06-03-2019, 08:25 AM

06-03-2019, 08:25 AM

|

#221

|

|

First Line Centre

Join Date: Apr 2006

Location: Calgary

|

Quote:

Originally Posted by White Out 403

Been a home owner for 5 years never seen an increase like this.

Maybe? I bought this house for a lot less than what the previous owners did. So I can't makes heads or tails. I'll def be filing a complaint Monday.

|

The appeal period was in March...

|

|

|

06-03-2019, 10:02 AM

06-03-2019, 10:02 AM

|

#222

|

|

#1 Goaltender

Join Date: Feb 2014

Location: Uranus

|

Quote:

Originally Posted by GGG

Sort of, That is the progressive part of property taxation. We accept that those who can pay more do pay more.

But a person who is spending day 600k on a house should be rewarded in lower taxes when they choose a smaller footprint. So you incentivize a multi family inner city home over a suburban home.

|

Many of these buildings around the city are at well below capacity and are turning sales units into rentals due to a complete lack of interest. Even then, a quick search online reveals a staggering amount of availability. The majority of homeowners simply don't want to buy into units that are typically too small, located 20 floors above ground and then run like a police state with rules and regulations.

I just can't see that taking off besides the fact that these units only appeal to a very narrow band of the cities population. If you start penalizing the typical suburban family, you're likely going to create a situation where people simply start moving to outlying communities that aren't much farther away. It's a very slippery slope.

__________________

I hate to tell you this, but I’ve just launched an air biscuit

Last edited by Hot_Flatus; 06-03-2019 at 10:09 AM.

|

|

|

06-05-2019, 05:35 PM

06-05-2019, 05:35 PM

|

#223

|

|

Norm!

|

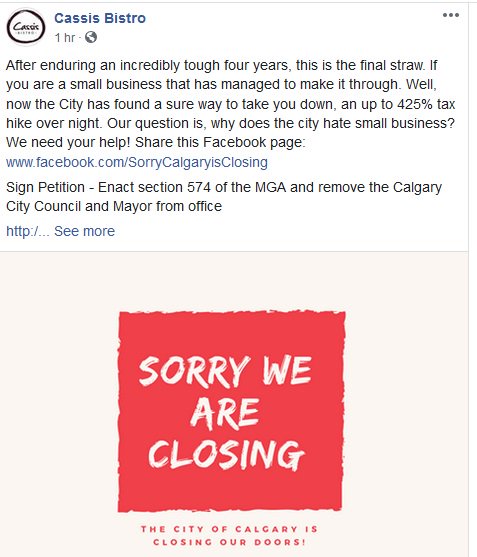

I guess this belongs here. Kinda sad, I liked Cassis Bistro

__________________

My name is Ozymandias, King of Kings;

Look on my Works, ye Mighty, and despair!

|

|

|

06-05-2019, 05:53 PM

06-05-2019, 05:53 PM

|

#224

|

|

Norm!

|

ok, as an add on they're not closing their doors yet, this is an awareness thing that they're getting hammered by a huge increase in their property tax.

__________________

My name is Ozymandias, King of Kings;

Look on my Works, ye Mighty, and despair!

|

|

|

06-05-2019, 07:24 PM

06-05-2019, 07:24 PM

|

#225

|

|

#1 Goaltender

|

Am I the only one who actually doubts they saw a 425% increase this year?

__________________

No, no…I’m not sloppy, or lazy. This is a sign of the boredom.

|

|

|

06-05-2019, 07:43 PM

06-05-2019, 07:43 PM

|

#226

|

|

Franchise Player

Join Date: Feb 2010

Location: Park Hyatt Tokyo

|

If the restaurant owns the property won’t the property tax still exist whether they’re open or closed?

|

|

|

06-05-2019, 08:09 PM

06-05-2019, 08:09 PM

|

#227

|

|

Scoring Winger

|

This is an example of how the media shades the truth. If you're on TIPPS which most people these days are, you pay monthly based on last year's taxes, and when the tax bill for this year is issued, your payments are adjusted accordingly. So if you paid 1500/mo for 6 months and your tax bill is $38,000 then you have to make up the difference in the remaining 6 months. It's not a 4.27x increase in taxes, it's a 4.27x increase in payments.

