08-15-2011, 12:09 PM

08-15-2011, 12:09 PM

|

#1

|

|

wins 10 internets

Join Date: Feb 2006

Location: slightly to the left

|

Warren Buffet calls for higher taxes on the rich

Warren Buffet calls for higher taxes on the rich

http://www.nytimes.com/2011/08/15/op...&smid=fb-share

Quote:

Back in the 1980s and 1990s, tax rates for the rich were far higher, and my percentage rate was in the middle of the pack. According to a theory I sometimes hear, I should have thrown a fit and refused to invest because of the elevated tax rates on capital gains and dividends.

I didn’t refuse, nor did others. I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9 percent in 1976-77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off. And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation.

|

the US and the world need more billionaires with his level of thinking

|

|

|

|

The Following 27 Users Say Thank You to Hemi-Cuda For This Useful Post:

|

anyonebutedmonton,

bubbsy,

burn_this_city,

cal_guy,

Delthefunky,

Dion,

flamesrule_kipper34,

Frank MetaMusil,

gallione11,

icarus,

Jedi Ninja,

kirant,

Mazrim,

pepper24,

Rathji,

Red Ice Player,

RedJester,

saskflames69,

seattleflamer,

SeeBass,

Shasta Beast,

Sliver,

squiggs96,

Sr. Mints,

Table 5,

topfiverecords,

Traditional_Ale

|

08-15-2011, 01:53 PM

08-15-2011, 01:53 PM

|

#2

|

|

Franchise Player

|

You have to look at tax rates in comparison to the areas/countries you are competing with.

You can raise tax rates all you want but eventually you will get to the point where it is beneficial for the investor to put their money in a different location that offers more benefit. I'm not saying they are at that point I'm just saying that you need to be competitive with tax rates in other states/provinces/countries.

|

|

|

08-15-2011, 10:53 PM

08-15-2011, 10:53 PM

|

#3

|

|

First Line Centre

|

Quote:

Originally Posted by Jacks

You have to look at tax rates in comparison to the areas/countries you are competing with.

You can raise tax rates all you want but eventually you will get to the point where it is beneficial for the investor to put their money in a different location that offers more benefit. I'm not saying they are at that point I'm just saying that you need to be competitive with tax rates in other states/provinces/countries.

|

I can't believe your incredibly wise comment never occurred to billionaire Warren Buffett. What is he thinking?!?

|

|

|

08-15-2011, 11:01 PM

08-15-2011, 11:01 PM

|

#4

|

|

Franchise Player

Join Date: Dec 2007

Location: CGY

|

If they gave their money away now, rather than after death, then the recession is over tomorrow.

__________________

So far, this is the oldest I've been.

|

|

|

08-15-2011, 11:49 PM

08-15-2011, 11:49 PM

|

#6

|

|

Franchise Player

|

Quote:

Originally Posted by longsuffering

I can't believe your incredibly wise comment never occurred to billionaire Warren Buffett. What is he thinking?!?

|

If you have nothing to add then feel free to take a hike.

|

|

|

|

The Following 2 Users Say Thank You to Jacks For This Useful Post:

|

|

08-16-2011, 01:12 AM

08-16-2011, 01:12 AM

|

#7

|

|

Franchise Player

Join Date: Aug 2008

Location: California

|

If he really wants higher taxes for the rich he should start paying more in taxes than he legally has to. There is no requirement that you can't pay more.

If the liberal rich volunteered to pay more than required they would be more credible when wanting others to pay more

|

|

|

08-16-2011, 03:20 AM

08-16-2011, 03:20 AM

|

#8

|

|

God of Hating Twitter

|

Quote:

Originally Posted by GGG

If he really wants higher taxes for the rich he should start paying more in taxes than he legally has to. There is no requirement that you can't pay more.

If the liberal rich volunteered to pay more than required they would be more credible when wanting others to pay more

|

Seriously? 1 rich guy gives away his money to government instead of trying to get all of his fellow rich friends to all pay. You don't see the difference?

I'd rather he continue to push for it while using his money as he see's fit, considering how much he gives to charity and will give 95% of his wealth away when he dies.

__________________

Allskonar fyrir Aumingja!!

|

|

|

|

The Following 4 Users Say Thank You to Thor For This Useful Post:

|

|

08-16-2011, 03:48 AM

08-16-2011, 03:48 AM

|

#9

|

|

Franchise Player

|

Quote:

Originally Posted by fotze

I think when the ultra-rich said that raising taxes will reduce employment. They must have thought "wait? They actually bought that bullshat?"

|

|

|

|

08-16-2011, 04:05 AM

08-16-2011, 04:05 AM

|

#10

|

|

Franchise Player

Join Date: Jan 2010

Location: east van

|

Quote:

Originally Posted by Jacks

You have to look at tax rates in comparison to the areas/countries you are competing with.

