11-09-2021, 05:41 PM

11-09-2021, 05:41 PM

|

#441

|

|

Powerplay Quarterback

|

I guess France is not counting the prototype third generation EPR Flammanville 3 unit when it talks about first new reactors in decades?

https://en.wikipedia.org/wiki/Flaman...r_Plant#Unit_3

It'll be interesting to know if this new building programme will use the same design which has been problematic for France and Finland (Olkiluoto Nuclear Power Plant). Even China, which has the only two operational EPR reactors, seem to have had more problems with it compared to other designs.

|

|

|

|

The Following User Says Thank You to accord1999 For This Useful Post:

|

|

11-09-2021, 08:48 PM

11-09-2021, 08:48 PM

|

#442

|

|

#1 Goaltender

|

Quote:

Originally Posted by opendoor

Particularly if SMRs are the way forward. So far they're even more expensive per GW than traditional nuclear plants. Theoretically with mass production they could be made more efficiently, but that's far from a given. Nuclear energy has shown a negative learning rate over the last 50 years as traditional nuclear plants have just gotten more and more expensive to build. And smaller plants were generally more expensive to build and run relative to the energy they produced vs. larger ones (i.e. a 1 GW plant doesn't necessarily need 3x the workers and capital costs compared a 330 MW plant).

Nuclear has some real advantages over the alternatives, but cost isn't one of them.

|

SMRs should come in around $2/Wt, but they should probably be sold to markets that are too small to be served by GW scale plants. Alberta is such a grid, and our thermal energy requirements could be very well served by the proper SMR selection.

The negative cost curve you’re talking about is a US based phenomenon experienced after the creation of the NRC, it is not the experience of countries who stick to mastering a design and getting good at doing it.

__________________

Quote:

Originally Posted by Biff

If the NHL ever needs an enema, Edmonton is where they'll insert it.

