01-22-2025, 02:15 PM

01-22-2025, 02:15 PM

|

#241

|

|

wins 10 internets

Join Date: Feb 2006

Location: slightly to the left

|

Quote:

Originally Posted by Fuzz

Had me curious so I had to look at what the industries are in Mississippi that help them out, as I couldn't think of what they even do there.

Top 5:

1. Hospitals $11.4b

2. New Car Dealers $8.8b

3. Commercial Banking$7.8b

4. Health & Medical Insurance $6.5b

5. Petroleum Refining $6.2b

https://www.ibisworld.com/united-sta...s/mississippi/

Is most of that even generating any real value? How can so many afford new cars? |

The fact that HOSPITALS is their largest "industry" is disgusting, and shows just how broken the US is as a whole

|

|

|

01-22-2025, 02:21 PM

01-22-2025, 02:21 PM

|

#242

|

|

Franchise Player

Join Date: Mar 2015

Location: Pickle Jar Lake

|

It's OK, health and medical insurance also have a huge cut. "Here we run our sate on economy on useless middle men, pushing papers and increasing healthcare costs for shareholder value".

|

|

|

01-22-2025, 02:21 PM

01-22-2025, 02:21 PM

|

#243

|

|

Franchise Player

|

I think that says more about GDP being a poor measure to judge relative economic prosperity than anything else. Anyone who has been to the poorer US states and also been to the various Canadian provinces could tell you that.

And that's because GDP doesn't measure income, or wealth, or quality of life. It measures economic activity, even if the jurisdiction it's measured in doesn't actually benefit from it. Ireland is a great example. Companies often headquarter their international holdings there because of favourable corporate tax rates, with Apple being the most notable example. So Apple's non-North American business flows through their Irish subsidiary, which creates a huge amount of economic activity that gets booked in Ireland, but the money just flows back out of Ireland again to the company and its investors, with the only real benefit to Ireland being a small amount of corporate tax revenue and then some jobs related to that setup. But the economic activity gets credited to Ireland because that's how GDP is measured.

And it's not even necessarily real money that's driving that. Apple re-domiciled their non-US intellectual property (worth about $350B) to Ireland in 2015 (which was a completely paper transaction). So as a result Ireland's GDP grew by 26% in a year. Obviously the actual economy that Irish residents participate in didn't grow 26%, and income in Ireland didn't grow by that much, because it was simply a paper transactino where holdings were shifted from one country to another. But the Irish GDP grew massively because of it. So jurisdictions with lots of international businesses headquartered there (which the US is a prime example of) will tend to have higher GDPs because the companies' income is credited to that jurisdiction, even if it just flows back out to investors around the world.

So comparing somewhere like Mississippi to Canadian provinces on the basis of GDP per capita is a bit like saying a millionaire who had $0 income in a year because of some tax maneuvers is in the same position as a homeless person. US incomes are still higher than Canadian ones, that's not in question. But GDP is a pretty terrible measure when comparing across jurisdictions.

|

|

|

|

The Following 7 Users Say Thank You to opendoor For This Useful Post:

|

|

01-22-2025, 02:23 PM

01-22-2025, 02:23 PM

|

#244

|

|

Franchise Player

Join Date: Mar 2015

Location: Pickle Jar Lake

|

The value of the dollar, largely booted by it's global status, also tends to distort those numbers, I think.

|

|

|

01-22-2025, 02:40 PM

01-22-2025, 02:40 PM

|

#245

|

|

Franchise Player

|

Quote:

Originally Posted by Hemi-Cuda

The fact that HOSPITALS is their largest "industry" is disgusting, and shows just how broken the US is as a whole

|

Health care is also the largest industry (by number of employees) in Alberta with ~247 000 workers. That would include more than just hospitals I presume.

|

|

|

01-22-2025, 02:59 PM

01-22-2025, 02:59 PM

|

#246

|

|

Franchise Player

Join Date: Oct 2001

Location: NYYC

|

You may not like the industries that make money in a place like Mississippi (or anywhere), but at the end of the day economic activity is what drives our societies. No matter what you define as worthy, you don't get to spend money without first making it. And maybe a lot of money today is made by pencil pushers and middle men (plenty of us like that on CP too I'm sure)..but that income is still used to pay taxes, support infrastructure and social programs, buy goods and services, travel etc.

