04-04-2023, 12:43 PM

04-04-2023, 12:43 PM

|

#1161

|

|

Loves Teh Chat!

|

Quote:

Originally Posted by bluejays

Really? Not arguing but why would the BOC need to keep rates high long term?

|

These aren't high rates, it's a return to normal rates.

|

|

|

|

The Following User Says Thank You to Torture For This Useful Post:

|

|

04-04-2023, 12:54 PM

04-04-2023, 12:54 PM

|

#1162

|

|

Franchise Player

Join Date: Mar 2007

Location: Calgary

|

Quote:

Originally Posted by nik-

What are all these acronyms about man?!

|

39% have Government derangement syndrome, vs 44% with Trump derangement syndrome. Sad, very sad.

|

|

|

04-08-2023, 10:39 AM

04-08-2023, 10:39 AM

|

#1163

|

|

Franchise Player

Join Date: Sep 2005

Location: Toronto, Ontario

|

Quote:

Originally Posted by Torture

These aren't high rates, it's a return to normal rates.

|

Not arguing, but I was surprised to see the past 15 years or so, the BOC rates not high at all.

https://tradingeconomics.com/canada/interest-rate

|

|

|

04-08-2023, 12:14 PM

04-08-2023, 12:14 PM

|

#1164

|

|

Appealing my suspension

Join Date: Sep 2002

Location: Just outside Enemy Lines

|

I'm not sure what to do. Stupidly stayed with my variable mortgage from 2018 instead of fixing last year. It's due to renew in June. Do I just stay variable and set the payment at 7% and pray the B.O.C rate comes back down to the 3% range. Or just take my punishment for being a total effing idiot and take the fixed rate I can get which makes me less house poor. Almost tempted to fix and than add 300 to the payment per month to pay down now and hedge against potentially higher rates. Which is like splitting the difference so to speak.

God I hate myself I really suck at life. I also regret keeping my rental property instead of listing it last spring.

__________________

"Some guys like old balls"

Patriots QB Tom Brady

|

|

|

04-08-2023, 12:17 PM

04-08-2023, 12:17 PM

|

#1165

|

|

My face is a bum!

|

Quote:

Originally Posted by nik-

What are all these acronyms about man?!

|

Initialisms.

|

|

|

|

The Following 2 Users Say Thank You to Bill Bumface For This Useful Post:

|

|

04-08-2023, 12:28 PM

04-08-2023, 12:28 PM

|

#1166

|

|

Franchise Player

Join Date: Sep 2005

Location: Toronto, Ontario

|

Quote:

Originally Posted by Sylvanfan

I'm not sure what to do. Stupidly stayed with my variable mortgage from 2018 instead of fixing last year. It's due to renew in June. Do I just stay variable and set the payment at 7% and pray the B.O.C rate comes back down to the 3% range. Or just take my punishment for being a total effing idiot and take the fixed rate I can get which makes me less house poor. Almost tempted to fix and than add 300 to the payment per month to pay down now and hedge against potentially higher rates. Which is like splitting the difference so to speak.

God I hate myself I really suck at life. I also regret keeping my rental property instead of listing it last spring.

|

I don't know what's right, and I don't know what's wrong, but in under a month I have to renew my mortgage with CIBC. I'm looking to move to a bigger place so I want to keep it open, but don't want to pay open rates. So what I think I'm going to do is pay down as much as I can at renewal, go variable at prime - 0.35%, but split the mortgage into a heloc at prime + 0.5% as much as possible, so when it comes time to sell (potentially this summer), the penalty won't be that much on breaking the variable mortgage. I don't know if any of this is helpful to you but it may be. General rule of thumb is to do what you can afford. So if you're nearing your threshold for your mortgage payments rubbing up against your income payments, you may want to go fixed - just know fixed has higher penalties, and IF rates go down a lot, you're locked in. Again, I don't know what your answer is but being risk averse when it comes to your biggest investment is probably prudent.

|

|

|

04-09-2023, 09:24 PM

04-09-2023, 09:24 PM

|

#1167

|

|

Franchise Player

Join Date: Aug 2008

Location: California

|

Quote:

Originally Posted by bluejays

I don't know what's right, and I don't know what's wrong, but in under a month I have to renew my mortgage with CIBC. I'm looking to move to a bigger place so I want to keep it open, but don't want to pay open rates. So what I think I'm going to do is pay down as much as I can at renewal, go variable at prime - 0.35%, but split the mortgage into a heloc at prime + 0.5% as much as possible, so when it comes time to sell (potentially this summer), the penalty won't be that much on breaking the variable mortgage. I don't know if any of this is helpful to you but it may be. General rule of thumb is to do what you can afford. So if you're nearing your threshold for your mortgage payments rubbing up against your income payments, you may want to go fixed - just know fixed has higher penalties, and IF rates go down a lot, you're locked in. Again, I don't know what your answer is but being risk averse when it comes to your biggest investment is probably prudent.

|

Are you staying within Canada? If so you may be able to port your mortgage from your current house to your new house for the portion that still exists on the current house without penalty. At least I was able to do this 15 years. You have to stay with the same provider though for the new house.

