06-27-2022, 12:29 PM

06-27-2022, 12:29 PM

|

#481

|

|

Franchise Player

Join Date: Jun 2004

Location: SW Ontario

|

Prices are already declining with the the relatively small interest rate increases we are seeing today and you already see articles about people who over leveraged themselves having to sell home.

I suspect things just got ultra over heated during the pandemic because people were almost forced into saving money because most things you'd spend money on weren't available. That's not to say it was in great shape before - but things went hog wild over the past 2-3 years.

|

|

|

06-27-2022, 12:31 PM

06-27-2022, 12:31 PM

|

#482

|

|

Franchise Player

Join Date: Mar 2007

Location: Income Tax Central

|

Quote:

Originally Posted by blankall

Pretty simple. We had the capacity to house our population at one point. As that population grew, we ran out of space until eventually there was a shortage. It's not just immigration. We have the millennials, who are the biggest co-hort ever entering the market, and the babyboomers don't want to downsize.

|

I wanted to touch on this a bit. Its not even that the Babyboomers 'Dont Want' to downsize. I think this issue is more complex than that.

I think it boils down to, as you alluded to, supply is short and ergo price is increasing. Furthermore a significant chunk of babyboomers essentially have their retirement plans and funding baked into the value of their homes.

But the price of those homes, due to shortages and other market factors, are unattainable for the people that we're targeting right now.

You've got these people who have been living in their homes for 20-30 years and now these things are being valued outrageously high and the people coming into the market now, as you mentioned, are that mid-30s group.

Well these people cant afford $750K -$1.25M homes.

And these are just single-family homes in 'older' neighbourhoods.

And whats more, is that those same babyboomers cant take a haircut on the value of their homes because they're banking on that for their retirement.

I do agree with you on a number of points, but primarily, at the moment we as a society are going to seriously suffer with a housing crisis.

One poster mentioned 'communism' in terms of diverting students to specific career paths in reference to targeted economic planning, and they're not wrong, I dont think we really want to see that.

But one thing the communists may have gotten right was State-Provided, Dense, inexpensive housing.

But its not even just the Soviet-style communal housing, you see it in China and you see it in the old British Housing Estates.

Our Government, at some point, may have to move into the Housing industry.

__________________

The Beatings Shall Continue Until Morale Improves!

This Post Has Been Distilled for the Eradication of Seemingly Incurable Sadness.

The World Ends when you're dead. Until then, you've got more punishment in store. - Flames Fans

If you thought this season would have a happy ending, you haven't been paying attention.

|

|

|

|

The Following User Says Thank You to Locke For This Useful Post:

|

|

06-27-2022, 12:37 PM

06-27-2022, 12:37 PM

|

#483

|

|

Franchise Player

|

Quote:

Originally Posted by belsarius

And sorry, I like the way our education system operates, the last thing I want to tell poor Jonny is "sorry, I know you wanted to study philosophy but instead you have to be a welder. Deal with it because that is what society needs." Sounds pretty communist to me.

Maybe we should focus on the employers and making those jobs more desirable, not by restricting people from taking an education they want.

|

As long as post-secondary education is heavily subsidized with public funding, state planners have a stake in ensuring its aims and outputs align with our economic needs. We’ve spent too long pretending most young Canadians should and can get university degrees in whatever they choose and graduate into generic white-collar jobs. Pretending everyone can be an office worker actually harms our egalitarian aims. Countries with more egalitarian job markets and less inequality (Germany, Netherlands, Sweden, etc) take a firm hand in steering state education to meet economic needs, including providing clear career paths and robust training for jobs in the trades.

__________________

Quote:

Originally Posted by fotze

If this day gets you riled up, you obviously aren't numb to the disappointment yet to be a real fan.

|

Last edited by CliffFletcher; 06-27-2022 at 12:47 PM.

|

|

|

|

The Following 2 Users Say Thank You to CliffFletcher For This Useful Post:

|

|

06-27-2022, 12:39 PM

06-27-2022, 12:39 PM

|

#484

|

|

Ate 100 Treadmills

|

Quote:

Originally Posted by Locke

I wanted to touch on this a bit. Its not even that the Babyboomers 'Dont Want' to downsize. I think this issue is more complex than that.