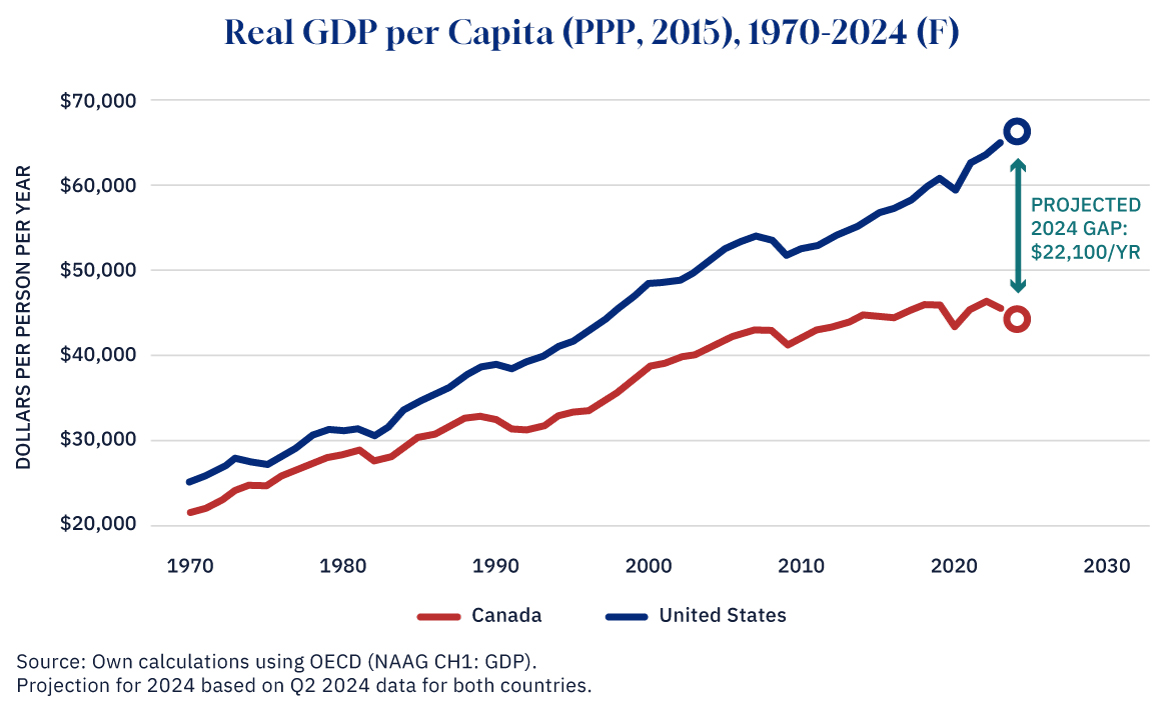

And of course GDP doesn't tell the whole story, but it's one of the key metrics we all use to track economic progress/health...if you have a better metric you prefer, feel free to share. And even if GDP/capita is not perfect, the US is our closest comparable and we tend to work under a similar economic/social framework, so it gives decent insight to where things are tracking. Looking at the diverging trends of the prosperity gap chart I posted, does anyone think it's good for Canada that we're diverging negatively?

|

|

|

|

The Following 3 Users Say Thank You to Table 5 For This Useful Post:

|

|

01-22-2025, 03:13 PM

01-22-2025, 03:13 PM

|

#247

|

|

Franchise Player

Join Date: Mar 2015

Location: Pickle Jar Lake

|

Is the US really our closest or best comparable? They basically dominate the western world in tech, have the reserve currency thing, and don't really care much about workers rights(compared to Canada and many other western countries), along with a massive cheap labour pool. I just don't see how, even if we do very well, we'd get all that close anymore.

|

|

|

01-22-2025, 03:14 PM

01-22-2025, 03:14 PM

|

#248

|

|

Ate 100 Treadmills

|

Quote:

Originally Posted by opendoor

I think that says more about GDP being a poor measure to judge relative economic prosperity than anything else. Anyone who has been to the poorer US states and also been to the various Canadian provinces could tell you that.

And that's because GDP doesn't measure income, or wealth, or quality of life. It measures economic activity, even if the jurisdiction it's measured in doesn't actually benefit from it. Ireland is a great example. Companies often headquarter their international holdings there because of favourable corporate tax rates, with Apple being the most notable example. So Apple's non-North American business flows through their Irish subsidiary, which creates a huge amount of economic activity that gets booked in Ireland, but the money just flows back out of Ireland again to the company and its investors, with the only real benefit to Ireland being a small amount of corporate tax revenue and then some jobs related to that setup. But the economic activity gets credited to Ireland because that's how GDP is measured.

