PM

|

#1706

|

|

Franchise Player

|

Quote:

Originally Posted by PeteMoss

Look at what happened during the inflation during the 70s and 80s. They would hold/drop interest rates and then inflation would go ramping back up and they would have to start raising rates again.

I'm not even sure if interest rates are doing a ton at this point, but obviously the banks think they are - so you don't just hit the target and start dropping rates and bring inflation back up. You want to get to a stable position.

|

The difference back then was they were adding about 15% to the money supply every single year, so it didn't really matter what interest rates were. That's the equivalent of the 2020 increase in money supply every single year from 1970 to 1982. When money supply growth is 10-12 points above your GDP growth, you're going to have bad inflation. That's not happening now. Canada's money supply growth since 2021 has been a little over 3% annualized.

|

|

|

|

The Following 4 Users Say Thank You to opendoor For This Useful Post:

|

|

07-17-2023, 12:49 PM

07-17-2023, 12:49 PM

|

#1707

|

|

Ate 100 Treadmills

|

Quote:

Originally Posted by opendoor

The difference back then was they were adding about 15% to the money supply every single year, so it didn't really matter what interest rates were. That's the equivalent of the 2020 increase in money supply every single year from 1970 to 1982. When money supply growth is 10-12 points above your GDP growth, you're going to have bad inflation. That's not happening now. Canada's money supply growth since 2021 has been a little over 3% annualized.

|

The economic conditions now and in the 70s/80s are entirely different.

Even then, if you look at the "crash" of the early 80s, it was only about a 20% drop, that lasted for 5 years, at which point things rebounded to above peak prices within 7 years of the crash:

https://fred.stlouisfed.org/series/QCAR628BIS

A massive drop of 50+%, that will allow the average young person to buy a detached home again, would be totally unprecedented in Canadian real estate. During the last "crash", average citizens weren't snapping up cheap properties, as what was holding down prices was unaffordable mortgage rates.

A another crash is obviously possible, but with the current housing shortage, I just don't see it happening. We're already down over 20%, so if things follow the same pattern as the last crash, it's real estate staying level for about 4-5 more years and then skyrocketing up again. No further crashes.

IMO, the end of 2023 is likely the best time to buy, in terms of absolute price, as we should see a small decrease in prices through 2023 in most markets. Most forecasters have things going up from there.

|

|

|

07-17-2023, 01:20 PM

07-17-2023, 01:20 PM

|

#1708

|

|

Franchise Player

|

Quote:

Originally Posted by blankall

The economic conditions now and in the 70s/80s are entirely different.

Even then, if you look at the "crash" of the early 80s, it was only about a 20% drop, that lasted for 5 years, at which point things rebounded to above peak prices within 7 years of the crash:

https://fred.stlouisfed.org/series/QCAR628BIS

A massive drop of 50+%, that will allow the average young person to buy a detached home again, would be totally unprecedented in Canadian real estate. During the last "crash", average citizens weren't snapping up cheap properties, as what was holding down prices was unaffordable mortgage rates.

A another crash is obviously possible, but with the current housing shortage, I just don't see it happening. We're already down over 20%, so if things follow the same pattern as the last crash, it's real estate staying level for about 4-5 more years and then skyrocketing up again. No further crashes.

IMO, the end of 2023 is likely the best time to buy, in terms of absolute price, as we should see a small decrease in prices through 2023 in most markets. Most forecasters have things going up from there. |

I mean, a huge price crash suddenly making everything affordable was never really realistic. High interest rates and recessions are what drive price crashes, and in that situation it's not like younger people are going to be flush with cash and credit to scoop up houses.

However, look at the long periods of stagnancy after peaks in that chart you linked. Inflation-adjusted real estate prices were the same in 1987 as they were in 1974 and had dropped as much as 20% in the interim. And they were the same in 2003 as they were in 1989, with a long period of prices being 20% below the 1989 peak. That's how affordability improves, as Real Wages increase while Real Property prices stagnate. So actual selling prices might not decline all that much in terms of dollars (and will even tend to go up eventually), but they become more affordable due to wage growth and inflation.

