02-22-2013, 09:04 PM

02-22-2013, 09:04 PM

|

#1

|

|

Lifetime Suspension

Join Date: Oct 2011

Location: Cool Ville

|

Anyone able to help with a finance question

Anyone able to help with a finance question

Hey guys,

I have an exam monday and cannot for the life of me figure out a particular question:

The question is: you own 2500 shares of RIM which are currently trading at $30, over a 3month period they can go up or down by 20%. Risk free rate is 6% per annum.

You cannot sell your shares for 6months.

You want to protect your investment from falling below $60,000. A bank will insure your investment for an upfront fee of $2000.

What would you do?

If someone can help guide me in the right direction I would really appreciate it.

Thanks,

What I know is that this is a binomial tree that has a low of 48,000. we will need to purchase put options to protect it. But how I don't know.

Last edited by HELPNEEDED; 02-22-2013 at 10:56 PM.

|

|

|

02-22-2013, 09:25 PM

02-22-2013, 09:25 PM

|

#2

|

|

RealtorŪ

Join Date: Feb 2009

Location: Calgary

|

|

|

|

|

The Following User Says Thank You to Travis Munroe For This Useful Post:

|

|

02-22-2013, 09:28 PM

02-22-2013, 09:28 PM

|

#3

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Well a 20% drop from 75k is 60k...so I guess you let it ride!

|

|

|

|

The Following User Says Thank You to Slava For This Useful Post:

|

|

02-22-2013, 09:31 PM

02-22-2013, 09:31 PM

|

#4

|

|

Retired

|

^ ^ Which can drop to 48000 over a 6 month period.

|

|

|

|

The Following User Says Thank You to CaramonLS For This Useful Post:

|

|

02-22-2013, 09:31 PM

02-22-2013, 09:31 PM

|

#5

|

|

Lifetime Suspension

Join Date: Oct 2011

Location: Cool Ville

|

Quote:

Originally Posted by Slava

Well a 20% drop from 75k is 60k...so I guess you let it ride!

|

But its 20% every 3months, so two periods so it can go as low as 48K, its a 2step binomial function

|

|

|

02-22-2013, 09:37 PM

02-22-2013, 09:37 PM

|

#6

|

|

Franchise Player

Join Date: Dec 2012

Location: On your last nerve...:D

|

Well, being a smartass that I am, my first question is why the hell I bought RIM stock in the first place. Just teasing.

Hope you get some excellent, non-smart-assy answers.

|

|

|

02-22-2013, 09:38 PM

02-22-2013, 09:38 PM

|

#7

|

|

Franchise Player

Join Date: Dec 2006

Location: Calgary, Alberta

|

Quote:

Originally Posted by CaramonLS

^ ^ Which can drop to 48000 over a 6 month period.

|

Quote:

Originally Posted by HELPNEEDED

But its 20% every 3months, so two periods so it can go as low as 48K, its a 2step binomial function

|

That sentence wasn't there originally (or I should've read closer!  )

Do you have values form the option premiums in the question?