And it's not even necessarily real money that's driving that. Apple re-domiciled their non-US intellectual property (worth about $350B) to Ireland in 2015 (which was a completely paper transaction). So as a result Ireland's GDP grew by 26% in a year. Obviously the actual economy that Irish residents participate in didn't grow 26%, and income in Ireland didn't grow by that much, because it was simply a paper transactino where holdings were shifted from one country to another. But the Irish GDP grew massively because of it. So jurisdictions with lots of international businesses headquartered there (which the US is a prime example of) will tend to have higher GDPs because the companies' income is credited to that jurisdiction, even if it just flows back out to investors around the world.

So comparing somewhere like Mississippi to Canadian provinces on the basis of GDP per capita is a bit like saying a millionaire who had $0 income in a year because of some tax maneuvers is in the same position as a homeless person. US incomes are still higher than Canadian ones, that's not in question. But GDP is a pretty terrible measure when comparing across jurisdictions.

|

Apple employs 6000 people in Ireland - mostly in Cork. There are major economic benefits to having large corporations headquartered in your jurisdiction.

|

|

|

01-22-2025, 03:20 PM

01-22-2025, 03:20 PM

|

#249

|

|

Franchise Player

Join Date: Aug 2005

Location: Memento Mori

|

Quote:

Originally Posted by Fuzz

The value of the dollar, largely booted by it's global status, also tends to distort those numbers, I think.

|

It's the reserve currency because the USA won't squelch on currency conversions.

Keep in mind, there is zero legal obligation for them to do that.

__________________

If you don't pass this sig to ten of your friends, you will become an Oilers fan.

|

|

|

01-22-2025, 03:21 PM

01-22-2025, 03:21 PM

|

#250

|

|

Ate 100 Treadmills

|

Quote:

Originally Posted by Fuzz

Is the US really our closest or best comparable? They basically dominate the western world in tech, have the reserve currency thing, and don't really care much about workers rights(compared to Canada and many other western countries), along with a massive cheap labour pool. I just don't see how, even if we do very well, we'd get all that close anymore.

|

The issue is more the widening gap between Canada and the USA. Canada has stalled out for a while.

10 years ago, the factors your pointing out didn't exist?

|

|

|

|

The Following 2 Users Say Thank You to blankall For This Useful Post:

|

|

01-22-2025, 03:22 PM

01-22-2025, 03:22 PM

|

#251

|

|

Franchise Player

Join Date: Aug 2005

Location: Memento Mori

|

Quote:

Originally Posted by opendoor

I think that says more about GDP being a poor measure to judge relative economic prosperity than anything else. Anyone who has been to the poorer US states and also been to the various Canadian provinces could tell you that.

And that's because GDP doesn't measure income, or wealth, or quality of life. It measures economic activity, even if the jurisdiction it's measured in doesn't actually benefit from it. Ireland is a great example. Companies often headquarter their international holdings there because of favourable corporate tax rates, with Apple being the most notable example. So Apple's non-North American business flows through their Irish subsidiary, which creates a huge amount of economic activity that gets booked in Ireland, but the money just flows back out of Ireland again to the company and its investors, with the only real benefit to Ireland being a small amount of corporate tax revenue and then some jobs related to that setup. But the economic activity gets credited to Ireland because that's how GDP is measured.

And it's not even necessarily real money that's driving that. Apple re-domiciled their non-US intellectual property (worth about $350B) to Ireland in 2015 (which was a completely paper transaction). So as a result Ireland's GDP grew by 26% in a year. Obviously the actual economy that Irish residents participate in didn't grow 26%, and income in Ireland didn't grow by that much, because it was simply a paper transactino where holdings were shifted from one country to another. But the Irish GDP grew massively because of it. So jurisdictions with lots of international businesses headquartered there (which the US is a prime example of) will tend to have higher GDPs because the companies' income is credited to that jurisdiction, even if it just flows back out to investors around the world.

So comparing somewhere like Mississippi to Canadian provinces on the basis of GDP per capita is a bit like saying a millionaire who had $0 income in a year because of some tax maneuvers is in the same position as a homeless person. US incomes are still higher than Canadian ones, that's not in question. But GDP is a pretty terrible measure when comparing across jurisdictions.

|

Let's take an exception and make it the rule.

No one in their right mind would ever dismiss GDP growth. Yet here you are. I get your life is awesome, who the hell cares about anybody else. Yeah that Uber driver sure has a great life ahead. Maybe give him your high paying job?