And that doesn't even get into the fact that post-1980, we have largely had a declining rate environment. So the actual mortgage costs for homeowners declined even more on an inflation-adjusted basis during those periods than the Real Property price would suggest.

|

|

|

07-17-2023, 01:54 PM

07-17-2023, 01:54 PM

|

#1709

|

|

Ate 100 Treadmills

|

Quote:

Originally Posted by opendoor

I mean, a huge price crash suddenly making everything affordable was never really realistic. High interest rates and recessions are what drive price crashes, and in that situation it's not like younger people are going to be flush with cash and credit to scoop up houses.

However, look at the long periods of stagnancy after peaks in that chart you linked. Inflation-adjusted real estate prices were the same in 1987 as they were in 1974 and had dropped as much as 20% in the interim. And they were the same in 2003 as they were in 1989, with a long period of prices being 20% below the 1989 peak. That's how affordability improves, as Real Wages increase while Real Property prices stagnate. So actual selling prices might not decline all that much in terms of dollars (and will even tend to go up eventually), but they become more affordable due to wage growth and inflation.

And that doesn't even get into the fact that post-1980, we have largely had a declining rate environment. So the actual mortgage costs for homeowners declined even more on an inflation-adjusted basis during those periods than the Real Property price would suggest.

|

If you look at the graphs, prices have already been stagnant for 5 years now, with the 2022 adjustment erasing the big run up that began in 2019. Based on previous patterns, we'd be looking at another 5-9 years or so of stagnancy and then another run up.

The X factor here is housing supply. During those long periods of stagnancy, there was excess housing. Now there's a major shortage.

|

|

|

07-17-2023, 02:34 PM

07-17-2023, 02:34 PM

|

#1710

|

|

Franchise Player

|

Quote:

Originally Posted by blankall

If you look at the graphs, prices have already been stagnant for 5 years now, with the 2022 adjustment erasing the big run up that began in 2019. Based on previous patterns, we'd be looking at another 5-9 years or so of stagnancy and then another run up.

The X factor here is housing supply. During those long periods of stagnancy, there was excess housing. Now there's a major shortage.

|

I don't think there's a lot of evidence that there was any significant level of excess housing in those periods. Housing starts plummeted during those times and vacancy rates were totally normal (low, if anything). The average vacancy rate in Canadian Census Metropolitan Areas during the low points of Real Property prices:

1982-86: 2.0%

1995-2001: 2.8%

Vs. the last 10 years: 2.8%

If there was a ton of excess housing, you'd expect vacancy rates to be higher than the 50-year average of 2.7%, but they weren't. Which makes sense, because property development is largely a feedback loop. Once the economic conditions don't support higher housing prices and speculation starts to subside, housing construction slows to compensate. And we're seeing this now, with housing starts dropping significantly in the last 6 months or so. If the people who invest in construction believed that there was a structural shortage of housing that was going to keep driving prices upwards, why would they slow their investment so much?

|

|

|

07-17-2023, 03:25 PM

07-17-2023, 03:25 PM

|

#1711

|

|

Ate 100 Treadmills

|

Quote:

Originally Posted by opendoor

I don't think there's a lot of evidence that there was any significant level of excess housing in those periods. Housing starts plummeted during those times and vacancy rates were totally normal (low, if anything). The average vacancy rate in Canadian Census Metropolitan Areas during the low points of Real Property prices:

1982-86: 2.0%

1995-2001: 2.8%

Vs. the last 10 years: 2.8%

If there was a ton of excess housing, you'd expect vacancy rates to be higher than the 50-year average of 2.7%, but they weren't. Which makes sense, because property development is largely a feedback loop. Once the economic conditions don't support higher housing prices and speculation starts to subside, housing construction slows to compensate. And we're seeing this now, with housing starts dropping significantly in the last 6 months or so. If the people who invest in construction believed that there was a structural shortage of housing that was going to keep driving prices upwards, why would they slow their investment so much?

|

There's a difference between having conditions where no one is building because it's not profitable vs. just not being able to build.

