06-15-2015, 01:39 PM

06-15-2015, 01:39 PM

|

#21

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Quote:

Originally Posted by Bownesian

I generated this chart from: http://www.gasbuddy.com/Charts

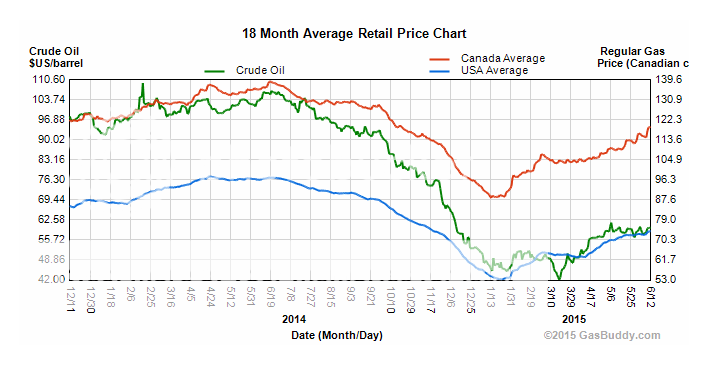

It shows that the gasoline price in the US and the price in Canada are tracking pretty much 1:1, and that the gasoline price does reflect the Oil price, though not perfectly. Part of the story is that there are fixed costs (taxes, refineries, retail) plus the variable cost, and part of the story here is that oil is priced in US dollars and we pay for gas in Canadian dollars and we've had a significant currency depreciation since the price was high.

The rest of the answer is there is typically a bit of a tighter market for gas in June because the refinery maintenance season just passed and the summer driving season is coming soon. This chart shows that for it to be price fixing, it would have to be across all of Canada and the US, which is pretty hard to imagine.

Usually prices drop in the fall and they will again, all things being equal. |

The main thing I can see from that chart is that the crude oil price looked somewhat correlated until about November, when crude oil dove hard and gas prices didn't follow. Then oddly enough oil prices started rising slowly and so did gas prices. It's as if the two are correlated on the way up and not on the way down. So bizarre.

|

|

|

06-15-2015, 02:00 PM

06-15-2015, 02:00 PM

|

#22

|

|

Scoring Winger

Join Date: Jul 2009

Location: Bowness

|

The main thing I see from that chart is the scales are different for the Crude/Gasoline prices. If one were to compress the green line so it fit in the top 60% of the chart, it would look extremely similar to the Canada average and someone who isn't much of a chart person would think there is excellent correlation.

Regarding captainyooh's last question:

Oil is a global commodity and the cost to ship it is relatively small compared to its value (and a fair amount smaller than the 15% difference in the USD:CAD). Thus, the wholesale price is pretty similar in all interconnected jurisdictions with no tariff difference (such as North America). If a barrel is selling for $100 US in Cushing Oklahoma, and your bid as a refinery operator for that barrel was $100 CAD and there was a 15% difference in the dollars, I wouldn't sell it to you, I would sell it to the refiner in Cushing. Thus the prices stay very similar to each other.

The geographic variance we see is first and foremost dependent on which province/state you are talking about (HST/PST/GST, excise taxes, carbon taxes), and then much further down the list is the distance to a refinery and market size.

|

|

|

06-15-2015, 02:12 PM

06-15-2015, 02:12 PM

|

#23

|

|

Franchise Player

Join Date: Feb 2010

Location: Calgary

|

Quote:

Originally Posted by Bownesian

...

Oil is a global commodity and the cost to ship it is relatively small compared to its value (and a fair amount smaller than the 15% difference in the USD:CAD). Thus, the wholesale price is pretty similar in all interconnected jurisdictions with no tariff difference (such as North America). If a barrel is selling for $100 US in Cushing Oklahoma, and your bid as a refinery operator for that barrel was $100 CAD and there was a 15% difference in the dollars, I wouldn't sell it to you, I would sell it to the refiner in Cushing. Thus the prices stay very similar to each other.

The geographic variance we see is first and foremost dependent on which province/state you are talking about (HST/PST/GST, excise taxes, carbon taxes), and then much further down the list is the distance to a refinery and market size.

|

Well, gasoline is not really a global commodity, because transporting it for long distances is not overly popular. It is actually more of a local commodity.

The numbers in your post are not what has been said by various corporate officials, politicians and administrators over the past 10 years. They all say (said) that by the time Alberta oil reaches distribution hubs in Texas and Oklahoma, it could net our exporters approximately 50% of the market price for crude they sell due to very high transmission and transportation costs, as well as taxes and other charges. This, in fact, was (and still is) one of the biggest factors for lobbying the new inter-provincial pipelines.

If the above is true, then it would make sense for the producers to sell for less to local refineries without too many transportation hassles and realize the same or higher profit (which means that they can still sell excess supply to other markets for less profit).