Likely last year's taxes were $18,000 so a big jump, but last year there would still have been a business tax bill which was fully eliminated this year. So a big increase but not as big as it looks.

|

|

|

|

The Following 2 Users Say Thank You to Smartcar For This Useful Post:

|

|

06-05-2019, 08:13 PM

06-05-2019, 08:13 PM

|

#228

|

|

Franchise Player

|

Quote:

Originally Posted by topfiverecords

If the restaurant owns the property won’t the property tax still exist whether they’re open or closed?

|

Many/most small businesses rent their premises, but typically pay rent on a "net lease" basis. So they pay the operating costs and taxes of the building, plus rent.

I believe the reason for that (which is different than residential rentals) is that lease terms are much longer. It would be hard for a property owner to sign a 20 year lease where they were responsible for taxes, because they could end up losing money.

If the restaurant is leased, the corporation that owns it could declare bankruptcy, which would get them out of paying the taxes going forward. The city will still get paid by the building owner, who will have to find a new tenant...

|

|

|

06-05-2019, 08:58 PM

06-05-2019, 08:58 PM

|

#229

|

|

Franchise Player

Join Date: Mar 2015

Location: Pickle Jar Lake

|

Quote:

Originally Posted by Smartcar

This is an example of how the media shades the truth. If you're on TIPPS which most people these days are, you pay monthly based on last year's taxes, and when the tax bill for this year is issued, your payments are adjusted accordingly. So if you paid 1500/mo for 6 months and your tax bill is $38,000 then you have to make up the difference in the remaining 6 months. It's not a 4.27x increase in taxes, it's a 4.27x increase in payments.

Likely last year's taxes were $18,000 so a big jump, but last year there would still have been a business tax bill which was fully eliminated this year. So a big increase but not as big as it looks.

|

Ya, I'm not sure why they don't synchronize it. It doesn't make sense for them to do it the way they do. Just have the TIPPS year start July 1, or whatever day the new tax rates come into effect. Having it need to retroactively re-claim back to January doesn't make much sense.

|

|

|

06-05-2019, 10:12 PM

06-05-2019, 10:12 PM

|

#230

|

|

Franchise Player

Join Date: Feb 2010

Location: Park Hyatt Tokyo

|

Quote:

Originally Posted by Fuzz

Ya, I'm not sure why they don't synchronize it. It doesn't make sense for them to do it the way they do. Just have the TIPPS year start July 1, or whatever day the new tax rates come into effect. Having it need to retroactively re-claim back to January doesn't make much sense.

|

Does it have something to do with the City’s annual budget? Calendar year?

|

|

|

06-05-2019, 11:45 PM

06-05-2019, 11:45 PM

|

#231

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Quote:

Originally Posted by Smartcar

This is an example of how the media shades the truth. If you're on TIPPS which most people these days are, you pay monthly based on last year's taxes, and when the tax bill for this year is issued, your payments are adjusted accordingly. So if you paid 1500/mo for 6 months and your tax bill is $38,000 then you have to make up the difference in the remaining 6 months. It's not a 4.27x increase in taxes, it's a 4.27x increase in payments.

Likely last year's taxes were $18,000 so a big jump, but last year there would still have been a business tax bill which was fully eliminated this year. So a big increase but not as big as it looks.

|

Yeah but really, regardless of whether they’re paying by TIPP or in a lump sum, it’s an enormous cost increase for a business to bear. Restaurants seem like they’ve been hit with one thing after another these last couple years. Wage increases, increased property taxes and at the same time people cutting back with the recession. Just a grim series of events.