__________________

If you don't pass this sig to ten of your friends, you will become an Oilers fan.

|

|

|

01-22-2025, 03:24 PM

01-22-2025, 03:24 PM

|

#252

|

|

Franchise Player

|

Quote:

Originally Posted by blankall

Apple employs 6000 people in Ireland - mostly in Cork. There are major economic benefits to having large corporations headquartered in your jurisdiction.

|

Sure, but it's in no shape or form in proportion with the amount of GDP that gets credited there. About $220B in revenue is attributed to the Irish subsidary each year. With 6,000 employees, that's $37 million in revenue per employee. Do you really think that figure accurately reflects the economic activity occurring within Ireland? Obviously not, but it gets counted as part of Ireland's GDP because the money flows through there.

|

|

|

|

The Following User Says Thank You to opendoor For This Useful Post:

|

|

01-22-2025, 03:36 PM

01-22-2025, 03:36 PM

|

#253

|

|

Franchise Player

Join Date: Mar 2015

Location: Pickle Jar Lake

|

Quote:

Originally Posted by blankall

The issue is more the widening gap between Canada and the USA. Canada has stalled out for a while.

10 years ago, the factors your pointing out didn't exist?

|

So just to confirm my feelings, I took a look. I believe for the US it's Line 53, for Canada it's 519. If I got this wrong, it's all wrong!

Canada

US

The US from 2010 to 2023 went from 163 billion to 786 billion in tech, and Canada in the same period went from 1.7 billion to 3.8 billion. And I just don't see how we do a Microsoft, Google, Apple, Amazon etc, or how anyone else in the world manages that. So when you add those massive increases into the comparison, I think it's easy to see the distortion it causes, and makes us look much worse, but when you compare to other G7 countries, you see only the US has taken off, largely on the backs of these companies taking money from all over the globe and bringing it to the US. So ignoring this stuff, and then pointing at the gap and saying we need to catch up isn't much help, because it's nearly fundamentally impossible to do that. Does that make sense?

Last edited by Fuzz; 01-22-2025 at 03:39 PM.

|

|

|

01-22-2025, 03:36 PM

01-22-2025, 03:36 PM

|

#254

|

|

Franchise Player

Join Date: Oct 2001

Location: NYYC

|

Quote:

Originally Posted by blankall

The issue is more the widening gap between Canada and the USA. Canada has stalled out for a while.

10 years ago, the factors your pointing out didn't exist?

|

Yep. Maybe some people missed it, because it was spoilered, but you can tell from this chart that we've followed similar fluctuations because we're pretty close to the hip (for better or worse!) but the gap in prosperity has been steadily widening.

The US is in a different league, but the bigger the gap, the more incentive for our best and brightest minds to move south, start business there instead of here, global investors to prioritize them etc. This of course already happens, but this trend will only exacerbate the issue.

|

|

|

01-22-2025, 03:38 PM

01-22-2025, 03:38 PM

|

#255

|

|

Franchise Player

|

Quote:

Originally Posted by Shazam

Let's take an exception and make it the rule.

No one in their right mind would ever dismiss GDP growth. Yet here you are. I get your life is awesome, who the hell cares about anybody else. Yeah that Uber driver sure has a great life ahead. Maybe give him your high paying job?

|

It's not an exception. Tax havens and countries with tons of companies headquartered there will tend to have inflated GDPs because economic activity that is largely generated outside the jurisdiction gets credited there.

And no one's dismissing GDP growth; I'm saying it's flawed when comparing different jurisdictions (e.g. Ontario and Mississippi have similar GDP per capitas, therefore the quality of life is comparable). That doesn't mean it's useless or anything, but it should be used to measure what it's intended for, which is a rough approximation of the size of a jurisdiction's economy and how much tax can be raised from it. GDP is not meant to measure welfare; economists have been clear on that forever, and the Statement of National Accounts even devotes much of its first chapter talking about that.

|

|

|

|

The Following User Says Thank You to opendoor For This Useful Post:

|

|

01-22-2025, 03:39 PM

01-22-2025, 03:39 PM

|

#256

|

|

Ate 100 Treadmills

|

Quote:

Originally Posted by opendoor

Sure, but it's in no shape or form in proportion with the amount of GDP that gets credited there. About $220B in revenue is attributed to the Irish subsidary each year. With 6,000 employees, that's $37 million in revenue per employee. Do you really think that figure accurately reflects the economic activity occurring within Ireland? Obviously not, but it gets counted as part of Ireland's GDP because the money flows through there.

|

Does anyone actually think Ireland is the 3rd richest country behind Switzerland and Luxembourg? Of course their GDP numbers are inflated. There are benefits Ireland's strategy of allowing corporations to set up their headquarters, without much taxation.