You can raise tax rates all you want but eventually you will get to the point where it is beneficial for the investor to put their money in a different location that offers more benefit. I'm not saying they are at that point I'm just saying that you need to be competitive with tax rates in other states/provinces/countries.

|

Taxes are only one part of the equation, raising taxes to pay for infrastructure such as health care, security roads etc will tend to reduce a company's cost, as if the goverment arnt paying for it then the companies will have to, and so still make it profitable to invest, also a market for the product is neccersary.

Africa has very low taxes, but also no infrastructure or market to sell in.

Germany has high taxes, but is a stable country with a good market to sell goods in and a large pool of highly skilled workers, it is doing very well in comparison with the US.

|

|

|

08-16-2011, 08:53 AM

08-16-2011, 08:53 AM

|

#11

|

|

CP Pontiff

Join Date: Oct 2001

Location: A pasture out by Millarville

|

Nice of him to offer OPM - Other People's Money - to the cause. Would it make any difference? This author says no.

. . . . . doubling the tax rate on Mr. Buffett’s fellow billionaires, America’s 400 wealthiest households, would raise enough money to run the federal government for only two days.

and

The federal system is not regressive (making the poor pay relatively more than the rich). The top 1 per cent of U.S. taxpayers pay 23.2 per cent of their income in taxes, nearly double the proportion of all Americans. At the bottom, nearly half of Americans pay no net tax.

http://www.theglobeandmail.com/repor...rticle2130834/

Quote:

|

I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9 percent in 1976-77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off. And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation.

|

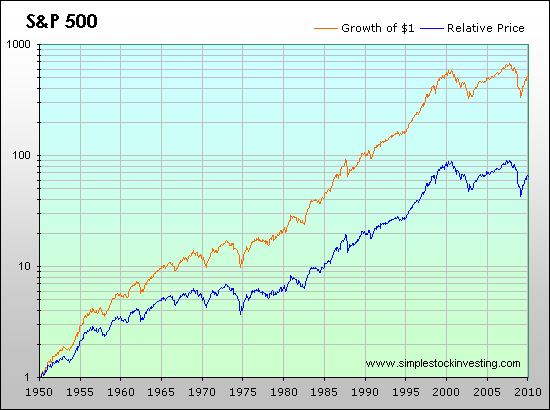

Mmmmmmm . . . . . the S & P 500 was about 92 in 1976 and its about 1,200 as an index today. Would it be at that level if capital gains rates were still 39.9%? One could easily argue it wouldn't be . . . . .

The fact the S&P 500 is at 1,200 has created wealth for the common man as well as the super wealthy. Stock ownership in Canada and the USA was probably less than 20% of the population in the 1970's and would be between 50% and 60% today, including mutual funds.

For the record, I think Americans should pay more in taxes. They need more taxpayers though, not necessarily more taxes on a select group.

Cowperson

__________________

Dear Lord, help me to be the kind of person my dog thinks I am. - Anonymous

|

|

|

|

The Following 6 Users Say Thank You to Cowperson For This Useful Post:

|

|

08-16-2011, 09:27 AM

08-16-2011, 09:27 AM

|

#12

|

|

Franchise Player

Join Date: Jun 2008

Location: Calgary

|

Buffett is a jerk.  I was just going to post the same thing as Cow (but less eloquently). It's nice of him to offer other people's money, when he is almost dead and has more money than he knows what do with. I don't recall him making this offer 30 years ago.

This "rich taxation" issue is a red herring. The problem, as mentioned, is that half of the people pay no taxes. I find it perverse that 50% pay tax, but 67% own their own homes - there is a disconnect there, and, I suggest, an indicator of a problem. Presumably, if you are too poor to pay tax, you shouldn't be able to get a mortgage. Conversely, if you are well off enough to own a home, you should be able to pay a bit of tax.

|

|

|

08-16-2011, 09:35 AM

08-16-2011, 09:35 AM

|

#13

|

|

Franchise Player

Join Date: Feb 2006

Location: Calgary AB

|

Quote:

Originally Posted by VladtheImpaler

This "rich taxation" issue is a red herring. The problem, as mentioned, is that half of the people pay no taxes. I find it perverse that 50% pay tax, but 67% own their own homes - there is a disconnect there, and, I suggest, an indicator of a problem. Presumably, if you are too poor to pay tax, you shouldn't be able to get a mortgage. Conversely, if you are well off enough to own a home, you should be able to pay a bit of tax.