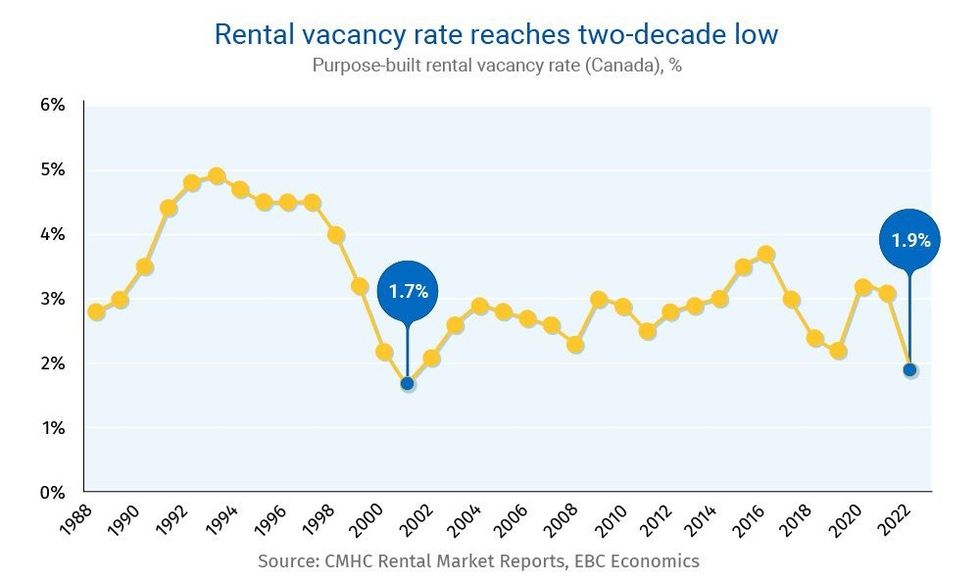

The numbers you are using are also out of date. There was a heavy increase in vacancies during covid, followed by an heavier decrease post-covid. The rate for 2022 was 1.9%, and likely lower now:

https://www150.statcan.gc.ca/t1/tbl1...pid=3410012701

Quote:

|

Although the stock of rental housing grew 2.4% in 2022, the fastest pace since 2014, the vacancy rate amongst purpose-built rentals fell to 1.9%, its lowest point in 21 years. The latter’s decline of 120 bps marks the steepest single-year drop in vacancy in over 30 years.

|

https://storeys.com/canada-rental-ho...shortage-2026/

If you look at the previous shortages, it was likely a long period of unprofitability, leading to less construction, which caused the lack of housing supply. Very different than right now, where we have a shortage from the get go:

|

|

|

|

The Following User Says Thank You to blankall For This Useful Post:

|

|

07-18-2023, 07:56 AM

07-18-2023, 07:56 AM

|

#1712

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Inflation dropped to 2.8% in Canada. It's the fastest decline in thirty years and the drop was primarily led by energy, travel and communications. Food has also declined. At this point, you'd have to expect the BoC to be on hold.

|

|

|

07-18-2023, 08:10 AM

07-18-2023, 08:10 AM

|

#1713

|

|

Franchise Player

|

Quote:

Originally Posted by Slava

Inflation dropped to 2.8% in Canada. It's the fastest decline in thirty years and the drop was primarily led by energy, travel and communications. Food has also declined. At this point, you'd have to expect the BoC to be on hold.

|

Apparently without mortgage inflation the rate would be a little under 2%. I don't expect the BoC to be done adjusting rates yet though.

|

|

|

07-18-2023, 08:14 AM

07-18-2023, 08:14 AM

|

#1714

|

|

Franchise Player

|

Quote:

Originally Posted by Slava

Inflation dropped to 2.8% in Canada. It's the fastest decline in thirty years and the drop was primarily led by energy, travel and communications. Food has also declined. At this point, you'd have to expect the BoC to be on hold.

|

The massive nest-egg households built up during the pandemic has finally drawn down.

