02-13-2012, 10:22 AM

02-13-2012, 10:22 AM

|

#101

|

|

Franchise Player

Join Date: Nov 2006

Location: Salmon with Arms

|

Quote:

Originally Posted by CaptainCrunch

I don't know if you can disagree that because of the way that Greece was doing business that these deep austerity cuts had to happen no matter how unpopular they are.

If you're going to be part of the EU, and you're going to go hat in hand to continually ask for bailouts, there are going to be hefty conditions, and as you ask for more, the conditions are going to get tougher and tougher.

I just don't see how a $4 billion dollar budget cut does anything when your getting $130 billion in bailouts.

I doubt that the government will last through the next election, eventually as the people get more angry you get Nationalist governments that tend to rise very quickly.

With the issues in Italy, and Greece and Spain, are we seeing another incubator for a rise in either communism or Facism?

|

A representative from some sort of Greek-Canadian business association gave a good rundown of the situation in the Globe. He was for the austerity measures, but thought they weren't deep enough. He said they need to break the back of the entitlement/tax free society, and the measures aren't steep enough. The economy will likely shrink with all this, but unless a fundamental shift in governmental expectations and tax code enforcement is seen, nothing is solved

|

|

|

02-13-2012, 10:24 AM

02-13-2012, 10:24 AM

|

#102

|

|

Norm!

|

I guess that's where I'm going. $4 billion dollars worth of cuts at this point is literally nothing when you need 130 billion for a short term bailout.

The people are going to have to bear the brunt of the government trying to fix its systems.

Its not like Greece has a massive military or massive infrastructure projects that you can cut to the bone.

__________________

My name is Ozymandias, King of Kings;

Look on my Works, ye Mighty, and despair!

|

|

|

02-13-2012, 10:37 AM

02-13-2012, 10:37 AM

|

#103

|

|

Franchise Player

Join Date: Nov 2006

Location: Salmon with Arms

|

Quote:

Originally Posted by CaptainCrunch

I guess that's where I'm going. $4 billion dollars worth of cuts at this point is literally nothing when you need 130 billion for a short term bailout.

The people are going to have to bear the brunt of the government trying to fix its systems.

Its not like Greece has a massive military or massive infrastructure projects that you can cut to the bone.

|

I don't think the $ 130B is for the government is it? I think the austerity measures are to force introspection in the entitlements in order to change fundamentals, not to ensure a balanced budget. Greece has an absolutely massive public employee workforce to pare down. Something like 150000 are to be let go in a country of 11 our so million. Ouch

Edit: 40 percent of economic output is from the public sector. If that is sustainable, I'm dating all 3 party girls from the cool/funny pictures thread. This is why the people are so upset. The only way forward is for them to find a new job, but the lack of attention to real job growth means there aren't any to be had

Last edited by Street Pharmacist; 02-13-2012 at 10:39 AM.

|

|

|

02-13-2012, 11:01 AM

02-13-2012, 11:01 AM

|

#104

|

|

Norm!

|

Quote:

Originally Posted by Street Pharmacist

I don't think the $ 130B is for the government is it? I think the austerity measures are to force introspection in the entitlements in order to change fundamentals, not to ensure a balanced budget. Greece has an absolutely massive public employee workforce to pare down. Something like 150000 are to be let go in a country of 11 our so million. Ouch

Edit: 40 percent of economic output is from the public sector. If that is sustainable, I'm dating all 3 party girls from the cool/funny pictures thread. This is why the people are so upset. The only way forward is for them to find a new job, but the lack of attention to real job growth means there aren't any to be had

|

From what I've read, and I could be wrong, the $130 billion dollar bailout is just so the government can pay salaries and keep the countries lights on. Its a short term bailout to get them to the next crisis point which is bond repayment where they'll probably need a bailout. So all of the $130 billion is slated to go to the government.

At this point I think that Greece ever balancing their budget is ever going to happen, a massive amount of their budget is probably going to go to servicing interest on loans.

Greece really needs to find ways to increase revenues rather then merely cutting costs.

They have to increase their tax levels to emergency levels, they have to go back and start chasing down back taxes for the last lets say 7 years. They have to probably introduce user fee based services for everything at least in the short to mid term. They will probably have to introduce strict pension reforms, wage freezes for a long time and not only governmental hiring freezes but massive reductions in forces to work eligible employees that aren't in a position to take early retirement.

They're going to have to chop every governmental department.

