Bizarre take.

Batteries cost $1200 per kWh 6 years ago. They're now $200. The US Department of Energy forecasted that this price would be achieved by 2030.

Small improvements?

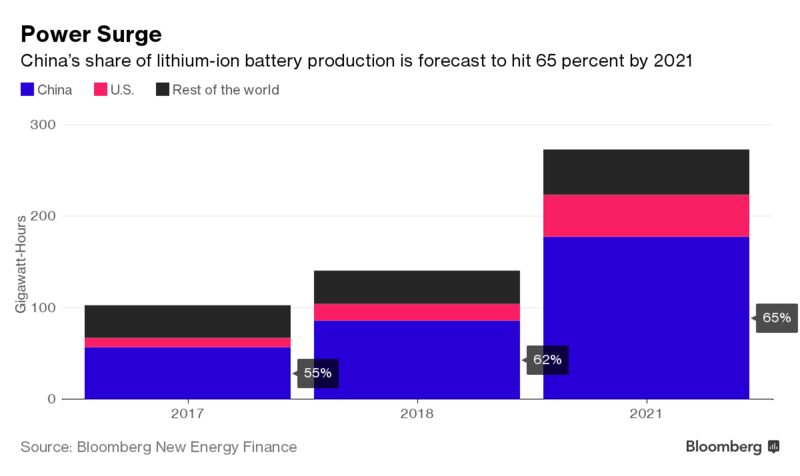

Your concerns on the supply chain challenges are noted. The market economy has also noted them and is in the process of doubling global battery production in 4 years.

No one's saying that BEV's are just going to replace ICE cars tomorrow. But that doesn't matter. What matters, as I've explained many times on this forum, is the change at the margin. Most people get it. Even Oil executives are starting to see the writing on the wall:

Quote:

Ben van Beurden, chief executive of Royal Dutch Shell, made no attempt to disguise the challenge facing “Big Oil”. Companies must become more discriminating about which oilfields to develop, he said, with only the most low-cost and productive likely to remain competitive.

“We have to have projects that are resilient in a world where demand has peaked and will be declining,” he said. “When will this happen? We do not know. But will it happen? We are certain.”

Mr van Beurden said “peak demand” could come as soon as the late 2020s in the most bullish scenarios for EV uptake. But that would require “much more aggressive” policy action on climate change and faster innovation in battery technology than seen so far.

|

https://www.ft.com/content/3946f7f2-...8-60495fe6ca71

Anyway, yes real scaling challenges exist. But to say that they are insurmountable show's a pretty deep pessimism toward the market economy and to recent history. It wasn't 15 years ago that the

exact same arguments were being made about solar power. How did those arguments turn out? Not well. Solar and wind now dominate new capacity additions in the power sector just as EVs will dominate new vehicle adoption in the coming 15 years.