|

The red herring is that a good chunk of that 67% just rent money to own a home in place of renting a home.

|

|

|

|

The Following User Says Thank You to Cowboy89 For This Useful Post:

|

|

08-16-2011, 09:35 AM

08-16-2011, 09:35 AM

|

#14

|

|

Franchise Player

Join Date: Nov 2006

Location: Supporting Urban Sprawl

|

Quote:

Originally Posted by VladtheImpaler

Buffett is a jerk.  I was just going to post the same thing as Cow (but less eloquently). It's nice of him to offer other people's money, when he is almost dead and has more money than he knows what do with. I don't recall him making this offer 30 years ago.

This "rich taxation" issue is a red herring. The problem, as mentioned, is that half of the people pay no taxes. I find it perverse that 50% pay tax, but 67% own their own homes - there is a disconnect there, and, I suggest, an indicator of a problem. Presumably, if you are too poor to pay tax, you shouldn't be able to get a mortgage. Conversely, if you are well off enough to own a home, you should be able to pay a bit of tax. |

While I don't disagree.

Their ability to own their home could be dependent upon them not paying taxes. How many people would you essentially be throwing out on the street if you mad them pay taxes, because they bought their house when they didnt pay.

__________________

"Wake up, Luigi! The only time plumbers sleep on the job is when we're working by the hour."

|

|

|

08-16-2011, 09:48 AM

08-16-2011, 09:48 AM

|

#15

|

|

Franchise Player

Join Date: Mar 2007

Location: Income Tax Central

|

Quote:

Originally Posted by Rathji

While I don't disagree.

Their ability to own their home could be dependent upon them not paying taxes. How many people would you essentially be throwing out on the street if you mad them pay taxes, because they bought their house when they didnt pay.

|

This is also an important distinction though. If you buy a house but you buy it just on the absolute edge of affordability then perhaps that purchase was unwise.

Taxes are a fact of life, if you're making a major life changing purchase and the affordability measure basically stipulates that you just cant handle any additional expense of any kind, let alone taxes then you're probably not financially ready for that house.

What happens when property taxes increase?

I agree with Buffet personally, but there has to be more to it. Taxing the rich more reasonably is something thats been thrown around for a long time. Most people just assume that everytime its even thought of thousands of highly paid lobbyists swarm DC and kill the very notion.

Like was said before, increased taxes on the rich would run the country for two days. Well, maybe the Government has to have a serious look at trimming some of the fat.

__________________

The Beatings Shall Continue Until Morale Improves!

This Post Has Been Distilled for the Eradication of Seemingly Incurable Sadness.

The World Ends when you're dead. Until then, you've got more punishment in store. - Flames Fans

If you thought this season would have a happy ending, you haven't been paying attention.

|

|

|

08-16-2011, 09:48 AM

08-16-2011, 09:48 AM

|

#16

|

|

Franchise Player

Join Date: Aug 2004

Location: Moscow, ID

|

http://www.economist.com/blogs/democ...7/tax-fairness

Quote:

|

Sometimes, the line is incorrectly adumbrated to a claim that half of Americans pay no taxes, which isn't true; all Americans pay some mix of payroll taxes, state taxes, capital-gains taxes, sales taxes and so forth.

|

Quote:

|

How poor would you be if you were too poor to pay federal income tax, strictly on the basis of your income and the standard deductions? Basically, you'd be making less than $20,000 a year, though you've still got a small chance of qualifying if you make under $40,000 and have some kids.

|

What most people who say increase the tax base fail to realize is how poor many Americans are. There's a huge level of poverty and the biggest reason so many people pay no income tax is there's not much to tax. Not to mention, all Americans are taxed in some way as the Economist article says.

The wealth disparity in the United States has been growing rapidly and the uber-rich have horded more and more of the wealth. This isn't at all up for debate as it's clear in the numbers the extremely rich have seen their net worth explode while the middle class has seen its stagnate over the last 20 years.

I'm for phasing out all of the Bush tax cuts, but I also think that the people who are making over a million a year should pay more on top of that. Poor people need the money and the US economy needs the poor people to keep their money so they can spend it in the economy. The rich will be as well off if they are taxed some more on their income over a million as they were before.

