06-15-2015, 11:21 AM

06-15-2015, 11:21 AM

|

#1

|

|

Franchise Player

Join Date: Feb 2010

Location: Calgary

|

Gas Prices

Gas Prices

Gas prices in Calgary are near their peak highs when oil was over $100 a barrel. Does anyone understand well the relationship between crude oil prices and gasoline retail prices at the pumps in Alberta? I do realize that wholesale prices of gasoline are set by refineries, which we do not have many, so there is a bit of an oligopoly. However; there was no announcements of any of them breaking down recently. There is no gasoline shortage. There is no increased demand. What is going on? I have no logical explanation of this other than price fixing. Am I wrong assuming that? I am genuinely curious.

__________________

"An idea is always a generalization, and generalization is a property of thinking. To generalize means to think." Georg Hegel

To generalize is to be an idiot. William Blake

|

|

|

06-15-2015, 11:30 AM

06-15-2015, 11:30 AM

|

#2

|

|

Franchise Player

Join Date: Mar 2007

Location: Calgary

|

CAD is about 20-25% less vs the USD than when oil was $100/barrel. I think that alone makes up the bulk of the difference.

|

|

|

06-15-2015, 11:33 AM

06-15-2015, 11:33 AM

|

#3

|

|

In Your MCP

Join Date: Apr 2004

Location: Watching Hot Dog Hans

|

Yeah I'm no conspiracy theorist, but I sure was annoyed to see $1.15/l at the pump today. WTF indeed.

Maybe the NDP is onto something by building refineries here. Sure my taxes go up, but at least then I can fool myself into thinking they're doing a great job when I fill up on the cheap.

|

|

|

06-15-2015, 11:39 AM

06-15-2015, 11:39 AM

|

#4

|

|

Powerplay Quarterback

|

Quote:

Originally Posted by Tron_fdc

Yeah I'm no conspiracy theorist, but I sure was annoyed to see $1.15/l at the pump today. WTF indeed.

Maybe the NDP is onto something by building refineries here. Sure my taxes go up, but at least then I can fool myself into thinking they're doing a great job when I fill up on the cheap.

|

Building another refinery here won't really do too much. Oil and refined gasoline are still global commodities that are bought and sold in USD and Canada is already a net exporter.

And NWR is already under construction, no NDP involvement in that idea at all.

|

|

|

06-15-2015, 11:39 AM

06-15-2015, 11:39 AM

|

#5

|

|

Franchise Player

Join Date: Jul 2005

Location: 555 Saddledome Rise SE

|

It's a few different factors.

For one, some major US midwest refineries have had issues over the past couple months. Since prices around North America are fairly well connected by established differentials, when a major producing region like Illinois has supply issues it ripples across the entire North American market.

Here's a pretty good Edmonton Journal article on the subject from late May.

http://www.edmontonjournal.com/Blame...656/story.html

The dollar also doesn't help at all. A 1.25 exchange rate eats up a big chunk of the differential between WTI in USD and gas prices in CAD.

|

|

|

06-15-2015, 11:40 AM

06-15-2015, 11:40 AM

|

#6

|

|

Franchise Player

Join Date: Mar 2012

Location: Sylvan Lake

|

Quote:

Originally Posted by undercoverbrother

The up and down price of gas during a time that the O&G industry is meant to be taking it in ther pooper.

$114.9/L a $0.10 jump last night.

|

I feel ya Brah!!

|

|

|

06-15-2015, 11:40 AM

06-15-2015, 11:40 AM

|

#7

|

|

Franchise Player

Join Date: Feb 2010

Location: Calgary

|

Quote:

Originally Posted by burn_this_city

CAD is about 20-25% less vs the USD than when oil was $100/barrel. I think that alone makes up the bulk of the difference.

|

Not sure I agree. Alberta oil companies pay their costs in $CDN and receive revenues in $US. This is a 20-30% net gain situation for them. Alberta refineries work for $CDN and sell most of the refined product here for $CDN. Net zero effect.

__________________

"An idea is always a generalization, and generalization is a property of thinking. To generalize means to think." Georg Hegel

To generalize is to be an idiot. William Blake

Last edited by CaptainYooh; 06-15-2015 at 11:42 AM.

|

|

|

06-15-2015, 11:44 AM

06-15-2015, 11:44 AM

|

#8

|

|

In Your MCP

Join Date: Apr 2004

Location: Watching Hot Dog Hans

|

Quote:

Originally Posted by llwhiteoutll

Building another refinery here won't really do too much. Oil and refined gasoline are still global commodities that are bought and sold in USD and Canada is already a net exporter.

