Quote:

Originally Posted by hulkrogan

Stacey, you are bad at math.

A 3.9% for another 5 years is worse than breaking his current mortgage and signing a new 5 year fixed, so to suggest that is a good idea shows you should stop posting in this thread.

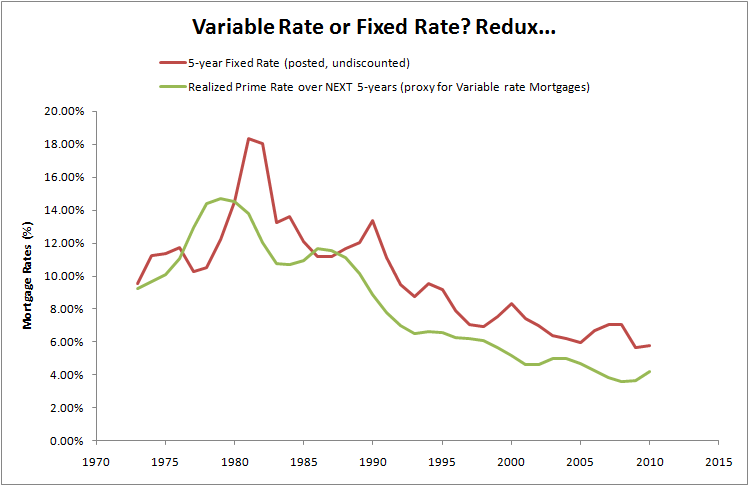

There has been one brief period where fixed has been better, and one very brief blip after that. If you were going on 5 year fixed mortgages during this you might have hit one of these times, but they were less than 5 year windows, so you might have hit none of them. Variable terms are cheaper 89% of the time in Canadian history. If you are going to go 5 year fixed over the life of your mortgage, if that is 4 terms or more (20 years or more to pay back the mortgage) there is not once in Canadian history where you would save money with the fixed.

So have fun spending $60,000+ on your "peace of mind" for that 11% chance.

|

Basically, you argument breaks down into rates have been falling for the last 30 years (except for when they went up), so we should bank on that and always get a variable rate.

When rates are rising, fixed is better. I know there has only been one period in the last 35 years where that has happened, but now rates are at an all time low and really have nowhere to go but up.

The thing is, that the spread between variable and fixed rates is quite significant right now, as banks are accomodating for the fact rates will go up. The people at the banks setting the rates are a lot more knowledgable than anyone here. So at any given time, it should, in theory, be a coin flip between variable and fixed. Except when banks are in a pricing war and offering 2.99% fixed...then I'd definitely go fixed.