|

|

|

|

The Following User Says Thank You to GGG For This Useful Post:

|

|

04-09-2023, 10:40 PM

04-09-2023, 10:40 PM

|

#1168

|

|

Franchise Player

Join Date: Sep 2005

Location: Toronto, Ontario

|

Quote:

Originally Posted by GGG

Are you staying within Canada? If so you may be able to port your mortgage from your current house to your new house for the portion that still exists on the current house without penalty. At least I was able to do this 15 years. You have to stay with the same provider though for the new house.

|

Thanks. I am considering that or just moving in with the folks for a few months until I get a house. The porting aspect is an interesting one as I think you have to find a new place within 120 days or something like that.

|

|

|

04-10-2023, 11:54 AM

04-10-2023, 11:54 AM

|

#1169

|

|

Dances with Wolves

Join Date: Jun 2006

Location: Section 304

|

Quote:

Originally Posted by Sylvanfan

I'm not sure what to do. Stupidly stayed with my variable mortgage from 2018 instead of fixing last year. It's due to renew in June. Do I just stay variable and set the payment at 7% and pray the B.O.C rate comes back down to the 3% range. Or just take my punishment for being a total effing idiot and take the fixed rate I can get which makes me less house poor. Almost tempted to fix and than add 300 to the payment per month to pay down now and hedge against potentially higher rates. Which is like splitting the difference so to speak.

God I hate myself I really suck at life. I also regret keeping my rental property instead of listing it last spring.

|

You do not suck at life, it's just that in hindsight these types of decisions seem way more obvious than they actually are. I've had a variable rate mortgage for 15 years and not one of those years has gone by that somebody hasn't told me I was a moron for not locking in. Have the last couple years taken me out back to the woodshed? Oh yes. Did I clean up the previous 13 though? Also yes.

Just make the best decision you can in June. Good luck!

|

|

|

|

The Following 5 Users Say Thank You to Russic For This Useful Post:

|

|

04-10-2023, 12:36 PM

04-10-2023, 12:36 PM

|

#1170

|

|

Powerplay Quarterback

|

My son just got a mortgage at 4.94% fixed 5 year and he’s happy with it because it’s now a predictable factor in his budget for the foreseeable future.

|

|

|

04-10-2023, 12:38 PM

04-10-2023, 12:38 PM

|

#1171

|

|

Franchise Player

Join Date: Jan 2013

Location: Cape Breton Island

|

Quote:

Originally Posted by Torture

These aren't high rates, it's a return to normal rates.

|

For the average Canadian family, "normal" rates with the home prices in Canada are unaffordable.

|

|

|

04-10-2023, 12:42 PM

04-10-2023, 12:42 PM

|

#1172

|

|

Dances with Wolves

Join Date: Jun 2006

Location: Section 304

|

Quote:

Originally Posted by White Out 403

For the average Canadian family, "normal" rates with the home prices in Canada are unaffordable.

|

Ya it really feels like there was a section of about 10 years there where people's ideas of a reasonable house price went from $300,000 to $750,000. Suddenly not having a 2% interest rate gets a bit dicey.

|

|

|

|

The Following 3 Users Say Thank You to Russic For This Useful Post:

|

|

04-10-2023, 12:49 PM

04-10-2023, 12:49 PM

|

#1173

|

|

evil of fart

|

Quote:

Originally Posted by Russic

Ya it really feels like there was a section of about 10 years there where people's ideas of a reasonable house price went from $300,000 to $750,000. Suddenly not having a 2% interest rate gets a bit dicey.

|

Yeah, it's unreal how fast society just accepted exorbitant house prices.

|

|

|

04-10-2023, 01:28 PM

04-10-2023, 01:28 PM

|

#1174

|

|

Franchise Player

Join Date: Oct 2006

Location: San Fernando Valley

|

Quote:

Originally Posted by Sliver

Yeah, it's unreal how fast society just accepted exorbitant house prices.

|

It's happened with automobiles as well. Prices have gone up considerably since the pandemic and it's not stopping people from paying MSRP or higher.

|

|

|

|

The Following 2 Users Say Thank You to Erick Estrada For This Useful Post:

|

|

04-10-2023, 01:55 PM

04-10-2023, 01:55 PM

|

#1175

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Quote:

Originally Posted by Sliver

Yeah, it's unreal how fast society just accepted exorbitant house prices.

|

Well for Calgary, prices were stagnant for ~7 years. So, frankly, a lot of people were welcoming of some growth for a change. If you bought a condo here, you were sitting on dead money for years and you can finally look at breaking even.

|

|

|

04-10-2023, 02:00 PM

04-10-2023, 02:00 PM

|

#1176

|

|

Franchise Player

Join Date: Jan 2013

Location: Cape Breton Island

|

Quote:

Originally Posted by Slava

Well for Calgary, prices were stagnant for ~7 years. So, frankly, a lot of people were welcoming of some growth for a change. If you bought a condo here, you were sitting on dead money for years and you can finally look at breaking even.

|

The best I could do was 2009 and this year. The average house price in Calgary went from 420 k to 649k. I have no idea where you get the notion of stagnant.