|

|

|

02-22-2013, 09:51 PM

02-22-2013, 09:51 PM

|

#8

|

|

3 Wolves Short of 2 Millionth Post

|

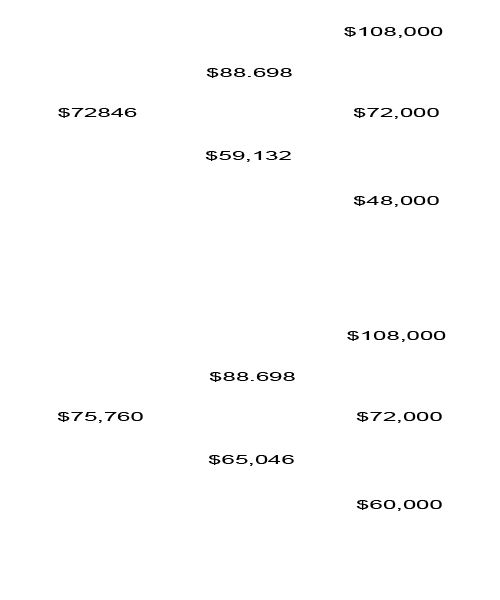

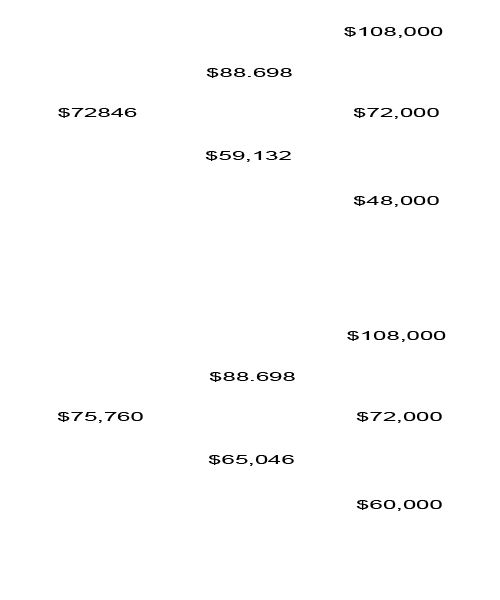

I'll take a shot at it:

So you're original value is 75,000

You're discount rate for 3 months would be = 1.06^(1/4) = 1.4673846%

Here are you're two binomial trees (the bottom one assumes you by the bank protection):

Since $75,760-$72,846 > $2000 (the cost of the bank protection) it would be beneficial for you to purchase the bank protection.

Last edited by wpgflamesfan; 02-22-2013 at 10:18 PM.

|

|

|

|

The Following User Says Thank You to wpgflamesfan For This Useful Post:

|

|

02-22-2013, 10:00 PM

02-22-2013, 10:00 PM

|

#9

|

|

3 Wolves Short of 2 Millionth Post

|

Nvm

Last edited by wpgflamesfan; 02-22-2013 at 10:19 PM.

|

|

|

|

The Following User Says Thank You to wpgflamesfan For This Useful Post:

|

|

02-22-2013, 10:14 PM

02-22-2013, 10:14 PM

|

#10

|

|

Lifetime Suspension

Join Date: Oct 2011

Location: Cool Ville

|

Quote:

Originally Posted by wpgflamesfan

Just realized I messed this up. I'll post a new solution shortly.

|

nvm your close and i'm wrong

sorry

Last edited by HELPNEEDED; 02-22-2013 at 10:16 PM.

|

|

|

02-22-2013, 10:22 PM

02-22-2013, 10:22 PM

|

#11

|

|

Lifetime Suspension

Join Date: Oct 2011

Location: Cool Ville

|

i've been reading the question wrong for 3-days FML

|

|

|

02-22-2013, 10:25 PM

02-22-2013, 10:25 PM

|

#12

|

|

Franchise Player

Join Date: Nov 2009

Location: Section 203

|

I like how there is a thread that has help needed by a poster named HELPNEEDED.

__________________

My thanks equals mod team endorsement of your post.

Quote:

Originally Posted by Bingo

Jesus this site these days

|

Quote:

Originally Posted by Barnet Flame

He just seemed like a very nice person. I loved Squiggy.

|

Quote:

Originally Posted by dissentowner

I should probably stop posting at this point

|

|

|

|

02-22-2013, 10:26 PM

02-22-2013, 10:26 PM

|

#13

|

|

3 Wolves Short of 2 Millionth Post

|

Quote:

Originally Posted by HELPNEEDED

i've been reading the question wrong for 3-days FML

|

Did I get it right with that last answer?

|

|

|

|

The Following User Says Thank You to wpgflamesfan For This Useful Post:

|

|

02-22-2013, 10:36 PM

02-22-2013, 10:36 PM

|

#14

|

|

Lifetime Suspension

Join Date: Oct 2011

Location: Cool Ville

|

Quote:

Originally Posted by wpgflamesfan

Did I get it right with that last answer?

|

no sir,

What you have to do is work to get the Call/Put option price first thats where the risk free is used using the RNV formula.