Massively increase corporate taxation, and find a way to increase and profit on tourism.

They could choose to default on everything, but I don't know about the ramifications of them ever being able to get access to international funding if they do, and even if they default, they're still in a position with internal costs that they're going to need bailouts that countries won't be so willing to give after a default.

__________________

My name is Ozymandias, King of Kings;

Look on my Works, ye Mighty, and despair!

|

|

|

02-14-2012, 07:53 PM

02-14-2012, 07:53 PM

|

#105

|

|

Franchise Player

|

Wow, the Greek economy is shrinking 7% a year, 20%+ unemployment, 5 straight years in recession and they still have to cut more just for a token reprieve of a few months.

I'd guess more riots are in the cards at the very least.

http://business.financialpost.com/20...little-chance/

|

|

|

02-14-2012, 09:13 PM

02-14-2012, 09:13 PM

|

#106

|

|

Scoring Winger

|

Default is the only realistic scenario.

|

|

|

02-14-2012, 09:15 PM

02-14-2012, 09:15 PM

|

#107

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Yes, but it absolutely has to be an orderly default in order to prevent chaos and contagion (as much as possible anyway).

|

|

|

02-14-2012, 11:25 PM

02-14-2012, 11:25 PM

|

#108

|

|

Lifetime Suspension

|

I think if you read closer into the tea leaves the EU is fully aware that the situation with Greece is irreperable. They're getting their due, mostly as a political hedge among their own national electorates by forcing severe austerity. And once they have some breathing room between bond issuances they'll "negotiate" a withdrawl from Greece. This is contingent mostly on the Italian and Portugese prognoses which don't look so bad right now. Ultimately, my point is that the timing for a Greek exit isn't good right now. Two things need to happen, forecasts for Italian and Portugese bonds need to stabilize (which they are) and an EU pact needs to be forged among the remaining members to give the appearance of order when the eventual call comes to kick Greece out of the euro.

The idea is that you have to put on a very brave face in order to not spook the bond markets.

|

|

|

02-15-2012, 12:33 AM

02-15-2012, 12:33 AM

|

#109

|

|

Powerplay Quarterback

|

Oh Herrow Prease

Asia Stocks Gain as China Pledges Europe Help

Asia Stocks Gain as China Pledges Europe Help

Asia stocks rose the most in a month, the yen fell to a three-month low and metals rallied after China pledged to help resolve Europeís debt crisis.

http://www.bloomberg.com/news/2012-0...e-concern.html

|

|

|

|

The Following User Says Thank You to ranchlandsselling For This Useful Post:

|

|

02-15-2012, 12:34 AM

02-15-2012, 12:34 AM

|

#110

|

|

Lifetime Suspension

|

I vote for letting Greece burn. It seems - I dunno, poetic? Something.

|

|

|

02-15-2012, 08:54 AM

02-15-2012, 08:54 AM

|

#111

|

|

Franchise Player

Join Date: Oct 2001

Location: Vancouver

|

The problem is, if not the EU, what other choice do the small European countries have? It is almost impossible to exist as a small, independent country and not have some kind of economic union.

Russia is really the only other option, and that option is not a good one for anyone... especially for NATO allies. You can't have a defense union with one bloc and an economic union with another. There would be too many conflicts of interest.

So really, Greece has 3 options, and the only one that would allow them to maintain complete autonomy would also likely make them 3rd world country.

__________________

"A pessimist thinks things can't get any worse. An optimist knows they can."

|

|

|

02-15-2012, 09:07 AM

02-15-2012, 09:07 AM

|

#112

|

|

Scoring Winger

|

Quote:

Originally Posted by Slava

Yes, but it absolutely has to be an orderly default in order to prevent chaos and contagion (as much as possible anyway).

|

What is an orderly default? If CDS contracts are honored I don't see how the rest of the dominoes don't fall.

|

|

|

02-15-2012, 09:53 AM

02-15-2012, 09:53 AM

|

#113

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Quote:

Originally Posted by freedogger

What is an orderly default? If CDS contracts are honored I don't see how the rest of the dominoes don't fall.

|

Ya, default is default in some ways. I suppose that just by looking like they are trying though might make it a more orderly default than simply coming right out and saying "no, you're on your own!"