Outside a small dip or break in the raise of pricing in ... I think was 2019 or 18, the price of housing has consistently gone up well past a reasonable rate of inflation. Canada maybe the least affordable housing in the g20. We aren't a crazy house like Toronto or Vancouver but were on our way

|

|

|

04-10-2023, 02:01 PM

04-10-2023, 02:01 PM

|

#1177

|

|

Franchise Player

Join Date: Oct 2001

Location: NYYC

|

I would do the dance of joy if my condo broke even this decade.

|

|

|

|

The Following 2 Users Say Thank You to Table 5 For This Useful Post:

|

|

04-10-2023, 02:04 PM

04-10-2023, 02:04 PM

|

#1178

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Quote:

Originally Posted by White Out 403

The best I could do was 2009 and this year. The average house price in Calgary went from 420 k to 649k. I have no idea where you get the notion of stagnant.

Outside a small dip or break in the raise of pricing in ... I think was 2019 or 18, the price of housing has consistently gone up well past a reasonable rate of inflation. Canada maybe the least affordable housing in the g20. We aren't a crazy house like Toronto or Vancouver but were on our way

|

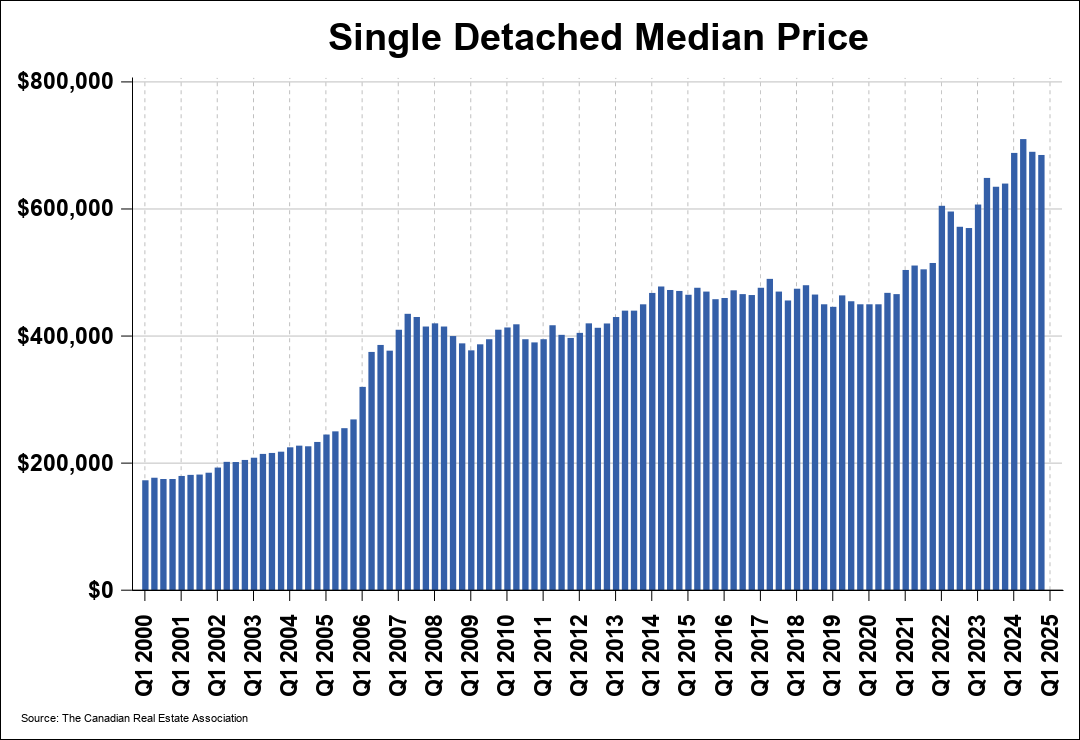

Well have a look at this graph. It's been up the last year or so, but outside of that, there's been almost nothing by and large for years.

|

|

|

|

The Following 2 Users Say Thank You to Slava For This Useful Post:

|

|

04-10-2023, 02:09 PM

04-10-2023, 02:09 PM

|

#1179

|

|

Franchise Player

|

Quote:

Originally Posted by White Out 403

The best I could do was 2009 and this year. The average house price in Calgary went from 420 k to 649k. I have no idea where you get the notion of stagnant.

|

Look at 2007-08 vs. 2020 in this chart. Basically up 10-15% in 12-13 years.

And that's single detached, which have seen the fastest increase. Townhouses took until 2022 to get back to their 2007 and 2015 levels, and condos still haven't even broken even over the last 15 years.

|

|

|

|

The Following User Says Thank You to opendoor For This Useful Post:

|

|

04-10-2023, 02:31 PM

04-10-2023, 02:31 PM

|

#1180

|

|

damn onions

|

Quote:

Originally Posted by Erick Estrada

It's happened with automobiles as well. Prices have gone up considerably since the pandemic and it's not stopping people from paying MSRP or higher.

|

Will there be a correction in automobile pricing though?

I tend to think there might be.

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 01:17 AM.

|

|