I think it boils down to, as you alluded to, supply is short and ergo price is increasing. Furthermore a significant chunk of babyboomers essentially have their retirement plans and funding baked into the value of their homes.

But the price of those homes, due to shortages and other market factors, are unattainable for the people that we're targeting right now.

You've got these people who have been living in their homes for 20-30 years and now these things are being valued outrageously high and the people coming into the market now, as you mentioned, are that mid-30s group.

Well these people cant afford $750K -$1.25M homes.

And these are just single-family homes in 'older' neighbourhoods.

And whats more, is that those same babyboomers cant take a haircut on the value of their homes because they're banking on that for their retirement.

I do agree with you on a number of points, but primarily, at the moment we as a society are going to seriously suffer with a housing crisis.

One poster mentioned 'communism' in terms of diverting students to specific career paths in reference to targeted economic planning, and they're not wrong, I dont think we really want to see that.

But one thing the communists may have gotten right was State-Provided, Dense, inexpensive housing.

But its not even just the Soviet-style communal housing, you see it in China and you see it in the old British Housing Estates.

Our Government, at some point, may have to move into the Housing industry.

|

I do agree with a lot of what you are saying.

However, the educational system we have right now is a lot more socialist than a more limited education system where the government allocates educational spots based on actual market conditions. Currently, we have unlimited spots in every field, and the government heavily subsidizes everything. Either forcing people to pay themselves or tying existing spots to market demand is not communism/socialism. I'd argue the opposite.

|

|

|

06-27-2022, 12:41 PM

06-27-2022, 12:41 PM

|

#485

|

|

Ate 100 Treadmills

|

Quote:

Originally Posted by PeteMoss

Prices are already declining with the the relatively small interest rate increases we are seeing today and you already see articles about people who over leveraged themselves having to sell home.

I suspect things just got ultra over heated during the pandemic because people were almost forced into saving money because most things you'd spend money on weren't available. That's not to say it was in great shape before - but things went hog wild over the past 2-3 years.

|

Prices are declining moderately, and only because young families are being priced out, as they can no longer afford the higher mortgage rates. This is not what we need to accomplish. This is the next stage in the erosion of the middle class and social mobility.

It has to be done, as we need to limit borrowing, but the government needs to act on the supply issue yesterday, and by yesterday I mean 20 years ago.

|

|

|

06-27-2022, 01:37 PM

06-27-2022, 01:37 PM

|

#486

|

|

Had an idea!

|

Quote:

Originally Posted by CliffFletcher

More immigration of people who work in the trades? Absolutely. More immigration of people looking to stash millions of dollars in Canadian real estate as a safe haven? Maybe not.

|

The government has recently changed some rules to allow for more recruitment of trade workers. The problem is lots of businesses are going to take advantage of that to bring in low page workers which pushes out 2nd generation people who should go into the trades as well.

We need to push high school kids into the trades. I have yet to talk any kid who is done his apprenticeship in a skilled trade who regrets his decision or doesn't make a pile of money.

|

|

|

|

The Following 5 Users Say Thank You to Azure For This Useful Post:

|

|

06-27-2022, 01:40 PM

06-27-2022, 01:40 PM

|

#487

|

|

Had an idea!

|

Quote:

Originally Posted by PeteMoss

Prices are already declining with the the relatively small interest rate increases we are seeing today and you already see articles about people who over leveraged themselves having to sell home.

I suspect things just got ultra over heated during the pandemic because people were almost forced into saving money because most things you'd spend money on weren't available. That's not to say it was in great shape before - but things went hog wild over the past 2-3 years.

|

True.