(I think your math is a little off and the increase means they’re paying ~$38k in the last six months after $1500/month for the first six months?)

|

|

|

06-06-2019, 12:06 AM

06-06-2019, 12:06 AM

|

#232

|

|

Franchise Player

|

The business tax bill posted earlier in this thread shows the property tax for 2019 at that address to be $51,096.

Their payments were $3,222 for the first half of the year, so I think one could safely guess that their 2018 bill was around $38,664, maybe slightly less than that.

That's a 32% increase, which is tremendous.

I have a VERY hard time imagining a business could have gotten hit with a 400+% increase. I would love to see the actual tax bill for that business for the last two years.

|

|

|

06-06-2019, 09:38 AM

06-06-2019, 09:38 AM

|

#233

|

|

Franchise Player

|

Quote:

Originally Posted by malcolmk14

The business tax bill posted earlier in this thread shows the property tax for 2019 at that address to be $51,096.

Their payments were $3,222 for the first half of the year, so I think one could safely guess that their 2018 bill was around $38,664, maybe slightly less than that.

That's a 32% increase, which is tremendous.

I have a VERY hard time imagining a business could have gotten hit with a 400+% increase. I would love to see the actual tax bill for that business for the last two years.

|

One of the news articles had an example of one that had at least tripled. But a huge piece if that was a very large increase in assessed value.

|

|

|

06-06-2019, 10:02 AM

06-06-2019, 10:02 AM

|

#234

|

|

Franchise Player

|

It's not an isolated story or incident.

City Council has a spending problem. They just recently removed new job postings for "cycling" coordinators and "walking" coordinators with pay of $88,000 to $133,000 only after it got out to the media.

With the obvious economic and budget situation, it's ridiculous that such things are even being considered. If they're throwing money around for that garbage there is clearly tons of fat to cut when you are seeing businesses close up shop all around town.

|

|

|

06-06-2019, 10:06 AM

06-06-2019, 10:06 AM

|

#235

|

|

Franchise Player

|

Quote:

Originally Posted by bizaro86

One of the news articles had an example of one that had at least tripled. But a huge piece if that was a very large increase in assessed value.

|

Which is fine, if you no longer want to run your business and sell the property. If you can find a buyer.

__________________

Quote:

Originally Posted by MisterJoji

Johnny eats garbage and isn’t 100% committed.

|

|

|

|

06-06-2019, 10:09 AM

06-06-2019, 10:09 AM

|

#236

|

|

Franchise Player

Join Date: Mar 2015

Location: Pickle Jar Lake

|

I'm not sure why a "cycling coordinator" is a garbage job for a city of over a million people. People complain about poorly integrate cycle tracks, poor connections, bad spots for bike lanes etc, well I assume those items would be part of the job. I'd also assume they can bring experience form other jurisdiction and look at the research to find what works best.

We also have plenty of bad sidewalks and areas with no sidewalks. I'd assume a walking coordinator makes sure paths are in the right spots along desire lines, making sure crossing are in appropriate spots etc. The city is full of examples of poor decisions made in the past that are sill or non-sensicle, and had we had a person to ensure we are doing the right things, well it probably would save money fixing them. All little things than can improve safety and efficiency.

It's a minuscule amount of money compared to what is spent on interchanges every year. But apparently a great dog whistle.

|

|

|

|

The Following 8 Users Say Thank You to Fuzz For This Useful Post:

|

|

06-06-2019, 10:12 AM

06-06-2019, 10:12 AM

|

#237

|

|

Franchise Player

Join Date: Mar 2007

Location: Income Tax Central

|

Quote:

Originally Posted by Fuzz

I'm not sure why a "cycling coordinator" is a garbage job for a city of over a million people. People complain about poorly integrate cycle tracks, poor connections, bad spots for bike lanes etc, well I assume those items would be part of the job. I'd also assume they can bring experience form other jurisdiction and look at the research to find what works best.

