Quote:

Originally Posted by stacey

This is what he said "I am two years into a 5 year fixed at 3.9%. My lender has offered to renew for another 5 years at the same rate of 3.9%. No fees or anything. "

I'm sure you'll pay RubberDuck's mortage if rates get jacked eh?

I honestly don't think arguing about half a percent is being "bent over" for the piece of mind a locked in low rate brings.

Your right you can't predict rates, and I would never ask your advice

Why don't you ask the people who had mortages in the 80's "every time"

|

Stacey, you are bad at math.

A 3.9% for another 5 years is worse than breaking his current mortgage and signing a new 5 year fixed, so to suggest that is a good idea shows you should stop posting in this thread.

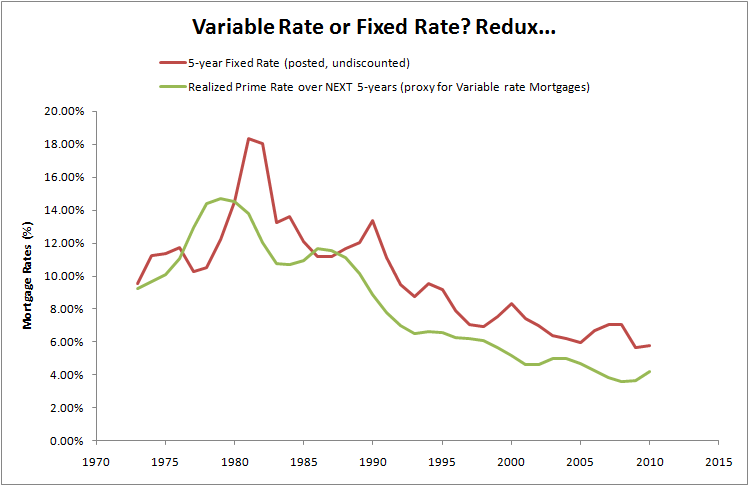

There has been one brief period where fixed has been better, and one very brief blip after that. If you were going on 5 year fixed mortgages during this you might have hit one of these times, but they were less than 5 year windows, so you might have hit none of them. Variable terms are cheaper 89% of the time in Canadian history. If you are going to go 5 year fixed over the life of your mortgage, if that is 4 terms or more (20 years or more to pay back the mortgage) there is not once in Canadian history where you would save money with the fixed.

So have fun spending $60,000+ on your "peace of mind" for that 11% chance.