Cost of housing materials went through the roof because a lot of extra spending went into that the last couple years because people couldn't really do anything else.

|

|

|

06-27-2022, 01:45 PM

06-27-2022, 01:45 PM

|

#488

|

|

Franchise Player

|

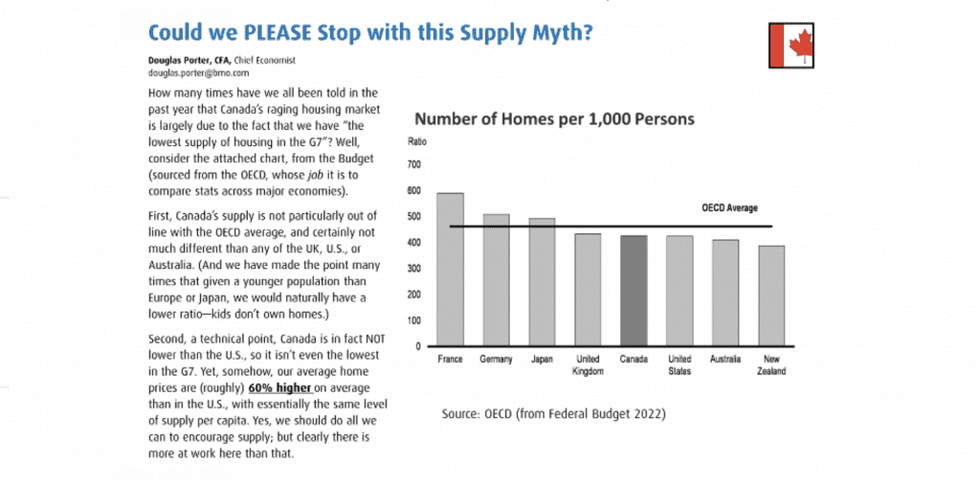

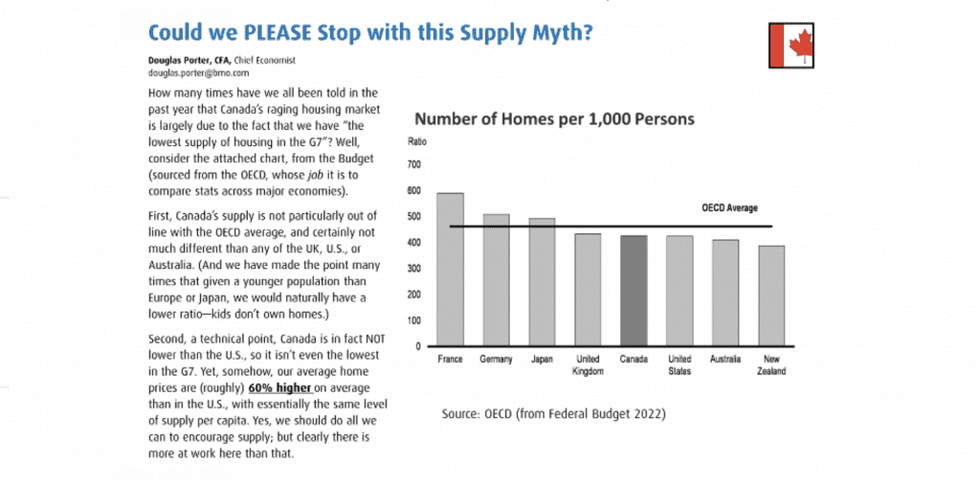

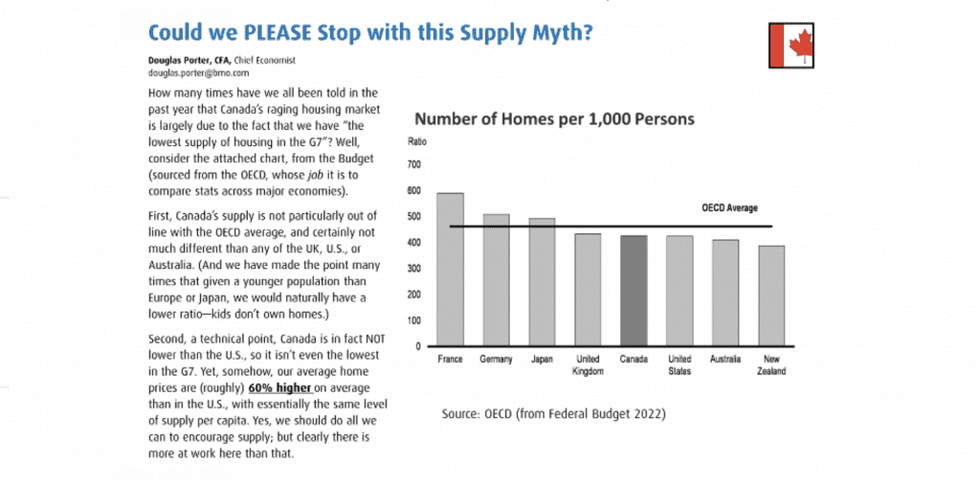

Regarding the "lowest # of housing units per capita in the G7", comparing Canada (median age of 41.8) to the 3 oldest countries in the world in Japan (median age of 48.6), Germany (47.8), and Italy (46.5) doesn't make a whole lot of sense given that kids don't buy or rent houses. Here's a slide from a presentation by BMO's Chief Economist which drives that home:

And France, which has by far the highest number of units per capita, and which has had basically stagnant population growth over the last decade, has seen property prices double in the last 10 years. There is clearly far, far more going on when basically the entire industrialized world with vast differences in population growth and immigration is all seeing huge increases in property prices.

|

|

|

06-27-2022, 01:59 PM

06-27-2022, 01:59 PM

|

#489

|

|

Franchise Player

|

Also, this OECD report has some good data. Some highlights:

-Canada's housing units per capita is unchanged from 2011. So if lack of supply is driving prices to the levels we see now, why didn't it then?

-we have one of the highest rates of housing stock in urban areas relative to our total, so there isn't an inordinate lack of supply in cities.

-Canada is 12th in the OECD in terms of units built relative to total housing stock, with a 1.3% increase in housing stock per year (which compares to our 0.8% increase in population). That's well above several peer countries (UK, USA, Germany, etc.) who are adding less than 1% to the housing stock per year.

|

|

|

06-27-2022, 02:30 PM

06-27-2022, 02:30 PM

|

#490

|

|

#1 Goaltender

|

Quote:

Originally Posted by Azure

The government has recently changed some rules to allow for more recruitment of trade workers. The problem is lots of businesses are going to take advantage of that to bring in low page workers which pushes out 2nd generation people who should go into the trades as well.

We need to push high school kids into the trades. I have yet to talk any kid who is done his apprenticeship in a skilled trade who regrets his decision or doesn't make a pile of money.