If the above is untrue, then we've been lied to all along, suggesting ... well... at least some kind of a bad thing...

__________________

"An idea is always a generalization, and generalization is a property of thinking. To generalize means to think." Georg Hegel

To generalize is to be an idiot. William Blake

Last edited by CaptainYooh; 06-15-2015 at 02:17 PM.

|

|

|

06-15-2015, 02:15 PM

06-15-2015, 02:15 PM

|

#24

|

|

Scoring Winger

|

I'm excited that the NDP won, they will eventually repeal Prentice's gas tax increase right?

|

|

|

06-15-2015, 02:20 PM

06-15-2015, 02:20 PM

|

#25

|

|

Scoring Winger

Join Date: Jul 2009

Location: Bowness

|

There is a bit of conflation going on here. The WCS:WTI discount is shown here, and it's not 50%:

http://economicdashboard.albertacanada.com/EnergyPrice

It is significant and would be alleviated by pipelines, and the price again is presented in USD, so the lines would move a fair amount when presented in CAD.

The bigger spread is when we compare the price we get vs. WTI and then the discount between WTI and Brent (the world price). We would approach the Brent price if we had a pipeline to tidewater because we would no longer be hostage to the US policy that prevents exporting oil out of North America.

So, Albertan gasoline buyers face 2 big discounts: WCS -> WTI and WTI -> Brent, at the same time that the spread has gone down (making WCS relatively more expensive) and the CAD has gone down (making WCS more expensive because WCS is priced in USD).

It's not as simple as cross-plotting the pump price and the WTI price.

Last edited by Bownesian; 06-15-2015 at 02:21 PM.

Reason: Added Brent price spread image

|

|

|

06-15-2015, 04:20 PM

06-15-2015, 04:20 PM

|

#26

|

|

Franchise Player

|

Quote:

Originally Posted by skudr248

6 months ago I was paying ~1.30 for Diesel on my VW, paying 15 cents more per litre than PREMIUM! Now the tides have turned  Sitting pretty at 95.9 on avg for a while now |

Until winter rolls around and heating season starts again out East.

|

|

|

06-15-2015, 09:13 PM

06-15-2015, 09:13 PM

|

#27

|

|

Franchise Player

|

Quote:

Originally Posted by skudr248

6 months ago I was paying ~1.30 for Diesel on my VW, paying 15 cents more per litre than PREMIUM! Now the tides have turned  Sitting pretty at 95.9 on avg for a while now |

Diesel at $1.12 here. First time in a long while it's been less than regular gas, usually runs about 10 cents more.

|

|

|

06-16-2015, 09:57 PM

06-16-2015, 09:57 PM

|

#29

|

|

Franchise Player

Join Date: Feb 2010

Location: Calgary

|

Quote:

...Oil has to be transported, stored, refined, taxed and delivered to stations. "There's a lot of moving parts. We have a glut of oil but still have a tight market for gasoline," McTeague said...

The U.S. has also become a major exporter of gasoline, tightening up the domestic supply.

"We see high demand bumping up against tight supplies -- we see this every year," Parent said.

PROFIT

Wholesales pries have jumped 3.4 cents a litre in the past few weeks. McTeague said the increase is unjustified and simply pocketed by the big oil companies because of a lack of competition.

LOW LOONIE

That $60-a-barrel oil is always priced in U.S. dollars, even if it's produced in Canada. With a loonie down around 80 cents USD, that means $60 a barrel is more like $75 a barrel in Canadian dollars.

Along with price, our market is also driven by U.S. supply. Although Canada produces plenty of crude, we don't have the refining capacity to meet our daily demand of about 2.3 million barrels. Wholesale prices have been climbing because four big U.S. refineries have cut back production due to breakdowns and maintenance.

|

This article does not look like a serious analysis. Most of the explanations that I've highlighted below are actually NOT explaining but contradicting higher gasoline prices. And one of them actually indirectly supports my suspicion of price collusion between the producers. The only explanation that does make some sense is Canadian lack of refining capacity, which I find bizarre, if true, for a resource-based economy.

__________________

"An idea is always a generalization, and generalization is a property of thinking. To generalize means to think." Georg Hegel

To generalize is to be an idiot. William Blake

|

|

|

06-18-2015, 09:35 AM

06-18-2015, 09:35 AM

|

#30

|

|

In Your MCP

Join Date: Apr 2004

Location: Watching Hot Dog Hans

|

https://ca.finance.yahoo.com/news/oi...032625014.html

Gasoline demand across the northern hemisphere has been remarkably strong in recent months, pushing gasoline margins – the profit refiners make from turning crude oil into motor fuel - to their highest in nearly a decade.

Analysts say this is one reason why oil markets have been so strong despite a huge surplus of crude in many parts of the world and heavy over-production by key OPEC oil producers.