|

|

|

|

11-09-2021, 09:59 PM

11-09-2021, 09:59 PM

|

#443

|

|

#1 Goaltender

|

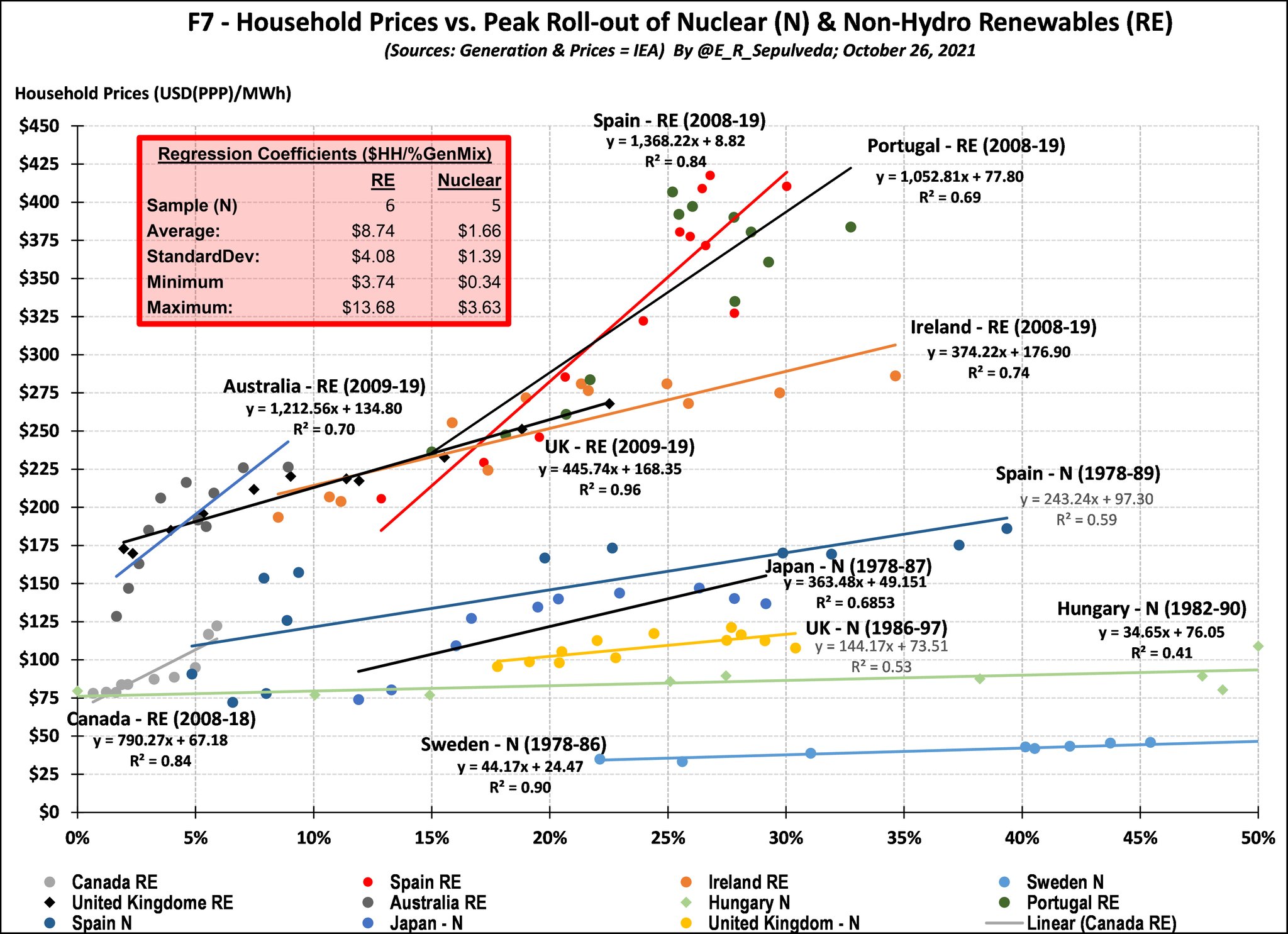

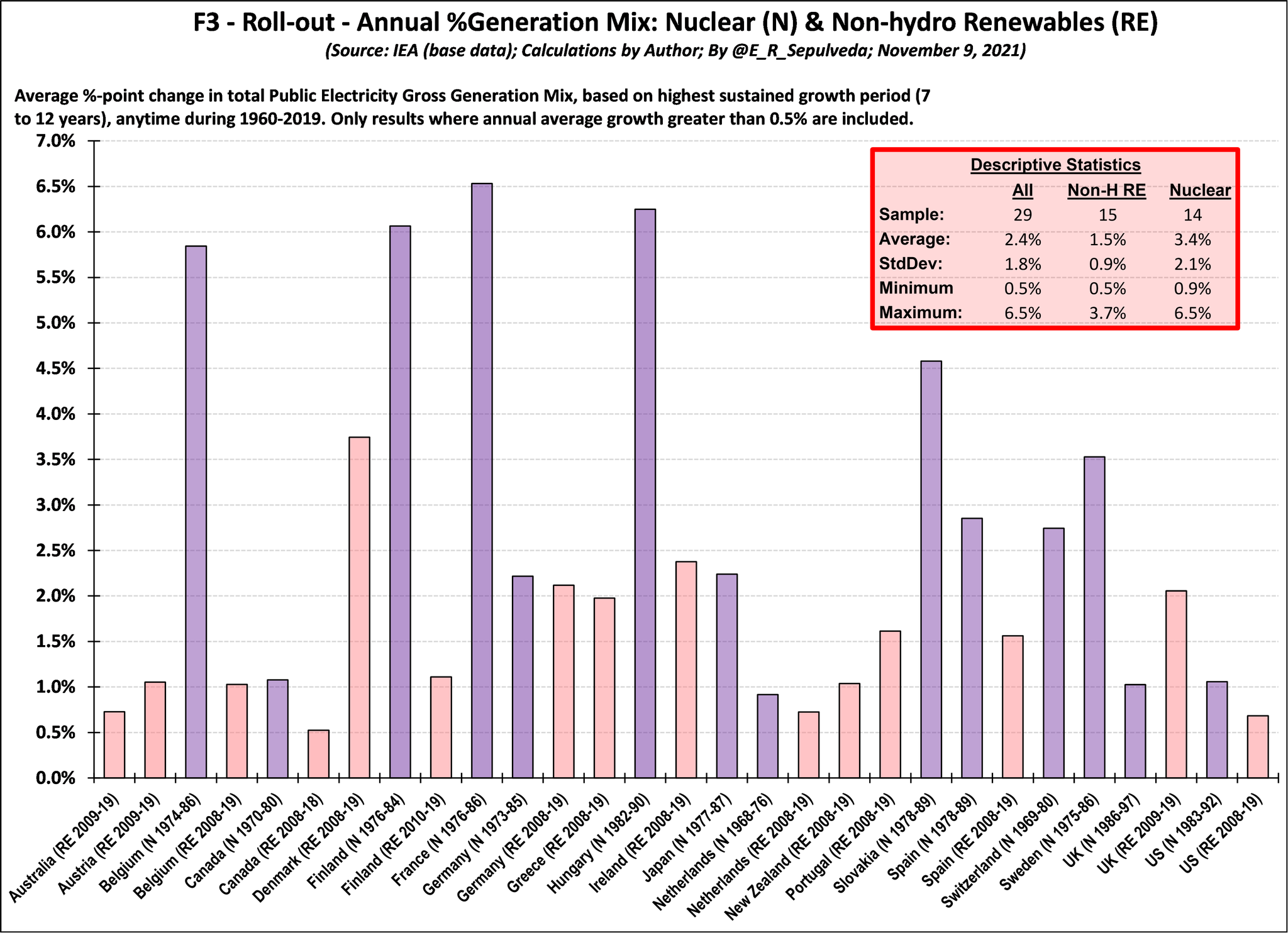

The fact is, higher % contribution from VREs on a grid lead to higher costs to the consumer. What a generator pays to install rated capacity is totally conflated with real costs to the consumer way too often. Nuclear, for as expensive it appears upfront has much better cost performance.

This is also true for speed of build out. You’d think renewables are faster but they contribute so little that nuclear has coordinated build programs taking coal and nat gas out of the mix faster.

__________________

Quote:

Originally Posted by Biff

If the NHL ever needs an enema, Edmonton is where they'll insert it.

|

Last edited by SeeGeeWhy; 11-12-2021 at 06:24 PM.

Reason: Changing photo sources

|

|

|

11-09-2021, 11:04 PM

11-09-2021, 11:04 PM

|

#444

|

|

Franchise Player

|

Quote:

Originally Posted by Slava

We spend money on all kinds of garbage though, so I’m fine with that.

|

Oh sure, the risk-reward is still good because if it works its a big deal (might save us $130 trillion or so!) But 10 years is not a realistic timeline for commercial use.

|

|

|

11-10-2021, 11:34 AM

11-10-2021, 11:34 AM

|

#445

|

|

First Line Centre

|

This should be required reading for every Canadian:

Quote:

Eric Nuttall: There's a massive chasm between government policy and our energy reality

It is epically frustrating that in Canada, a country blessed with some of the most abundant energy resources in the world, the majority of the population suffers from profound energy ignorance: the lack of knowledge of how hydrocarbons are used, how critical they are to our daily lives, and the realistic timeline to replace them with a “renewable” alternative.