__________________

Quote:

Originally Posted by fotze

If this day gets you riled up, you obviously aren't numb to the disappointment yet to be a real fan.

|

|

|

|

07-18-2023, 08:22 AM

07-18-2023, 08:22 AM

|

#1715

|

|

Had an idea!

|

In other words if we actually had more competition in the food sector, the BoC wouldn't have needed to blow up the economy with repeated rate increases and we'd likely see lower food prices and lower mortgage inflation resulting in overall lower inflation?

I mean lower cell phone prices have pushed inflation down this past month.

Shocker I know.

|

|

|

07-18-2023, 08:33 AM

07-18-2023, 08:33 AM

|

#1716

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Quote:

Originally Posted by calgarygeologist

Apparently without mortgage inflation the rate would be a little under 2%. I don't expect the BoC to be done adjusting rates yet though.

|

I think I posted before (maybe not though), that without the rate hikes this year the inflation would be at their target already. I think they've gone too far already, but I suppose time will tell.

Quote:

Originally Posted by Azure

In other words if we actually had more competition in the food sector, the BoC wouldn't have needed to blow up the economy with repeated rate increases and we'd likely see lower food prices and lower mortgage inflation resulting in overall lower inflation?

I mean lower cell phone prices have pushed inflation down this past month.

Shocker I know.

|

The food inflation "story" is almost just politics at this point. Competition is not the issue, as the grocers are not making enormous profits based on this. I've posted the evidence a number of times...they've made money on other items and while the grocery costs have risen, so have the inputs. Profit margins in that subsection have been flat.

|

|

|

07-18-2023, 09:45 AM

07-18-2023, 09:45 AM

|

#1717

|

|

Our Jessica Fletcher

|

Updated CPI:

July/22 8.1% (peak)

August 7.6%

September 7.0%

October 6.9%

November 6.9%

December 6.8%

January/23 6.3%

February 5.9%

March 5.2%

April 4.3%

May 4.4%

June 2.8%

So over the past year (since peak), we're averaging a .5% drop per month. It'll be interesting to see what happens over the next 3-6 months, and if they can level it off around 1.0-2.0%.

I don't think it will. The lag on these interest rate increases is probably still a year (or more?) away from truly being felt. My gut says the BOC overshot and we'll see atleast 1 rate drop before 2023 is over.

Last edited by The Fonz; 07-18-2023 at 09:50 AM.

|

|

|

07-18-2023, 10:06 AM

07-18-2023, 10:06 AM

|

#1718

|

|

Franchise Player

Join Date: Aug 2008

Location: California

|

I think they will want to see year over year low numbers before they drop rates.

In the same way high interest rates are baked in for a year the low rates are too after a few good months. I think they will try to keep rates flat until March/April next year if the economy holds up.

|

|

|

07-18-2023, 10:08 AM

07-18-2023, 10:08 AM

|

#1719

|

|

Our Jessica Fletcher

|

They do a 25bps drop on Dec 6th. I can feel it in my plums.

|

|

|

07-18-2023, 10:08 AM

07-18-2023, 10:08 AM

|

#1720

|

|

Franchise Player

|

Quote:

Originally Posted by Slava

I think I posted before (maybe not though), that without the rate hikes this year the inflation would be at their target already. I think they've gone too far already, but I suppose time will tell.

The food inflation "story" is almost just politics at this point. Competition is not the issue, as the grocers are not making enormous profits based on this. I've posted the evidence a number of times...they've made money on other items and while the grocery costs have risen, so have the inputs. Profit margins in that subsection have been flat.

|

They're pointing to non-grocery items as the cause of higher profits, but I don't believe any if the large grocers report segmented financials do they? Hard to conclusively say that's true without actual numbers, imo.

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 12:50 AM.

|

|