So what I take from that is we should all be thankful for high gas prices, as it has a correlation to oil prices (high fuel demand=higher oil prices)......lol

We all need bigger vehicles!!

|

|

|

06-18-2015, 09:53 AM

06-18-2015, 09:53 AM

|

#31

|

|

Powerplay Quarterback

|

Quote:

Originally Posted by CaptainYooh

The only explanation that does make some sense is Canadian lack of refining capacity, which I find bizarre, if true, for a resource-based economy.

|

This isn't the case. Canada has plenty of refining capacity and is a net exporter of refined product.

|

|

|

06-18-2015, 10:57 AM

06-18-2015, 10:57 AM

|

#32

|

|

#1 Goaltender

|

Quote:

Originally Posted by blueski

I'm excited that the NDP won, they will eventually repeal Prentice's gas tax increase right?

|

No chance in hell. There is a better chance they will raise it again eventually.

But it is a good point. People do need to remember a 25% currency adjustment from the peak gas price & a 3.5 % tax adjustment. So apples to apples if you are paying for a liter of gas today in US$ it would be about what, $0.88-$0.90?

|

|

|

12-04-2015, 10:02 AM

12-04-2015, 10:02 AM

|

#33

|

|

First Line Centre

|

BUMP!

Thought that this would be the best place as any to ask a question.

Have any of you filled up gas at Superstore? They have a 7cent superbucks back per litre. How does that work? After you fill up, do you take the receipt to superstore and then they scan it and apply any savings?

Thanks all.

|

|

|

12-04-2015, 10:06 AM

12-04-2015, 10:06 AM

|

#34

|

|

Franchise Player

Join Date: Oct 2001

Location: Behind Nikkor Glass

|

Quote:

Originally Posted by Izzle

BUMP!

Thought that this would be the best place as any to ask a question.

Have any of you filled up gas at Superstore? They have a 7cent superbucks back per litre. How does that work? After you fill up, do you take the receipt to superstore and then they scan it and apply any savings?

Thanks all.

|

The discount is applied when you either get a "Superbuck" coupon on your receipt or it's added to your PC Points (which you choose when you pay at the pump).

|

|

|

|

The Following User Says Thank You to Regulator75 For This Useful Post:

|

|

12-04-2015, 10:06 AM

12-04-2015, 10:06 AM

|

#35

|

|

In Your MCP

Join Date: Apr 2004

Location: Watching Hot Dog Hans

|

Yeah when you fill up there you get a receipt with a balance on it ($0.07 x liters purchased credit) that you can scan and use for groceries in the store.

|

|

|

12-04-2015, 10:06 AM

12-04-2015, 10:06 AM

|

#36

|

|

Franchise Player

Join Date: Mar 2015

Location: Pickle Jar Lake

|

The superbucks are only if you have one of their credit cards, if I remember right. Otherwise you can use a PC Plus points card and get 3.5c back on that. Then you can use those points in store. Maybe for gas too, not sure.

|

|

|

12-04-2015, 10:10 AM

12-04-2015, 10:10 AM

|

#37

|

|

Franchise Player

|

if you are gassing up at superstore, and also find yourself in need of pop or something, it would be well worth your while to run into the store as pop is more expensive at the gas bar

__________________

If I do not come back avenge my death

|

|

|

|

The Following 2 Users Say Thank You to Northendzone For This Useful Post:

|

|

12-04-2015, 10:13 AM

12-04-2015, 10:13 AM

|

#38

|

|

First Line Centre

|

Quote:

Originally Posted by Regulator75

The discount is applied when you either get a "Superbuck" coupon on your receipt or it's added to your PC Points (which you choose when you pay at the pump).

|

I also have the really cheap pc mastercard connected to PC points. I suppose I should be gassing up there more often than at the corner gas bar.

|

|

|

12-04-2015, 10:28 AM

12-04-2015, 10:28 AM

|

#39

|

|

In the Sin Bin

|

Quote:

Originally Posted by Northendzone

if you are gassing up at superstore, and also find yourself in need of pop or something, it would be well worth your while to run into the store as pop is more expensive at the gas bar

|

Nice reference.

|

|

|

06-03-2016, 07:38 AM

06-03-2016, 07:38 AM

|

#40

|

|

Franchise Player

Join Date: Mar 2015

Location: Pickle Jar Lake

|

Uh oh...

Quote:

|

"We're out of gas and unless we can get it from a third party then we'll be out three to five weeks," said Tianna Byers, an employee at the Petro-Canada on Highway 97 in Kelowna.

|

http://www.cbc.ca/news/canada/britis...614059?cmp=rss

If this lasts a month gas prices are going to go through the roof..might be a good day to fill up.

Last edited by Fuzz; 06-03-2016 at 07:41 AM.

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 08:21 PM.

|

|