Right now, wherever you are, look around. Everything you see, from the computer or piece of paper that you are reading this column on, from to the desk that you sit at, to the plastic lining in the coffee cup in front of you, all are either made of, or required the use of, hydrocarbons.

Every single day, the world consumes about 100 million barrels and demand is now back to pre-COVID levels despite jet fuel usage (8 per cent of total use) remaining weak due to lingering inconveniences such as quarantines and expensive testing requirements. According to the BP Statistical Review, of the 100 million barrels per day of daily usage, 60 million are for transportation (27 million by cars, 18 million in heavy hauling trucks, 8 million in planes, and the rest in ships and public transit). Just how big of a feat will it be to convert a staggering 1.45 billion vehicles, 29,000 aircraft, and 54,000 ships to renewable fuel sources and what is the timeline for them to reach critical scale?

For cars, the obvious alternative is electrification and in many countries, all new car sales must be emissions free (from the tailpipe, not necessarily the power source) by 2035. Electric car sales were approximately 5 million units in 2020 and while this number will steadily increase as more automakers develop new models at varying price points, how long will it take not just for electric car sales to gain meaningful share of news sales but to displace the 1.4 billion existing install base which will continue to grow for years to come (here’s a hint…the Energy Information Administration recently projected that the U.S. internal combustion car fleet won’t peak until 2038)?