The USA, unlike Ireland (and Switzerland), isn't pumping up their numbers by acting as a tax haven. They have much better numbers than us. If anything, it's Canada's numbers that are inflated. We're still exporting raw natural resources, and we're very poor at going after tax cheats.

|

|

|

01-22-2025, 03:41 PM

01-22-2025, 03:41 PM

|

#257

|

|

Franchise Player

Join Date: Mar 2015

Location: Pickle Jar Lake

|

Just to backup the point that it is only the US really taking off.

|

|

|

01-22-2025, 03:47 PM

01-22-2025, 03:47 PM

|

#258

|

|

#1 Goaltender

|

Quote:

Originally Posted by opendoor

It's not an exception. Tax havens and countries with tons of companies headquartered there will tend to have inflated GDPs because economic activity that is largely generated outside the jurisdiction gets credited there.

And no one's dismissing GDP growth; I'm saying it's flawed when comparing different jurisdictions (e.g. Ontario and Mississippi have similar GDP per capitas, therefore the quality of life is comparable). That doesn't mean it's useless or anything, but it should be used to measure what it's intended for, which is a rough approximation of the size of a jurisdiction's economy and how much tax can be raised from it. GDP is not meant to measure welfare; economists have been clear on that forever, and the Statement of National Accounts even devotes much of its first chapter talking about that.

|

Some good points relating to GDP and its statistical limitations, but based on other posts you feel that a place like Ireland would be good to dramatically increase government debt since you feel that debt to GDP ratio is a particularly useful measure?

Seems incongruous.

|

|

|

01-22-2025, 03:47 PM

01-22-2025, 03:47 PM

|

#259

|

|

Franchise Player

Join Date: Oct 2001

Location: NYYC

|

Quote:

Originally Posted by Fuzz

So ignoring this stuff, and then pointing at the gap and saying we need to catch up isn't much help, because it's nearly fundamentally impossible to do that. Does that make sense?

|

We're never going to out-tech/finance the US, but I think the way we close the gap is by again focusing on our most obvious strength, our natural resources. That's really the one thing that can set Canada apart on the global stage, and has in the past. It's not a surprise that the two provinces (Alberta and Saskatchewan) with the largest GDP per capita are the ones that have a large resource sector. For things like the AI/Tech boom...the way we prosper in Canada is not by trying to out nerd the nerds in the US/India/China, it's by being the ones who supply the power and commodities needed to run these things. We need to be the worlds commodity/energy backbone, and not be ashamed of that.

Last edited by Table 5; 01-22-2025 at 03:52 PM.

|

|

|

01-22-2025, 03:52 PM

01-22-2025, 03:52 PM

|

#260

|

|

Franchise Player

|

Quote:

Originally Posted by Table 5

Yep. Maybe some people missed it, because it was spoilered, but you can tell from this chart that we've followed similar fluctuations because we're pretty close to the hip (for better or worse!) but the gap in prosperity has been steadily widening.

The US is in a different league, but the bigger the gap, the more incentive for our best and brightest minds to move south, start business there instead of here, global investors to prioritize them etc. This of course already happens, but this trend will only exacerbate the issue.

|

To me there are 3 big factors driving that:

1) The US is largely creating economic growth through deficits. For the last decade or so, they're borrowing about 6% of GDP every year to fund artificially low tax rates. That's not an effective long-term strategy, nor is it something Canada can really replicate (we've been about 0-2% of GDP outside of COVID). And the way people talk about Canada's deficits now, their heads would explode if we had $200B deficits like we'd have at the US's rate.

2) Canada had a short-term big influx of people, including a lot of low productivity newcomers (i.e. students). That doesn't add much to the GDP right away, while also making the denominator bigger, reducing GDP per capita. That was clearly a failure of the federal government, but it's not something that's going to have an ongoing impact once it's corrected, so you would expect GDP per capita to rise faster once that normalizes.

3) Much of that divergence is based on the exchange rate. The US dollar has strengthened against virtually every major currency, but unless you think that's a permanent change (it's not) then it will shift the other way. We saw a similar divergence in the '90s when the CAD dropped significantly. But once it recovered eventually then GDP per capita (measured in USD) grew quickly again.

|

|

|

|

The Following User Says Thank You to opendoor For This Useful Post:

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 12:52 PM.

|

|