Its pretty ugly though. A lot of northerners wanted states like Greece in the union for their own reasons a few years ago. Now that things are not looking good though, they want them out. Thats a tough position in some ways.

|

|

|

02-15-2012, 10:27 AM

02-15-2012, 10:27 AM

|

#114

|

|

First Line Centre

|

Quote:

Originally Posted by Slava

Ya, default is default in some ways. I suppose that just by looking like they are trying though might make it a more orderly default than simply coming right out and saying "no, you're on your own!"

Its pretty ugly though. A lot of northerners wanted states like Greece in the union for their own reasons a few years ago. Now that things are not looking good though, they want them out. Thats a tough position in some ways.

|

Germany has never wanted anything to do with Greece. If Goldman Sachs wouldn't have cooked the books in 2001 no other EU country would have wanted Greece in the EU either. In 2001 Goldman Sachs engaged in a series of apparently legal but nonetheless repellent deals designed to hide the Greek government's true level of indeptedness. For these trades Goldman, which in effect, handed Greece a $1 billion loan - carved out a reported $300 million in fees. The machine that enabled Greece to borrow and spend at will was analogous to the machine created to launder the credit of the American subprime borrower-and the role of the American investment banker in the machine was the same.

The Investment bankers also taught the Greek government officials how to securitize future receipts from the national lottery, highway tolls, airport landing fees, and even funds granted to the country by the European Union. As anyone with a brain must have known, the Greeks would be able to disguise their true financial state for only as long as 1. lenders assumed that a loan to Greece was as good as guaranteed by the EU (read Germany), and 2. no one outside of Greece paid very much attention. Inside Greece there was no market for whistle-blowing, as basically everyone was/is on the racket.

Defaults are never orderly....

|

|

|

02-15-2012, 10:27 AM

02-15-2012, 10:27 AM

|

#115

|

|

Franchise Player

Join Date: Aug 2005

Location: Calgary

|

Isnt the reason they are trying so hard with Greece is so when Greece evenutally does leaves the markets believe they will try to do the same thing with a more core EU country and thus they can now blame Greece for it not working instead of the EU.

I have been to Greece, any place where you cannot flush toilet paper down the toilet when you are paying $150 Euro a night, is a place that deserves bankruptcy.

__________________

MYK - Supports Arizona to democtratically pass laws for the state of Arizona

Rudy was the only hope in 08

2011 Election: Cons 40% - Nanos 38% Ekos 34%

|

|

|

02-15-2012, 10:29 AM

02-15-2012, 10:29 AM

|

#116

|

|

Norm!

|

So the question is because I'm not a world finance guy

Greece defaults, doesn't that serverely wreck the EU economy even worse. And does it solve Greece current debt problem since most of their debts problems are caused by internal issues bloated pensions, bloated civil service, no tax collection.

and if Greece defaults is anyone going to ever issue them bonds, given then aid again?

__________________

My name is Ozymandias, King of Kings;

Look on my Works, ye Mighty, and despair!

|

|

|

02-15-2012, 10:36 AM

02-15-2012, 10:36 AM

|

#117

|

|

First Line Centre

|

Quote:

Originally Posted by CaptainCrunch

So the question is because I'm not a world finance guy

Greece defaults, doesn't that serverely wreck the EU economy even worse. And does it solve Greece current debt problem since most of their debts problems are caused by internal issues bloated pensions, bloated civil service, no tax collection.

and if Greece defaults is anyone going to ever issue them bonds, given then aid again?

|

In 2001 when Greece entered the EU Greeks could suddenly borrow long-term funds at roughly the same rate as Germans - not 18% but 5%. To remain in the EU, they were meant to maintain budget deficits of 3% of GDP. Things will have to go back to how they were before.....

|

|

|

02-15-2012, 10:50 AM

02-15-2012, 10:50 AM

|

#118

|

|

Norm!

|

Even if they default they're still going to need massive bailouts to right their ship.

If they have to borrow at 18% they'll never dig themselves out.

__________________

My name is Ozymandias, King of Kings;

Look on my Works, ye Mighty, and despair!

|

|

|

02-15-2012, 10:56 AM

02-15-2012, 10:56 AM

|

#119

|

|

CP Pontiff

Join Date: Oct 2001

Location: A pasture out by Millarville

|

Quote:

Originally Posted by mykalberta

Isnt the reason they are trying so hard with Greece is so when Greece evenutally does leaves the markets believe they will try to do the same thing with a more core EU country and thus they can now blame Greece for it not working instead of the EU.