What of the need to materially increase power generation capabilities to meet this new source of demand (the U.S. would have to roughly double its total energy power), while some simultaneously seek to entirely decarbonize their existing power grid by 2035? How will this massive undertaking occur when many basic raw elements, which are absolutely essential for increasing power generation and building car batteries, are entering into structural deficits such as copper, estimated by Royal Bank of Canada to be at a 32 per cent deficit by 2030, or nickel supply estimated by Rapidan to fall short of demand by 2024?

There is a massive chasm between well-intentioned government policies and our energy reality and yet eventually those two dynamics must eventually converge.

What of industry’s ability to produce enough hydrogen to displace the diesel used in heavy hauling trucks or produce renewable jet fuel, which is only now in the pilot project stage? Ignoring the massive financial requirement measured in many billions of dollars, it is estimated to take at least 20 years to reach any semblance of critical mass.

With all of that said, believe it or not, replacing the 60 million barrels per day of oil used in transportation with electrification, hydrogen, and renewable jet fuel is the easy part, relatively speaking. What of the other 40 million barrels of daily consumption that is not used for transportation, such as petrochemicals, plastics, cement, lubricants, rubber, agriculture, makeup, medicine, and over 2,000 other usages? What drives this demand growth and are there substitutions for the hydrocarbon based products that we use and rely on every day?

The world’s population today is approximately 7.7 billion and according to the United Nations is set to grow by 2 billion people by 2050, the time when the world is meant to reach “net zero” emissions status. With developed countries such as Canada, the United States, and Japan reaching peak population, the addition of 2 billion people will largely occur in Africa and Asia, areas of the world where living standards today are low yet are set to rise and this has a direct read through to how much hydrocarbons they will consume.

The average person in the world consumes only five barrels of oil per year yet in the United States, where higher living standards translates to higher hydrocarbon demand, that number is roughly 21. Thus, as the world’s population grows by 26 per cent and with it average hydrocarbon usage per person, how is it fathomable that the global demand for such things as plastics, fertilizer, mined metals for electronics, and specialty chemicals will fall?

...

|

Article Link

|

|

|

|

The Following 10 Users Say Thank You to Zarley For This Useful Post:

|

|

11-10-2021, 12:01 PM

11-10-2021, 12:01 PM

|

#446

|

|

Had an idea!

|

Like I said, they're all crazy, and this is just being done to facilitate a massive transfer of money from the taxpayers to the private sector (corporations & elite) with the tagname of 'green energy.'

It might be the biggest scam our civilization has ever seen. Untold amounts of money being spent on some pie in the sky plan, no realistic view at all on what is possible and what is a farce, and all being done to appease the absolutely dogmatic environmental agenda that has very clearly gone completely off the rails.

And we are already seeing the affects of that agenda with record energy prices across the board, and also the costs nobody in the consumer world is seeing. 50% increases across the board for the raw materials to produce the world's supply of stuff, especially in North America. Direct energy costs for businesses are up almost 300%. Indirect energy costs to manufacture are up almost 50%. Our industry has seen 30% price increases on raw materials directly related to the high cost of hydrocarbons, and all the products derived from them to help with manufacturing.

And to be clear, we work in an industry (wood based) that is VERY environmentally conscious, and is leading the world in sustainable manufacturing with billions of dollars in expansion planned.

Completely nuts.

|

|

|

11-10-2021, 12:08 PM

11-10-2021, 12:08 PM

|

#447

|

|

Franchise Player

Join Date: Mar 2015

Location: Pickle Jar Lake

|

Sometimes I wonder if governments and all these people proposing their ridiculous plans actually believe in them, or just commit to these things because they figure no one else is going to achieve them either, and it looks good for them. True believers, or along for the ride?

|

|

|

11-10-2021, 12:19 PM

11-10-2021, 12:19 PM

|

#448

|

|

Powerplay Quarterback

|

Quote:

Originally Posted by Fuzz

Sometimes I wonder if governments and all these people proposing their ridiculous plans actually believe in them, or just commit to these things because they figure no one else is going to achieve them either, and it looks good for them. True believers, or along for the ride?