|

Million times over. The shortage of tradesman isnít a lack of able bodied persons with a desire to make a good living. Itís the absolute absurdity of the trades pay scales, and there is no doubt in my mind that suppressing wages is a tactic to force governments hand at increasing access to foreign workers. For substantially less money out of the employers pocket.

Trades should be the most vocal opponent to foreign worker programs that are actioned before wages are brought up. $30-$40/hr for journeyperson Red Seal skilled trades. Yeah, thatís wages pushing people away from trades into comfortable office jobs for similar money, not a lack of labour.

Foreign workers is (largely) bull#### corporate tactic to hold staff wages down.

__________________

No, noÖIím not sloppy, or lazy. This is a sign of the boredom.

|

|

|

06-27-2022, 03:00 PM

06-27-2022, 03:00 PM

|

#491

|

|

Franchise Player

|

Quote:

Originally Posted by opendoor

Regarding the "lowest # of housing units per capita in the G7", comparing Canada (median age of 41.8) to the 3 oldest countries in the world in Japan (median age of 48.6), Germany (47.8), and Italy (46.5) doesn't make a whole lot of sense given that kids don't buy or rent houses. Here's a slide from a presentation by BMO's Chief Economist which drives that home:

And France, which has by far the highest number of units per capita, and which has had basically stagnant population growth over the last decade, has seen property prices double in the last 10 years. There is clearly far, far more going on when basically the entire industrialized world with vast differences in population growth and immigration is all seeing huge increases in property prices. |

But it can’t just be interest rates either. Japan has had rock-bottom interest rates for almost 20 years now and we haven’t seen real estate prices climb like they have here. Same with most of Europe.

Housing prices climbed steeply all over the developed world in the last decade. But they’ve climbed much steeper in Canada’s major cities (and a handful of others like Sydney and Auckland) than elsewhere. The Economist has written stories singling out Canada’s housing bubble, because it’s recognized as being especially egregious. Why? What’s different about Toronto and Vancouver compared to Vienna and Osaka?