__________________

As you can see, I'm completely ridiculous.

|

|

|

08-16-2011, 09:53 AM

08-16-2011, 09:53 AM

|

#17

|

|

Unfrozen Caveman Lawyer

Join Date: Oct 2002

Location: Crowsnest Pass

|

Nouriel Roubini, Ex-Clinton Adviser And Economics Guru

http://www.huffingtonpost.ca/2011/08..._n_927095.html

"Karl Marx had it right. At some point, capitalism can self-destroy itself."

|

|

|

|

The Following User Says Thank You to troutman For This Useful Post:

|

|

08-16-2011, 09:55 AM

08-16-2011, 09:55 AM

|

#18

|

|

Franchise Player

Join Date: Jun 2008

Location: Calgary

|

Quote:

Originally Posted by Cowboy89

The red herring is that a good chunk of that 67% just rent money to own a home in place of renting a home.

|

Right - I am saying that's an indication of a problem. You can look at it either way - too many people own homes or too few pay taxes. Or both.

|

|

|

08-16-2011, 09:59 AM

08-16-2011, 09:59 AM

|

#19

|

|

Powerplay Quarterback

Join Date: Aug 2002

Location: Mayor of McKenzie Towne

|

Quote:

Originally Posted by Cowperson

Nice of him to offer OPM - Other People's Money - to the cause. Would it make any difference? This author says no.

. . . . . doubling the tax rate on Mr. Buffett’s fellow billionaires, America’s 400 wealthiest households, would raise enough money to run the federal government for only two days.

|

Buffet's solution wasn't to double the taxes on the richest 400 households however.

Quote:

Originally Posted by Cowperson

Mmmmmmm . . . . . the S & P 500 was about 92 in 1976 and its about 1,200 as an index today. Would it be at that level if capital gains rates were still 39.9%? One could easily argue it wouldn't be . . . . .

|

The S&P had negative returns over the 2000 - 2010 period. Could an equally effective argument be made that the returns would've been better had the rates been back at 39.9%?

Also, the returns over the 30 years from 1950 - 1980 are still robust, and not nearly so volatile as the returns from 1980 - 2010. The important difference is that real average incomes increased far greater for the average American in the earlier period and increased far greater for wealthier americans in the latter. Which leads to a healthier nation?

Quote:

Originally Posted by Cowperson

The fact the S&P 500 is at 1,200 has created wealth for the common man as well as the super wealthy. Stock ownership in Canada and the USA was probably less than 20% of the population in the 1970's and would be between 50% and 60% today, including mutual funds.

Cowperson

|

I would disagree that this has lead to increased wealth for the common man as the track record of capital gains for the average retail investor is abysmal.

Opening up of the capital markets to the common man has only created wealth for the brokerages (and I work at one). Prior to this, the common man received the benefit of the markets through defined benefit pensions.

Quote:

Originally Posted by VladtheImpaler

Buffett is a jerk.  I was just going to post the same thing as Cow (but less eloquently). It's nice of him to offer other people's money, when he is almost dead and has more money than he knows what do with. I don't recall him making this offer 30 years ago. |

He didn't need to 30 years ago because the tax system was much different then than it is today.

In Mr. Buffet's opinion the changes made since then have been far more beneficial to the wealthy (as they have the lobbying power) than it has been for the 'common man'.

__________________

"Teach a man to reason, and he'll think for a lifetime"

~P^2

Last edited by firebug; 08-16-2011 at 10:10 AM.

|

|

|

|

The Following 21 Users Say Thank You to firebug For This Useful Post:

|

Bill Bumface,

BlackEleven,

Flames Fan, Ph.D.,

Flamezzz,

fotze,

ikaris,

joe_who,

jtfrogger,

MarchHare,

Mazrim,

onetwo_threefour,

pepper24,

Phanuthier,

QuadCityImages,

redforever,

Shasta Beast,

smoothpops,

Table 5,

Thor,

troutman,

woob

|

08-16-2011, 10:13 AM

08-16-2011, 10:13 AM

|

#20

|

|

Franchise Player

Join Date: Oct 2001

Location: Ontario

|

Couple of things:

- Even though Buffet's tax rate was lower than most at 17%, he still paid ~$7 million in taxes. Still a very sizable chunk.

"Last year my federal tax bill — the income tax I paid, as well as payroll taxes paid by me and on my behalf — was $6,938,744. That sounds like a lot of money. But what I paid was only 17.4 percent of my taxable income — and that’s actually a lower percentage than was paid by any of the other 20 people in our office. Their tax burdens ranged from 33 percent to 41 percent and averaged 36 percent. "

- Tax rates is a small part of the equation when figuring out where to work. Salary is a much more important factor, and a main reason why manufacturing is done in China instead of Canada/US. Heck, my business moved my location from Alberta to Ontario so they wouldn't have to compete with the Oil industry.

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 06:44 AM.

|

|