|

It's hilarious hearing from the head of the IEA, Fatih Birol earlier this year that the world needs to stop new investment for oil, NG and coal:

Quote:

|

"The pathway to net zero is narrow but still achievable. If we want to reach net zero by 2050 we do not need any more investments in new oil, gas and coal projects," Fatih Birol, the IEA's executive director, told Reuters.

|

https://www.reuters.com/business/env...ea-2021-05-18/

Yet in a recent call with Japan he talks about increased investment to meet future demand.

https://twitter.com/user/status/1458341756169342978

|

|

|

|

The Following 2 Users Say Thank You to accord1999 For This Useful Post:

|

|

11-10-2021, 12:54 PM

11-10-2021, 12:54 PM

|

#449

|

|

First Line Centre

Join Date: Feb 2002

Location: Normally, my desk

|

It's driving me crazy...US/Canada, all G20 I suppose, spewing green energy rhetoric in Glasgow while the US is considering dipping into their SPR to manage oil pricing. You want to curb demand - let oil go to $150 a barrel!

Maybe that should go in the GG thread.

If it matters, I'm all for transitioning away from fossil fuels, but let's sprinkle a bit of reality into the conversation. As the article suggests, it's pretty simple math.

|

|

|

11-12-2021, 06:30 PM

11-12-2021, 06:30 PM

|

#450

|

|

#1 Goaltender

|

Quote:

Originally Posted by Zarley

This should be required reading for every Canadian:

Article Link |

Quoted for truth, and while Nuttall is correct we need to be cautious.

Our fossil fuel basket is declining in quality. It is taking more and more energy to produce the next barrel than it did to produce the last barrel.

I can dig up some research to back this up but you can see it with your own eyes in our own back yard. This is called the Seneca curve or Seneca cliff, and is really really important to stay away from the edge because everything feels and looks pretty normal until all of a sudden it is taking as much or even more energy to produce that barrel than we get out of it.

That already happens for many energy sources and they’re backed up by other more productive supplies. But with fossil fuels supplying 80% of total global energy demand, it will become very apparent which supplies are pulling their weight and which are not.

Sorry, but geologically sourced fossil fuels have to be swapped out with something more energetically abundant on short order or we will face collapse pressures far sooner than the worst climate change impacts can ever appear.

__________________

Quote:

Originally Posted by Biff

If the NHL ever needs an enema, Edmonton is where they'll insert it.

|

|

|

|

11-12-2021, 07:19 PM

11-12-2021, 07:19 PM

|

#451

|

|

Franchise Player

Join Date: Mar 2015

Location: Pickle Jar Lake

|

Quote:

Originally Posted by SeeGeeWhy

Quoted for truth, and while Nuttall is correct we need to be cautious.

Our fossil fuel basket is declining in quality. It is taking more and more energy to produce the next barrel than it did to produce the last barrel.

I can dig up some research to back this up but you can see it with your own eyes in our own back yard. This is called the Seneca curve or Seneca cliff, and is really really important to stay away from the edge because everything feels and looks pretty normal until all of a sudden it is taking as much or even more energy to produce that barrel than we get out of it.

That already happens for many energy sources and they’re backed up by other more productive supplies. But with fossil fuels supplying 80% of total global energy demand, it will become very apparent which supplies are pulling their weight and which are not.

Sorry, but geologically sourced fossil fuels have to be swapped out with something more energetically abundant on short order or we will face collapse pressures far sooner than the worst climate change impacts can ever appear.

|

There is no shortage of oil, it just needs higher prices to make it economic. As prices rice, more production can happen.

|

|

|

11-12-2021, 10:38 PM

11-12-2021, 10:38 PM

|

#452

|

|

#1 Goaltender

|

Quote:

Originally Posted by Fuzz

There is no shortage of oil, it just needs higher prices to make it economic. As prices rice, more production can happen.

|

No disagreement there, lots of the stuff around but what is the price point that induces economic recession?

And it isn’t about dollar economics as much as it is about energy economics. What contribution does a barrel of oil make to the energy market if it took a barrel of oil to get it to that market?