Quote:

Nevertheless, a comparison between Canada and other rich countries should give rise to some concern. Since 2000 the average house price has more than tripled in Canada; in America, by contrast, it is up by just about 60% (see chart). The median home in Canada costs ten times the median household income, the highest multiple since at least 1980. Within the oecd, a club of mainly rich countries, only New Zealand has seen house prices increase at a faster rate relative to incomes over the past two decades...

https://www.economist.com/finance-an...roperty-market

|

__________________

Quote:

Originally Posted by fotze

If this day gets you riled up, you obviously aren't numb to the disappointment yet to be a real fan.

|

Last edited by CliffFletcher; 06-27-2022 at 04:45 PM.

|

|

|

06-27-2022, 03:05 PM

06-27-2022, 03:05 PM

|

#492

|

|

Had an idea!

|

Citing a bunch of fancy statistics and bean counter stupidity doesn't address the problem on the ground.

Shortage of labor

Shortage of materials

NIMBYism

Zoning Stupidity

Higher Immigration than other G7 countries (we are growing MUCH faster than most other G7 countries)

And then you can even add to that foreign investment, speculation, money laundering, etc.

|

|

|

06-27-2022, 03:09 PM

06-27-2022, 03:09 PM

|

#493

|

|

Ate 100 Treadmills

|

Quote:

Originally Posted by opendoor

Regarding the "lowest # of housing units per capita in the G7", comparing Canada (median age of 41.8) to the 3 oldest countries in the world in Japan (median age of 48.6), Germany (47.8), and Italy (46.5) doesn't make a whole lot of sense given that kids don't buy or rent houses. Here's a slide from a presentation by BMO's Chief Economist which drives that home:

And France, which has by far the highest number of units per capita, and which has had basically stagnant population growth over the last decade, has seen property prices double in the last 10 years. There is clearly far, far more going on when basically the entire industrialized world with vast differences in population growth and immigration is all seeing huge increases in property prices. |

The housing shortage isn't just in Canada, it's global:

https://www.bnnbloomberg.ca/the-glob...the%20pandemic.

And the fact that Canada, a country with a lot of land, is near the top of multiple housing unaffordability lists, suggests that there has been exceptionally poor planning here. There are clearly some market factors outside of Canada's individual control going on, but Canada, amongst its peers of similar economic development, should be near the bottom of unaffordability not near the top.

To be clear I don't think supply is the only issue. For example, Canada has most certainly allowed investors to plunder the housing market. However, supply most certainly remains a major issue.

|

|

|

06-27-2022, 03:18 PM

06-27-2022, 03:18 PM

|

#494

|

|

Franchise Player

Join Date: Jun 2004

Location: SW Ontario

|

Quote:

Originally Posted by CliffFletcher

But it canít just be interest rates either. Japan has had rock-bottom interest rates for almost 20 years now and we havenít seen real estate prices climb like they have here. Same with most of Europe.

Housing prices climbed steeply all over the developed world in the last decade. But theyíve climbed much steeper in Canadaís major cities (and a handful of others like Sidney and Auckland) than elsewhere. The Economist has written stories singling out Canadaís housing bubble, because itís recognized as being especially egregious. Why? Whatís different about Toronto and Vancouver compared to Vienna and Osaka?

|

What is your theory?

|

|

|

06-27-2022, 03:32 PM

06-27-2022, 03:32 PM

|

#496

|

|

Franchise Player

|

Quote:

Originally Posted by PeteMoss

What is your theory?

|

1) Rapid population growth in the affected regions (both domestic and international).

2) A shortfall of new housing of the sort families want relative to that growing population.

3) Investors - including deep-pocketed newcomers looking for a safe haven - piling into the market due to a combination of 1 and 2.

Whatís your theory why Canada is as outlier compared to other countries with sustained low interest rates?

__________________

Quote:

Originally Posted by fotze

If this day gets you riled up, you obviously aren't numb to the disappointment yet to be a real fan.

|

|

|

|

06-27-2022, 03:33 PM

06-27-2022, 03:33 PM

|

#497

|

|

Franchise Player

Join Date: Jun 2004

Location: SW Ontario

|

Quote:

Originally Posted by chedder

|

Italy and Japan have the largest share of old people in their population.