Next step I don't know yet. Will update once i get there.

|

|

|

02-22-2013, 10:45 PM

02-22-2013, 10:45 PM

|

#15

|

|

3 Wolves Short of 2 Millionth Post

|

Quote:

Originally Posted by HELPNEEDED

no sir,

What you have to do is work to get the Call/Put option price first thats where the risk free is used using the RNV formula.

Next step I don't know yet. Will update once i get there.

|

Ah ok, I read the "You want to protect your investment from falling below $60,000. A bank will give you a loan for the required insurance for an upfront fee of $2000" part wrong.

|

|

|

|

The Following User Says Thank You to wpgflamesfan For This Useful Post:

|

|

02-22-2013, 10:56 PM

02-22-2013, 10:56 PM

|

#16

|

|

Lifetime Suspension

Join Date: Oct 2011

Location: Cool Ville

|

Quote:

Originally Posted by wpgflamesfan

I'll take a shot at it:

So you're original value is 75,000

You're discount rate for 3 months would be = 1.06^(1/4) = 1.4673846%

Here are you're two binomial trees (the bottom one assumes you by the bank protection):

Since $75,760-$72,846 > $2000 (the cost of the bank protection) it would be beneficial for you to purchase the bank protection. |

I edited the question, sorry just the way i was reading it wrong the bank is willing to insure your investment for 2000.

Give me 10 minutes and I'll throw the answer up here.

|

|

|

02-22-2013, 11:08 PM

02-22-2013, 11:08 PM

|

#17

|

|

Lifetime Suspension

Join Date: Oct 2011

Location: Cool Ville

|

Ok, In this case, we do not worry about PV of the future price since it is all considered at the 6month point.

So.... from $30 it can goto Su = 36, Sd=24, Suu=43.2, Sud/Sdu=28.8 and Sdd=19.2

To guarantee $60000, stock price must be $24 since $24*2500=$60,000

There for your strike price on your put option must be K=24.

now the hard part...

we know in the UU UD/DU cases that P=0

only in the DD case Pdd=4.8

you use the RNV formula (if you want details let me know its balls to type out)

to calculate a Pd which will be 2.19

use RNV again to calculate Po=$1 so you need to purchase 2500 puts to protect your investment at a cost of 2500.....so the banks offer is great you take it.

Thanks for the help, you did get me on the right track, RTFQ

|

|

|

02-22-2013, 11:41 PM

02-22-2013, 11:41 PM

|

#18

|

|

3 Wolves Short of 2 Millionth Post

|

Quote:

Originally Posted by HELPNEEDED

Ok, In this case, we do not worry about PV of the future price since it is all considered at the 6month point.

So.... from $30 it can goto Su = 36, Sd=24, Suu=43.2, Sud/Sdu=28.8 and Sdd=19.2

To guarantee $60000, stock price must be $24 since $24*2500=$60,000

There for your strike price on your put option must be K=24.

now the hard part...

we know in the UU UD/DU cases that P=0

only in the DD case Pdd=4.8

you use the RNV formula (if you want details let me know its balls to type out)

to calculate a Pd which will be 2.19

use RNV again to calculate Po=$1 so you need to purchase 2500 puts to protect your investment at a cost of 2500.....so the banks offer is great you take it.

Thanks for the help, you did get me on the right track, RTFQ

|

Makes complete sense now. Been a while since I've touched option pricing. Can't wait for the derivatives section of the CFA Level 2 curriculum.

|

|

|

02-23-2013, 12:04 AM

02-23-2013, 12:04 AM

|

#19

|

|

Lifetime Suspension

|

If we're talking about BB at $30, I would forget the insurance and use the time machine you have access to and obtain a Grays Sports Almanac.

|

|

|

02-23-2013, 11:55 AM

02-23-2013, 11:55 AM

|

#20

|

|

Lifetime Suspension

Join Date: Oct 2011

Location: Cool Ville

|

Quote:

Originally Posted by wpgflamesfan

Makes complete sense now. Been a while since I've touched option pricing. Can't wait for the derivatives section of the CFA Level 2 curriculum.  |

I'll probably hit up the CFA after this suckers done or a PHd, undecided as of now.

Do you work in IB or some other finance related role>

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 10:05 AM.

|

|