We also have plenty of bad sidewalks and areas with no sidewalks. I'd assume a walking coordinator makes sure paths are in the right spots along desire lines, making sure crossing are in appropriate spots etc. The city is full of examples of poor decisions made in the past that are sill or non-sensicle, and had we had a person to ensure we are doing the right things, well it probably would save money fixing them. All little things than can improve safety and efficiency.

It's a minuscule amount of money compared to what is spent on interchanges every year. But apparently a great dog whistle.

|

I think you can probably find someone who already works for the City to tackle these Herculean tasks.

__________________

The Beatings Shall Continue Until Morale Improves!

This Post Has Been Distilled for the Eradication of Seemingly Incurable Sadness.

The World Ends when you're dead. Until then, you've got more punishment in store. - Flames Fans

If you thought this season would have a happy ending, you haven't been paying attention.

|

|

|

|

The Following 4 Users Say Thank You to Locke For This Useful Post:

|

|

06-06-2019, 10:22 AM

06-06-2019, 10:22 AM

|

#238

|

|

Franchise Player

|

Wasn't the beginning of this problem switching from a business value basis for taxing businesses to a property tax assessment basis? And then assessing the property value as if it were the highest and best use? Like someone renting a dumpster on 4th st sw would be charged as if the building were a high rise condo or office? So it almost laser focuses the dramatic increases to the small business community. It's amazing reading articles from 4 years ago when the writing was well inscribed to the wall. It's also amazing to see the extent our councilors will go to to keep their precious jobs.

|

|

|

06-06-2019, 10:27 AM

06-06-2019, 10:27 AM

|

#239

|

|

Franchise Player

Join Date: Mar 2007

Location: Income Tax Central

|

Quote:

Originally Posted by OMG!WTF!

Wasn't the beginning of this problem switching from a business value basis for taxing businesses to a property tax assessment basis? And then assessing the property value as if it were the highest and best use? Like someone renting a dumpster on 4th st sw would be charged as if the building were a high rise condo or office? So it almost laser focuses the dramatic increases to the small business community. It's amazing reading articles from 4 years ago when the writing was well inscribed to the wall. It's also amazing to see the extent our councilors will go to to keep their precious jobs.

|

Well they are pretty sweet jobs with great pay, perks and pensions.

The writing for this was certainly on the wall as soon as downtown turned into a ghost-town and the City lost its gravy train.

Hard decisions are going to have to be made.

__________________

The Beatings Shall Continue Until Morale Improves!

This Post Has Been Distilled for the Eradication of Seemingly Incurable Sadness.

The World Ends when you're dead. Until then, you've got more punishment in store. - Flames Fans

If you thought this season would have a happy ending, you haven't been paying attention.

|

|

|

|

The Following User Says Thank You to Locke For This Useful Post:

|

|

06-06-2019, 10:27 AM

06-06-2019, 10:27 AM

|

#240

|

|

Franchise Player

Join Date: Aug 2008

Location: California

|

Quote:

Originally Posted by OMG!WTF!

Wasn't the beginning of this problem switching from a business value basis for taxing businesses to a property tax assessment basis? And then assessing the property value as if it were the highest and best use? Like someone renting a dumpster on 4th st sw would be charged as if the building were a high rise condo or office? So it almost laser focuses the dramatic increases to the small business community. It's amazing reading articles from 4 years ago when the writing was well inscribed to the wall. It's also amazing to see the extent our councilors will go to to keep their precious jobs.

|

Best use taxation policy is good for long term city development. You want the dumpster on 4th to be developed into a Condo tower.

I agree this does have negative outcomes on businesses. I think getting rid of the business tax was the mistake.

The biggest problem though is our residential share of taxes is too low relative to other municipalities. Like most of the Alberta Advantage it was low taxes through prudent spending decisions it was low taxes do to O+G windfall.

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 05:38 PM.

|

|