Japan is first in +65 people by a mile (28.2%), Italy is 2nd (22.8%).

|

|

|

06-27-2022, 03:36 PM

06-27-2022, 03:36 PM

|

#498

|

|

Franchise Player

|

Quote:

Originally Posted by CliffFletcher

But it canít just be interest rates either. Japan has had rock-bottom interest rates for almost 20 years now and we havenít seen real estate prices climb like they have here. Same with most of Europe.

|

Japan had a catastrophic asset crash in the early '90s that they still haven't really recovered from because of stagnant growth (both economic and population). Look at the Nikkei; it's still ~30% below its 1989 peak.

Quote:

|

Housing prices climbed steeply all over the developed world in the last decade. But theyíve climbed much steeper in Canadaís major cities (and a handful of others like Sidney and Auckland) than elsewhere. The Economist has written stories singling out Canadaís housing bubble, because itís recognized as being especially egregious. Why? Whatís different about Toronto and Vancouver compared to Vienna and Osaka?

|

If supply of housing units was the primary culprit, then rents would have increased in concert with housing prices, but they haven't in Canada. Based on OECD data, Canada has seen one of the lowest increases in rental prices in the OECD. Since 2010 we're 30th of 38 OECD nations in rental price increases.

That points to something other than supply being behind the rise which sets Canada apart from peer nations. The most obvious factors to me are: a) monetary/government policy which has created an asset bubble, and b) an outsized influence from property investors, as that would tend to drive up purchase prices relative to rental prices (since it's constricting purchase supply but bolstering rental supply).

Now I'm not saying for a second that more supply wouldn't make housing more affordable; it would and we should increase it. But the supply relative to our population has remained static for the last couple of decades, so the idea that there's some shortage now that didn't exist before, and that that's driving house price increases isn't really supported by the evidence.

|

|

|

|

The Following User Says Thank You to opendoor For This Useful Post:

|

|

06-27-2022, 03:45 PM

06-27-2022, 03:45 PM

|

#499

|

|

Franchise Player

Join Date: Jun 2004

Location: SW Ontario

|

Quote:

Originally Posted by CliffFletcher

1) Rapid population growth in the affected regions (both domestic and international).

2) A shortfall of new housing of the sort families want relative to that growing population.

3) Investors - including deep-pocketed newcomers looking for a safe haven - piling into the market due to a combination of 1 and 2.

Whatís your theory why Canada is as outlier compared to other countries with sustained low interest rates?

|

I don't particularly know, but contributors would definitely be what you list above plus

* terrible transit infrastructure meaning there is no advantage to living near transit so everyone is willing to move further and further out from the city. People would be more willing to live in a condo downtown with a family if they could go without a car, but you can't do that - so logically everyone wants a yard and a single family house.

* Next to no 'small town' infrastructure. Even if you drive through the US there is a bunch of 'small towns' that rarely exist outside of tiny areas near cities in Canada. If you live in a small town in Ontario at least - you are driving 30 minutes to get groceries or going to a bank so there is just no demand to live in those places for young people so all the demand concentrates on cities.

|

|

|

06-27-2022, 03:45 PM

06-27-2022, 03:45 PM

|

#500

|

|

Franchise Player

|

Quote:

Originally Posted by blankall

The housing shortage isn't just in Canada, it's global:

https://www.bnnbloomberg.ca/the-glob...the%20pandemic.

And the fact that Canada, a country with a lot of land, is near the top of multiple housing unaffordability lists, suggests that there has been exceptionally poor planning here. There are clearly some market factors outside of Canada's individual control going on, but Canada, amongst its peers of similar economic development, should be near the bottom of unaffordability not near the top.

To be clear I don't think supply is the only issue. For example, Canada has most certainly allowed investors to plunder the housing market. However, supply most certainly remains a major issue. |

If it's a lack of housing units, then why has Canada's rental price growth lagged virtually the entire OECD over the last 20 years? Look at the gap between 2005 and 2020 in Canada vs. the rest of the OECD:

Basically the only countries with less growth over that period are ones with stagnant or declining populations (Japan, Germany, Italy, etc.)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 01:48 AM.

|

|