I have been to Greece, any place where you cannot flush toilet paper down the toilet when you are paying $150 Euro a night, is a place that deserves bankruptcy.  |

They are trying so hard because its an inconvenient moment in the economic cycle for a country to go bankrupt and secondly, a bankruptcy creates concerns about a panicked contagion spreading beyond its contained box and infecting the rest of Europe and then the world.

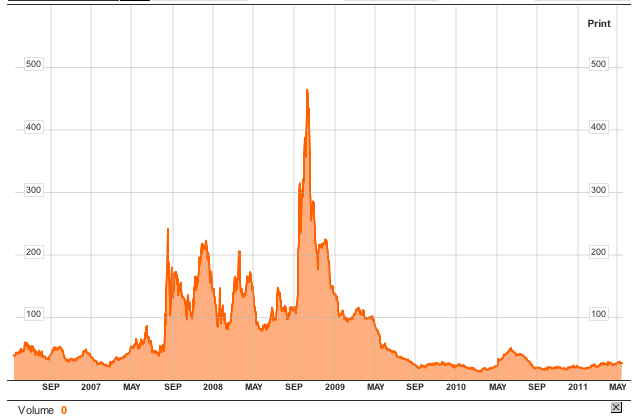

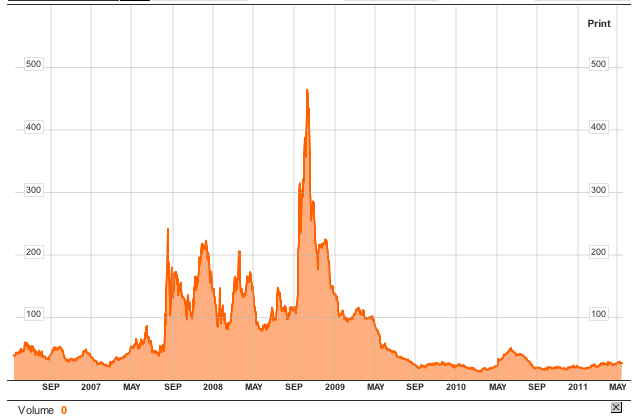

If you want to watch a real time gauge of the the panic threshold related to Greece and Europe in the global banking system, keep an eye on the Ted Spread and the Libor Rate and compare today with the purest moment of honesty and fear, the Fall of 2008 as well as pre-2008.

Both indicators are expressing some concern since Spring, 2011, peaking in the early Fall of 2011, but trending lower in the last few months.

A more sophisticated measure of the level of financial fear is the "TED spread." The TED spread is defined as "the difference between the three-month T-bill interest rate and three-month LIBOR."

The TED Spread below, not totally up to date, but giving you a feel for what true panic looks like:

You can watch the TED Spread here. http://www.bloomberg.com/quote/!TEDSP:IND Press the 1 year chart to fill in the blanks.

Things can change fast but the money that matters isn't freaking out.

Cowperson

__________________

Dear Lord, help me to be the kind of person my dog thinks I am. - Anonymous

|

|

|

|

The Following User Says Thank You to Cowperson For This Useful Post:

|

|

02-15-2012, 11:23 AM

02-15-2012, 11:23 AM

|

#120

|

|

First Line Centre

|

Quote:

Originally Posted by Cowperson

They are trying so hard because its an inconvenient moment in the economic cycle for a country to go bankrupt and secondly, a bankruptcy creates concerns about a panicked contagion spreading beyond its contained box and infecting the rest of Europe and then the world.

If you want to watch a real time gauge of the the panic threshold related to Greece and Europe in the global banking system, keep an eye on the Ted Spread and the Libor Rate and compare today with the purest moment of honesty and fear, the Fall of 2008 as well as pre-2008.

Both indicators are expressing some concern since Spring, 2011, peaking in the early Fall of 2011, but trending lower in the last few months.

A more sophisticated measure of the level of financial fear is the "TED spread." The TED spread is defined as "the difference between the three-month T-bill interest rate and three-month LIBOR."

The TED Spread below, not totally up to date, but giving you a feel for what true panic looks like:

You can watch the TED Spread here. http://www.bloomberg.com/quote/!TEDSP:IND Press the 1 year chart to fill in the blanks.

Things can change fast but the money that matters isn't freaking out.

Cowperson |

Not a bad ETF TEDSP:IND with a 1 year return of 100.35%  Too bad about the year to date down 31.97%

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 10:01 AM.

|

|