And NWR is already under construction, no NDP involvement in that idea at all.

|

Well what we need is an energy program. One that sets the price that refineries can sell gasoline to Albertans at. We build the refineries, control production, and dictate the price they sell for.

|

|

|

06-15-2015, 11:45 AM

06-15-2015, 11:45 AM

|

#9

|

|

Scoring Winger

Join Date: Jul 2009

Location: Bowness

|

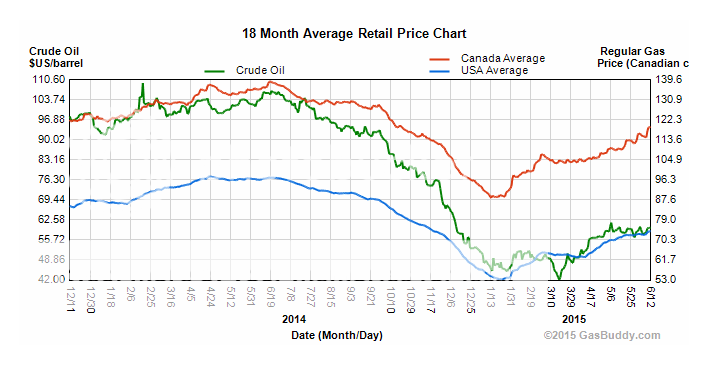

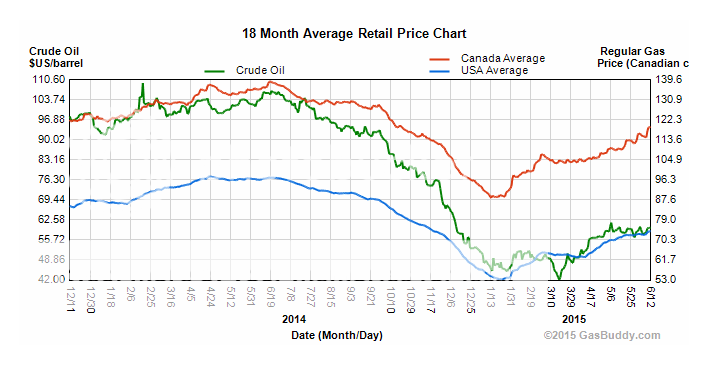

I generated this chart from: http://www.gasbuddy.com/Charts

It shows that the gasoline price in the US and the price in Canada are tracking pretty much 1:1, and that the gasoline price does reflect the Oil price, though not perfectly. Part of the story is that there are fixed costs (taxes, refineries, retail) plus the variable cost, and part of the story here is that oil is priced in US dollars and we pay for gas in Canadian dollars and we've had a significant currency depreciation since the price was high.

The rest of the answer is there is typically a bit of a tighter market for gas in June because the refinery maintenance season just passed and the summer driving season is coming soon. This chart shows that for it to be price fixing, it would have to be across all of Canada and the US, which is pretty hard to imagine.

Usually prices drop in the fall and they will again, all things being equal.

|

|

|

|

The Following 3 Users Say Thank You to Bownesian For This Useful Post:

|

|

06-15-2015, 11:46 AM

06-15-2015, 11:46 AM

|

#10

|

|

In the Sin Bin

|

There are 4 refineries across Canada in turnaround or shut down.

Shell was having issues two weeks ago which put their customers in the west (i.e. fuel distributors) into Allocation (simply meaning they could only buy however much fuel Shell told them). I believe there are also similar allocations going on in the East right now.

Simply put: Low supply, High summer time demand.

There's no conspiracy. Gas stations are the most scrutinized and most often complained about industry that the competition bureau deals with and it's extremely rare that any of these complaints have any validity.

|

|

|

|

The Following User Says Thank You to polak For This Useful Post:

|

|

06-15-2015, 11:48 AM

06-15-2015, 11:48 AM

|

#11

|

|

First Line Centre

Join Date: Oct 2011

Location: Winchestertonfieldville Jail

|

6 months ago I was paying ~1.30 for Diesel on my VW, paying 15 cents more per litre than PREMIUM! Now the tides have turned  Sitting pretty at 95.9 on avg for a while now

|

|

|

06-15-2015, 11:51 AM

06-15-2015, 11:51 AM

|

#12

|

|

First Line Centre

Join Date: Apr 2006

Location: Calgary

|

Quote:

Originally Posted by Bownesian

I generated this chart from: http://www.gasbuddy.com/Charts

It shows that the gasoline price in the US and the price in Canada are tracking pretty much 1:1, and that the gasoline price does reflect the Oil price, though not perfectly. Part of the story is that there are fixed costs (taxes, refineries, retail) plus the variable cost, and part of the story here is that oil is priced in US dollars and we pay for gas in Canadian dollars and we've had a significant currency depreciation since the price was high.

The rest of the answer is there is typically a bit of a tighter market for gas in June because the refinery maintenance season just passed and the summer driving season is coming soon. This chart shows that for it to be price fixing, it would have to be across all of Canada and the US, which is pretty hard to imagine.

Usually prices drop in the fall and they will again, all things being equal. |

That picture really makes it clear that someone upstream of the actual gas stations is screwing us, and I really don't know enough to know who.

