Is that why every other G7 country does it except Canada? Because it's ineffective? That sounds more like a Frasier Institute talking point than reality.

https://theconversation.com/should-c...nce-tax-102324

https://theconversation.com/should-c...nce-tax-102324

You should also re-read my posts, because you are attacking a point I'm not making. I've already said I don't expect all millennials to support it, I'm saying the demographics and actual number of recipients are a subset of millennials, and they don't represent a majority. I can't find any numbers to support or discredit this, so perhaps I'm wrong on that. But I'm not saying those set to receive large inheritance would vote against their own interests.

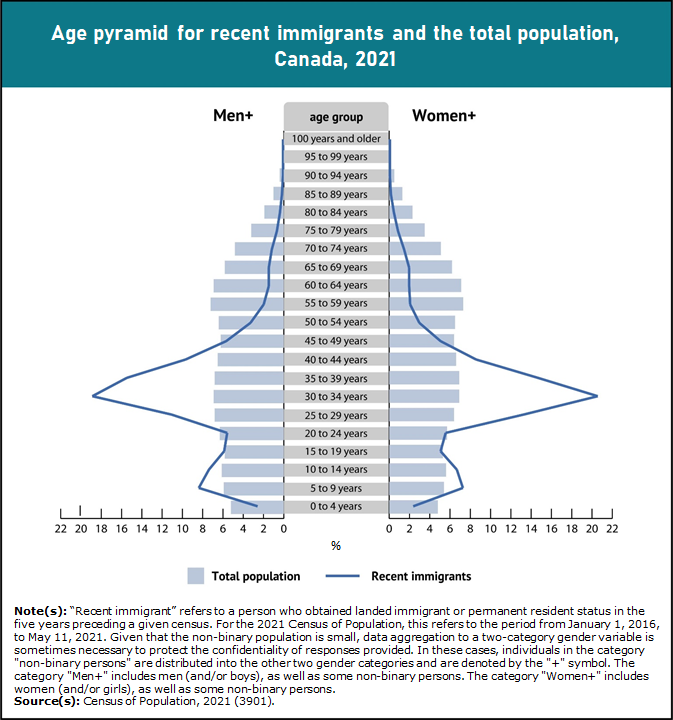

I did find this, which shows a large proportion of recent immigrants(unlikely to have large inheritances from Boomers) to make up younger populations. The real thing to figure out is the distribution of the discussed $1-2 Trillion and how many recipients above, say, a million or whatever dollars would exist.

https://www150.statcan.gc.ca/n1/dail...g-a002-eng.htm

https://www150.statcan.gc.ca/n1/dail...g-a002-eng.htm

Making a minimum untaxed amount at the right level, and having progressive would reduce the number of people it affects, and theoretically drive more support. But then, we know people vote very illogically in tax policy, and in this case may believe even if their inheritance is small, they don't want to risk that chance their parents win the lottery before they die. They may also not want their own inheritance taxed, in some distant future where they manage to succeed while paying high taxes to make up for the Boomers...still illogical in my mind.