Declining EROI of oil

__________________

Quote:

Originally Posted by Biff

If the NHL ever needs an enema, Edmonton is where they'll insert it.

|

|

|

|

11-14-2021, 04:13 PM

11-14-2021, 04:13 PM

|

#453

|

|

First Line Centre

|

Quote:

Originally Posted by Fuzz

There is no shortage of oil, it just needs higher prices to make it economic. As prices rice, more production can happen.

|

as oil prices increase, energy alternatives also start to look more attractive and thereby get more funding resulting in better technology. So yes I agree... hydrocarbon based pricing can and should naturally be allowed to increase as it basically helps just about all ESG groups. Just not our wallets.

Sadly... all this "green" and so-called renewable-energy stuff, particularly here in Canada, does NOT seem to include conversations around what it will cost the average consumer, and also very significantly - what are the environmental and lifecycle costs for the extraction, manufacture, install, operation, and demolition? Perhaps, quite simply, hydrocarbons may just be one of the best readily available sources of energy (I'm not including new nuclear because that seems to take a decade+ here in North America).

|

|

|

11-14-2021, 08:23 PM

11-14-2021, 08:23 PM

|

#454

|

|

Franchise Player

Join Date: Nov 2006

Location: Salmon with Arms

|

Quote:

Originally Posted by RichieRich

as oil prices increase, energy alternatives also start to look more attractive and thereby get more funding resulting in better technology. So yes I agree... hydrocarbon based pricing can and should naturally be allowed to increase as it basically helps just about all ESG groups. Just not our wallets.

Sadly... all this "green" and so-called renewable-energy stuff, particularly here in Canada, does NOT seem to include conversations around what it will cost the average consumer, and also very significantly - what are the environmental and lifecycle costs for the extraction, manufacture, install, operation, and demolition? Perhaps, quite simply, hydrocarbons may just be one of the best readily available sources of energy (I'm not including new nuclear because that seems to take a decade+ here in North America).

|

So we just give up then? Let the planet go to 3 or 4 degrees?

The whole point here is quite simply that:

cutting GHG>>>>>>>>>economy>ESG. If it's too expensive, then let's figure out how to do it cheaper, not give up.

As for the overblown environmental and lifecycle costs of renewable energy, they are less than hydrocarbon extraction so I'm not sure that's an argument

Last edited by Street Pharmacist; 11-14-2021 at 08:26 PM.

|

|

|

11-14-2021, 08:55 PM

11-14-2021, 08:55 PM

|

#455

|

|

Franchise Player

Join Date: Nov 2006

Location: Salmon with Arms

|

Quote:

Originally Posted by Azure

Like I said, they're all crazy, and this is just being done to facilitate a massive transfer of money from the taxpayers to the private sector (corporations & elite) with the tagname of 'green energy.'

It might be the biggest scam our civilization has ever seen. Untold amounts of money being spent on some pie in the sky plan, no realistic view at all on what is possible and what is a farce, and all being done to appease the absolutely dogmatic environmental agenda that has very clearly gone completely off the rails.

And we are already seeing the affects of that agenda with record energy prices across the board, and also the costs nobody in the consumer world is seeing. 50% increases across the board for the raw materials to produce the world's supply of stuff, especially in North America. Direct energy costs for businesses are up almost 300%. Indirect energy costs to manufacture are up almost 50%. Our industry has seen 30% price increases on raw materials directly related to the high cost of hydrocarbons, and all the products derived from them to help with manufacturing.

And to be clear, we work in an industry (wood based) that is VERY environmentally conscious, and is leading the world in sustainable manufacturing with billions of dollars in expansion planned.

Completely nuts.

|

There's some massive leaps in logic here.

Why are energy prices so high right now? Is it because of environmental agendas? Where's the evidence for that?

|

|

|

|

The Following User Says Thank You to Street Pharmacist For This Useful Post:

|

|

11-14-2021, 09:48 PM

11-14-2021, 09:48 PM

|

#456

|

|

Franchise Player

|

Quote:

Originally Posted by Street Pharmacist

So we just give up then? Let the planet go to 3 or 4 degrees?

The whole point here is quite simply that:

cutting GHG>>>>>>>>>economy>ESG. If it's too expensive, then let's figure out how to do it cheaper, not give up.