The refiners probably?

|

|

|

06-15-2015, 11:54 AM

06-15-2015, 11:54 AM

|

#13

|

|

Scoring Winger

Join Date: Jul 2009

Location: Bowness

|

Another contributing factor that may be working against us locally is that the differential between Western Canada Select and WTI has dropped ~15$ over the time we are looking at as well, so our local oil is more expensive relative to the WTI price than it was 8 months ago:

http://economicdashboard.albertacanada.com/EnergyPrice

|

|

|

06-15-2015, 12:00 PM

06-15-2015, 12:00 PM

|

#14

|

|

Franchise Player

Join Date: Feb 2010

Location: Calgary

|

Quote:

Originally Posted by Bownesian

Another contributing factor that may be working against us locally is that the differential between Western Canada Select and WTI has dropped ~15$ over the time we are looking at as well, so our local oil is more expensive relative to the WTI price than it was 8 months ago:

http://economicdashboard.albertacanada.com/EnergyPrice |

Since you have the data for the chart, would it be too much trouble to add $CDN/$US exchange rate on top of the one you've got?

__________________

"An idea is always a generalization, and generalization is a property of thinking. To generalize means to think." Georg Hegel

To generalize is to be an idiot. William Blake

|

|

|

06-15-2015, 12:00 PM

06-15-2015, 12:00 PM

|

#15

|

|

In the Sin Bin

|

Quote:

Originally Posted by Regorium

That picture really makes it clear that someone upstream of the actual gas stations is screwing us, and I really don't know enough to know who.

The refiners probably?

|

Refiners (Main ones being IOL, Shell and Suncor) set their price. Distributors then add their margin. This margin is ever shrinking as competition for retail business increases cause commercial business is being destroyed by the low oil prices.

Regular gas is selling for 76.9 cents at the racks (refinery) in Calgary today. Vancouver is paying 83 cents so we don't even have it that bad!

|

|

|

06-15-2015, 12:04 PM

06-15-2015, 12:04 PM

|

#16

|

|

Franchise Player

|

funny how there always seem to be some chke point in the whole supply chain that keeps the price high. it is like each particpant in the chain takes a tunr in jacking up thier portion......

__________________

If I do not come back avenge my death

|

|

|

|

The Following 3 Users Say Thank You to Northendzone For This Useful Post:

|

|

06-15-2015, 12:06 PM

06-15-2015, 12:06 PM

|

#17

|

|

Powerplay Quarterback

|

Quote:

Originally Posted by Regorium

That picture really makes it clear that someone upstream of the actual gas stations is screwing us, and I really don't know enough to know who.

The refiners probably?

|

The government also plays a role here. Taxes on gas are higher in Canada than in the US.

|

|

|

06-15-2015, 12:11 PM

06-15-2015, 12:11 PM

|

#18

|

|

In the Sin Bin

|

Quote:

Originally Posted by Northendzone

funny how there always seem to be some chke point in the whole supply chain that keeps the price high. it is like each particpant in the chain takes a tunr in jacking up thier portion......

|

Companies that store inventory (Fuel in tanks) lost ALOT of money when Oil tanked so quickly so they're understandably weary of inventory.

|

|

|

06-15-2015, 12:17 PM

06-15-2015, 12:17 PM

|

#19

|

|

Scoring Winger

Join Date: Jul 2009

Location: Bowness

|

Quote:

Originally Posted by CaptainYooh

Since you have the data for the chart, would it be too much trouble to add $CDN/$US exchange rate on top of the one you've got?

|

I don't have the data, I generated the charts from http://www.gasbuddy.com/Charts

One CAD:USD comparison chart you might look at is here (change the date range to 1 year):

http://www.bloomberg.com/quote/CADUSD:CUR

The CAD has dropped from ~0.93 US in July last year to ~0.81 US now. That dollar depreciation results in a 15% increase in the costs we pay.

I really think (and umpteen studies have proven) that there is no conspiracy.

|

|

|

06-15-2015, 12:43 PM

06-15-2015, 12:43 PM

|

#20

|

|

Franchise Player

Join Date: Feb 2010

Location: Calgary

|

Quote:

Originally Posted by Bownesian

...

The CAD has dropped from ~0.93 US in July last year to ~0.81 US now. That dollar depreciation results in a 15% increase in the costs we pay...

|

How does it increase the costs we pay? All costs of oil extracted in Alberta is paid in $CDN (except for some US-imported equipment, perhaps), delivered to Alberta refineries via Canadian carriers for $CDN, refined for $CDN and retailed by Alberta retailers for $CDN. The net cost of gasoline delivered to an Alberta pump is $US-neutral and, more importantly, significantly lower than the cost of gasoline delivered to rural BC, for example. Therefore, it is not unreasonable to assume that it can be sold for less than some hypothetical world market price or, similarly, some hypothetical North American market price without affecting profitability of the Alberta gasoline supply chain. Yes, theoretically, even if they can sell finished product (gasoline) for more somewhere else in North America if the market price there is higher than here. But it does not automatically mean that it would cost them the same to deliver it there. This is a disconnect in a logic that I have a hard time justifying.

__________________

"An idea is always a generalization, and generalization is a property of thinking. To generalize means to think." Georg Hegel

To generalize is to be an idiot. William Blake

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 08:19 PM.

|

|