As for the overblown environmental and lifecycle costs of renewable energy, they are less than hydrocarbon extraction so I'm not sure that's an argument

|

There are still real issues scaling up alternatives to fossil fuels that will take a lot of money to solve, but letting O&G prices rise to previously unthinkable levels will drive innovation in all areas and cheaper alternatives will come on strong. Oil has been a miracle of cheap energy that has fueled the advancement of the world’s economy for a century, but those days won’t and can’t last forever.

|

|

|

11-14-2021, 10:23 PM

11-14-2021, 10:23 PM

|

#457

|

|

Franchise Player

Join Date: Nov 2006

Location: Salmon with Arms

|

Quote:

Originally Posted by edslunch

There are still real issues scaling up alternatives to fossil fuels that will take a lot of money to solve, but letting O&G prices rise to previously unthinkable levels will drive innovation in all areas and cheaper alternatives will come on strong. Oil has been a miracle of cheap energy that has fueled the advancement of the world’s economy for a century, but those days won’t and can’t last forever.

|

I don't disagree. I think there's some massive conflation by people on both sides of the issue when it comes to fossil fuels. People in Oil

Here's how I see it: Even if we start deploying all of the clean tech we have in the highest possible scaling we can, we've got well over a decade of hydrocarbons we still need and the first few years will still probably see an increase in need. That's only if we do the absolute most which current politics will not allow.

So if that's the case, supply side policy will only increase prices for the poorest regions, but only decrease output by a little bit. It's also harder as there are many producing countries that will not comply and will simply pick up the slack in production. So how do we get there? Carrots and sticks on demand. Subsidize the transition to electric heating/mobility. Carbon tax to make green concrete/steel competitive. Mandate public purchasing to be of more greener materials. Invest in innovation through investment banks.

But I don't see very many policies aimed at the supply side. Carbon taxes work, but that's demand side. Almost every proposed policy is aimed at making us use less Oil and Gas and that's good. There are, of course, keyboard warriors shouting about shutting down O&G companies, but that's not what's happening at COP or other Climate conferences.

|

|

|

11-18-2021, 07:58 AM

11-18-2021, 07:58 AM

|

#458

|

|

Franchise Player

Join Date: Mar 2015

Location: Pickle Jar Lake

|

Quote:

Bill Gates' TerraPower Will Set Up a $4 Billion Nuclear Plant in Wyoming

And it will replace an already existing coal power plant.

Founded by Bill Gates, TerraPower, a company that plans to use nuclear energy to deliver power in a sustainable manner, has selected Kemmerer, Wyoming as a suitable site to demonstrate its advanced nuclear reactor, Natrium. The decision was made after extensive evaluation of the site and consultations with the local community, the company said in a press release.

|

Quote:

|

The demonstration plant where the company plans to set up a 345 MW reactor will be used to validate the design, construction, and operation of TerraPower's technology. Natrium technology uses uranium enriched to up to 20 percent, far higher than what is used by other nuclear reactors. However, nuclear energy supporters say that the technology creates lesser nuclear waste, Reuters reported.

|

https://interestingengineering.com/b...ant-in-wyoming

Progress! Lets hope they don't try to integrate Clippy into plant operations.

|

|

|

11-18-2021, 08:33 AM

11-18-2021, 08:33 AM

|

#459

|

|

Franchise Player

Join Date: Jun 2004

Location: SW Ontario

|

Biggest scam our civilization has ever seen?

|

|

|

11-18-2021, 08:34 AM

11-18-2021, 08:34 AM

|

#460

|

|

Had an idea!

|

Quote:

Originally Posted by Street Pharmacist

There's some massive leaps in logic here.

Why are energy prices so high right now? Is it because of environmental agendas? Where's the evidence for that?

|

Energy prices are high because of a lack of supply.

The lack of supply, especially for fossil fuels has to do with government policy trying to be 'green.' Shutting down gas plants, nuclear plants, not allowing for new developments for oil & gas extraction, no new pipelines, prohibiting LNG development, etc, etc.

Now the world is rapidly increasing the amount of coal it burns. China has given their coal miners carte blanche to extract as much coal as possible.

The US is begging other countries for their oil. Everyone thinks solar & wind are great, but they aren't even making a decent in the world's overall need for energy. EVs are amazing, but do they even make up 1% of car sales?

Where do you think carbon emissions are going from here on out?

But hey, at least we're green.

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 02:58 PM.

|

|